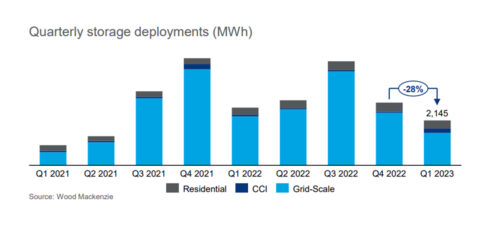

Across all segments of the industry, the U.S. energy storage market added 2,145 MWh in the first quarter of 2023, a 28% decrease from Q4 2022. The grid-scale segment installed 1,553 MWh in Q1 2023, recording the second-straight quarterly decline and falling 33% below first quarter 2022 installations, according to a new report released today by the American Clean Power Association (ACP) and Wood Mackenzie.

In the latest “U.S. Energy Storage Monitor” report, it shows that California and Texas continue to drive the market, accounting for 84% of Q1 activity, but project delays contributed to the declining environment.

In the latest “U.S. Energy Storage Monitor” report, it shows that California and Texas continue to drive the market, accounting for 84% of Q1 activity, but project delays contributed to the declining environment.

“The recent energy storage market slowdown illustrates how storage development is already interwoven with new solar and wind projects – and how trade and policy issues in those sectors affect storage deployment,” said John Hensley, ACP’s VP of Research & Analytics. “It’s crucial we continue to tackle supply chain and interconnection hurdles. The forecast through 2027 is encouraging and we remain confident in the long-term growth trajectory of the sector. The need of energy storage will continue to grow as more clean energy technologies are added to the grid.”

Wood Mackenzie has slated forecasted 2023 additions from the grid-scale project pipeline at 8.9 GW and 10.5 GW across all segments. While the forecasted capacity for 2023 decreased slightly quarter-over-quarter (QoQ), total additions for all segments are still expected to double by end-of-year 2023 from 2022.

Credit: B2U Storage Solutions

“We are seeing the effects of supply chain issues and interconnection queue backlogs hinder market growth,” said Vanessa Witte, senior analyst with Wood Mackenzie’s energy storage team. “This is the first consecutive quarterly decline we have seen in the energy storage market since 2015 when installations were much smaller in volume and more unpredictable. While the market has faced challenges, we do anticipate a stronger second quarter, as many project CODs have been pushed, but are still very viable.”

Community, commercial, and industrial installations bounced back in Q1 after four consecutive quarters of lower-than-average activity. In total, this market market installed 203.3 MWh for its second-highest quarter on record and 145% above year-over-year (YoY) numbers.

Residential storage recorded its second-highest quarter on record at 388.2 MWh but there was a decline from Q4 2022 installed capacity. This marked the first QoQ decline for the residential sector in nearly two years.

Said Witte: “Our outlook for the storage sector is still bullish, with projected growth strong through 2027. Near-term we will see some challenges, but we expect them to be corrected and activity to increase as more renewable generation will drive the need for storage.”

News item from ACP