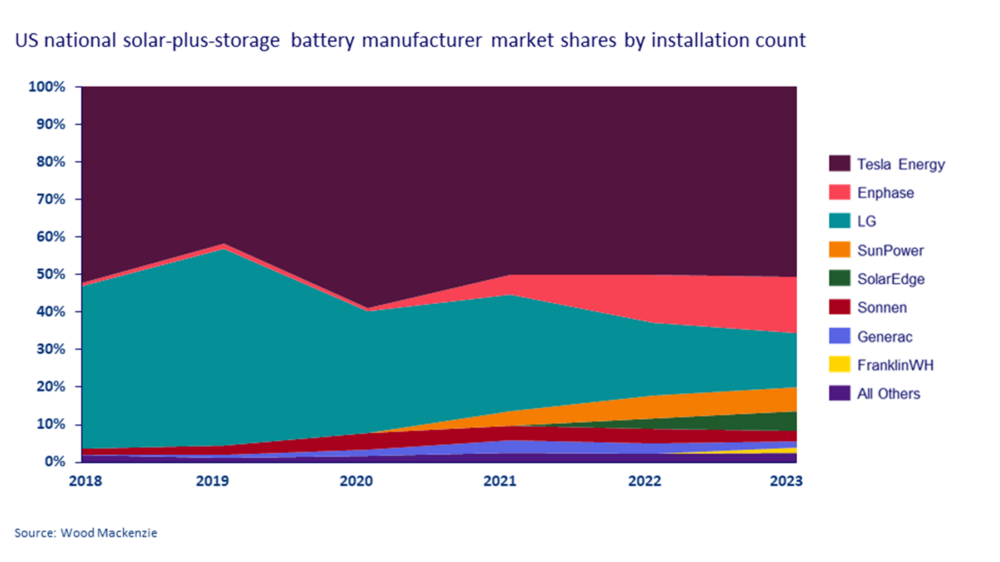

New analysis from Wood Mackenzie found great competition in the energy storage market in the United States.

The Tesla Gateway 2 product with Tesla Powerwalls. Photo credit: Goldin Solar

In Q3 2023, 11% of residential solar and 5% of non-residential solar installations were paired with storage. To track this competitive landscape, Wood Mackenzie has launched the “US Distributed Solar + Storage Leaderboard.” This new quarterly data product provides rankings and market shares for solar + storage installers and battery manufacturers in the United States.

According to the report, Tesla, LG and Enphase remain the most popular battery vendors, holding 80% of the cumulative market from 2018 through Q3 2023.

“These companies continue to dominate the market; however, they have recently come under pressure from new entrants,” said Max Issokson, a research analyst at Wood Mackenzie and author of the new report. “Whereas Tesla and LG products were installed on 96% of residential solar + storage projects in 2018, they made up 65% of installations in 2023 through Q3.”

Energy equipment companies such as SunPower, Generac and SolarEdge have entered the market and carved out spots amongst the top seven manufacturers. FranklinWH, less than two years after launching its first storage project, ranks eighth among manufacturers nationally.

“Compared to the residential solar installer landscape, the residential solar + storage installer market is far more consolidated,” said Issokson. “The top five players in the residential solar + storage ranking hold 59% of the market, while the top five players in the residential solar market hold just 24%.”

Tesla claims the top spot in the residential solar + storage installation rankings with a market share of 30.2% in 2023 through Q3, followed by Sunrun at 20.5% and SunPower at 4.6%.

“These leaders have invested in storage for years, either in their own products or through relationships with vendors,” said Issokson. “But we have also seen smaller installers build expertise in installing and selling storage. As favorable solar + storage policies grow, there’s much potential for regional installers to develop storage expertise and gain market share.”

Commercial solar + storage remains limited to a few key markets with direct storage incentives. New York, Massachusetts and California have accounted for 60% of installed non-residential solar-plus-storage capacity nationwide since 2018. Borrego leads with 20% market share, driven by strong installations in California and Massachusetts. Nexamp follows with a market share of 7%, fueled by its installations in Massachusetts and New York, and American Renewables Construction comes in third with a market share of 6.8% from projects in Massachusetts.

News item from WoodMac