Once electricity prices hit $0.25/kWh, disconnecting from the grid with residential solar-plus-storage starts to become financially viable, with sunny places making strong financial arguments. With recent drops in battery prices, the case for leaving the grid has grown even stronger.

If electricity prices in your area exceed 25 cents per kilowatt-hour (kWh) and your roof has enough space, going off-grid with solar and storage may be financially viable. With the recent collapse in solar module and battery prices, and the Inflation Reduction Act, the argument for leaving the power grid is stronger than ever.

In cities like Honolulu, San Diego, and San Francisco, disconnecting from the grid has already become economical. For example, an off-grid solar plus storage system in Honolulu could result in more than $120,000 in avoided electricity costs over time, with an initial investment of about $34,000. This translates to substantial annual savings for homeowners–savings that are only projected to improve.

A study “The threat of economic grid defection in the U.S. with solar photovoltaic, battery and generator hybrid systems,” published in Solar Energy, conducted by Western University’s School of Business and the Electricity and Computer Engineering department, analyzed the economic threat of grid defection in the U.S. The team examined the financial feasibility of abandoning the grid in favor of solar photovoltaic, battery, and generator hybrid systems in the study The threat of economic grid defection in the U.S. with solar photovoltaic, battery and generator hybrid systems, published in the ScienceDirect journal Solar Energy.

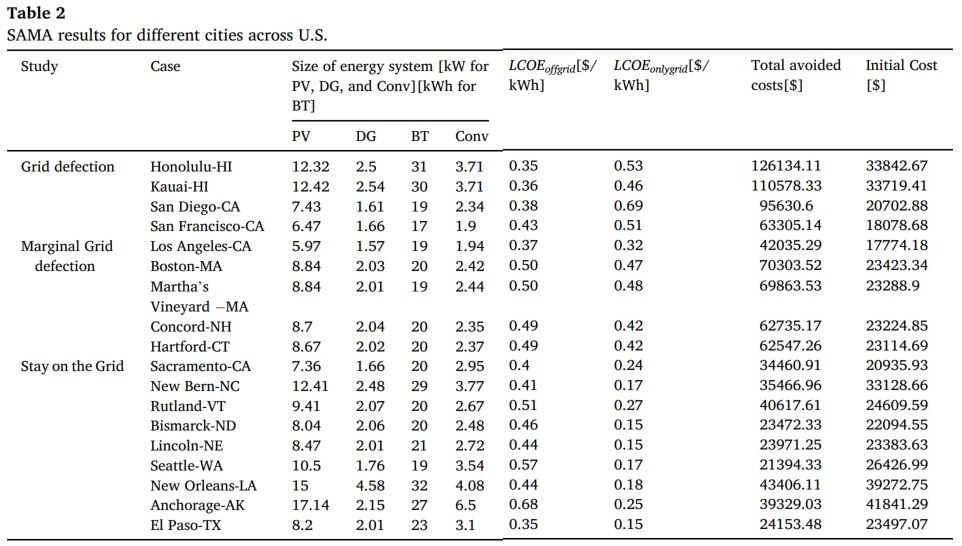

The analysis includes 18 case studies across the U.S., assessing the profitability of grid defection in various solar irradiation zones using hybrid solar-diesel generator-battery systems. The group conducted a cash flow analysis for solar projects in each city. Results were categorized into three cases: grid defection, marginal grid defection, and staying on the grid. The solar project sizes ranged from 7.5kW to 12.5kW, based on sunlight availability and electricity demand. Battery capacities varied between 18 kWh and 27 kWh.

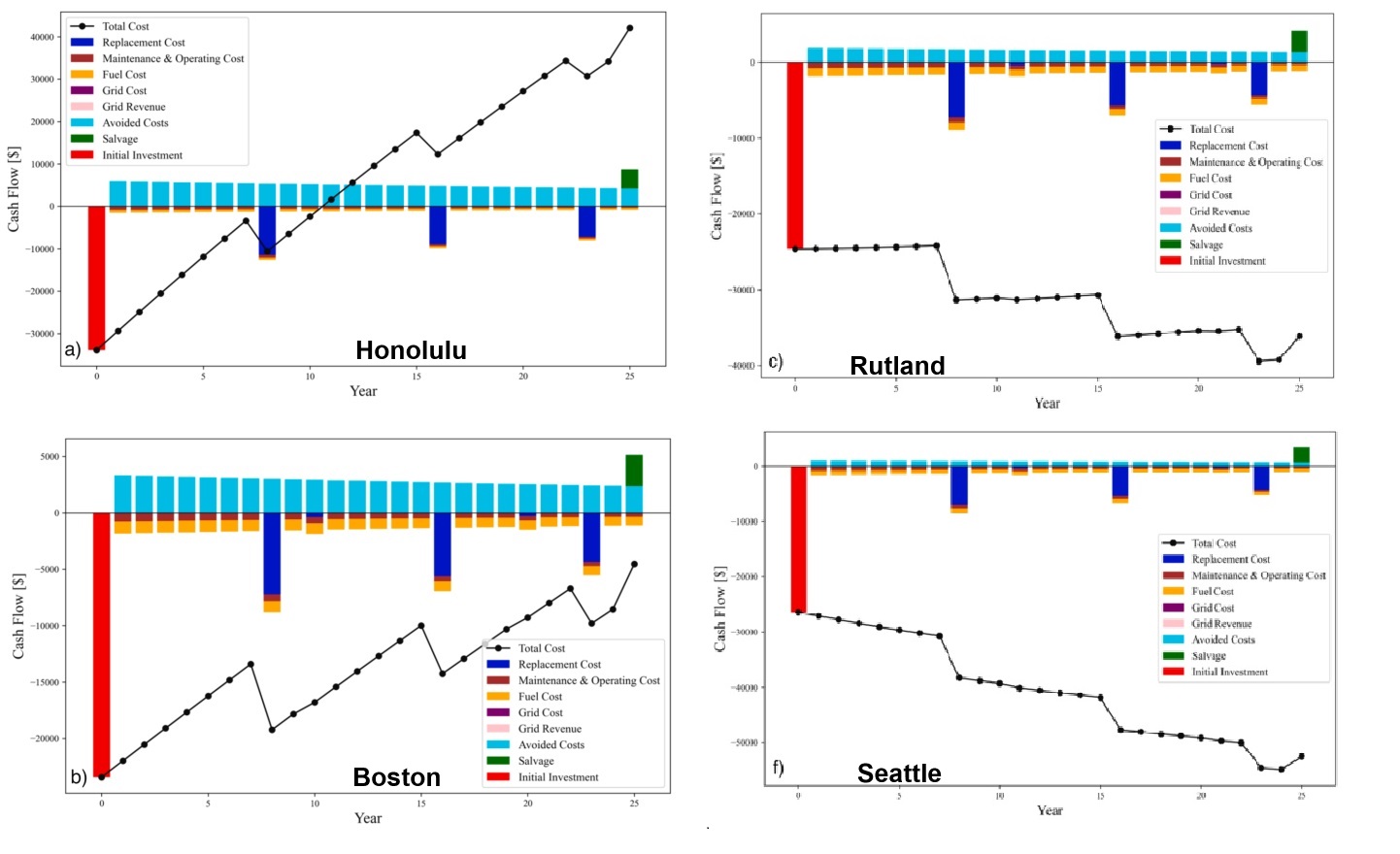

The graphs above compare financial scenarios for Honolulu (grid defection), Boston (marginal), Rutland (stay), and Seattle (stay). The Honolulu system demonstrates a quick payback, even without incentives, while Boston, like most in New England, depends on tax credits and local incentives to be economically viable. In contrast, both Rutland and Seattle, located in regions near Canada, would face higher costs by disconnecting from their local grid compared to staying connected.

The figure near the top of this article highlights electricity pricing, which is the main driver of the Boston project’s marginal financial viability. Massachusetts has some of the nation’s highest electricity prices, while Rutland and Seattle benefit from lower costs due to abundant hydroelectricity. Interestingly, Rutland and Boston both have similar solar resources, but the difference in electricity prices makes grid defection more viable in Boston.

Electricity prices in the U.S. vary widely, with San Diego recording the highest rate at $0.69/kWh, while Nebraska enjoys the lowest at nearly $0.06/kWh–92% cheaper than San Diego.

The analysis also finds that strong net metering programs can reduce the financial incentives for disconnecting from the grid. For instance, California recently cut back its net metering payback considerably, resulting in higher electricity prices during evening hours. This shift has led to a significant rise in energy storage adoption paired with residential solar projects. In contrast, Massachusetts has bucked the national trend by strengthening its net metering policies.

pv magazine USA reached out to the authors for insights on recent cost developments–specifically, the sharp decline in solar module and battery prices–and their impact on the analysis.

Joshua M. Pearce, Ph.D. FCAE, responded;

Co-Author Seyyed Ali Sadat points out that our analysis, conducted in mid-2023, was based on the NREL 2022 National Benchmarks (the newest cost benchmarks at that time). With battery prices now around $100/kWh, both initial and replacement costs are reduced significantly, which makes many of the marginal grid-defection cases fully economic.

Dr. Pearce continued, explaining that their sensitivity analysis considered residential solar prices as low as $1.50/W, with energy storage costs ranging from $250 to $458/kWh. As prices approach the lower end of these estimates, the potential for grid defection expands significantly.

Recent retail pricing data from EnergySage shows that the average price for fully installed solar is $2.69 per watt, with energy storage priced at $1,133/kWh.

The paper also notes that regions with electricity rates of $0.25/kWh or higher were early indicators of potential grid defection. With the ongoing drop in solar and energy storage costs, the lower threshold for grid defection is moving toward the national average electricity price of $0.15/kWh.

Dr. Pearce summarized the study’s findings by stating, “The key takeaway of our paper–particularly coupled with the recent drop in battery prices–is that grid defection is economically viable in much of the U.S. Policymakers should work to ensure rate structures are developed that avoid incentivizing grid defection.”

Popular content