The U.S. International Trade Commission unanimously voted that solar cell manufacturing in Cambodia, Malaysia, Thailand, and Vietnam, supported by local incentives, is harming U.S. industry. This decision paves the way for the Commerce Department to finalize its determinations on Countervailing Duties by July 18 and Anti-Dumping duties by October 1.

In its preliminary findings, the U.S. International Trade Commission (USITC) found reasonable indications that the domestic solar module manufacturing industry is being materially harmed by imported solar cells from Cambodia, Malaysia, Thailand, and Vietnam. These countries have been identified as providing governmental incentives for setting up manufacturing facilities, sparking this investigation.

The complaint was initially brought forward by the American Alliance for Solar Manufacturing Trade Committee, which includes prominent members such as First Solar, Hanwha Qcells USA, and Mission Solar Energy, according to the USITC. The group’s press release also named Convalt Energy, REC Silicon and Swift Solar.

Industry insiders told pv magazine USA that this outcome was expected from this group.

A detailed report titled “Crystalline Silicon Photovoltaic Cells, Whether or Not Assembled Into Modules from Cambodia, Malaysia, Thailand, and Vietnam; Inv. Nos. 701-TA-722-725 and 731-TA-1690-1693” is scheduled for release on July 5, 2024, on the USITC website.

The specific outcome from this meeting is that the U.S. Department of Commerce (Commerce) will continue its most recent ongoing investigation on the topic. Commerce will release its preliminary determination results on Countervailing Duties on July 18, with Anti-Dumping results due on October 1. These will be followed by final rulings from Commerce and the USITC’s final rulings on the subject.

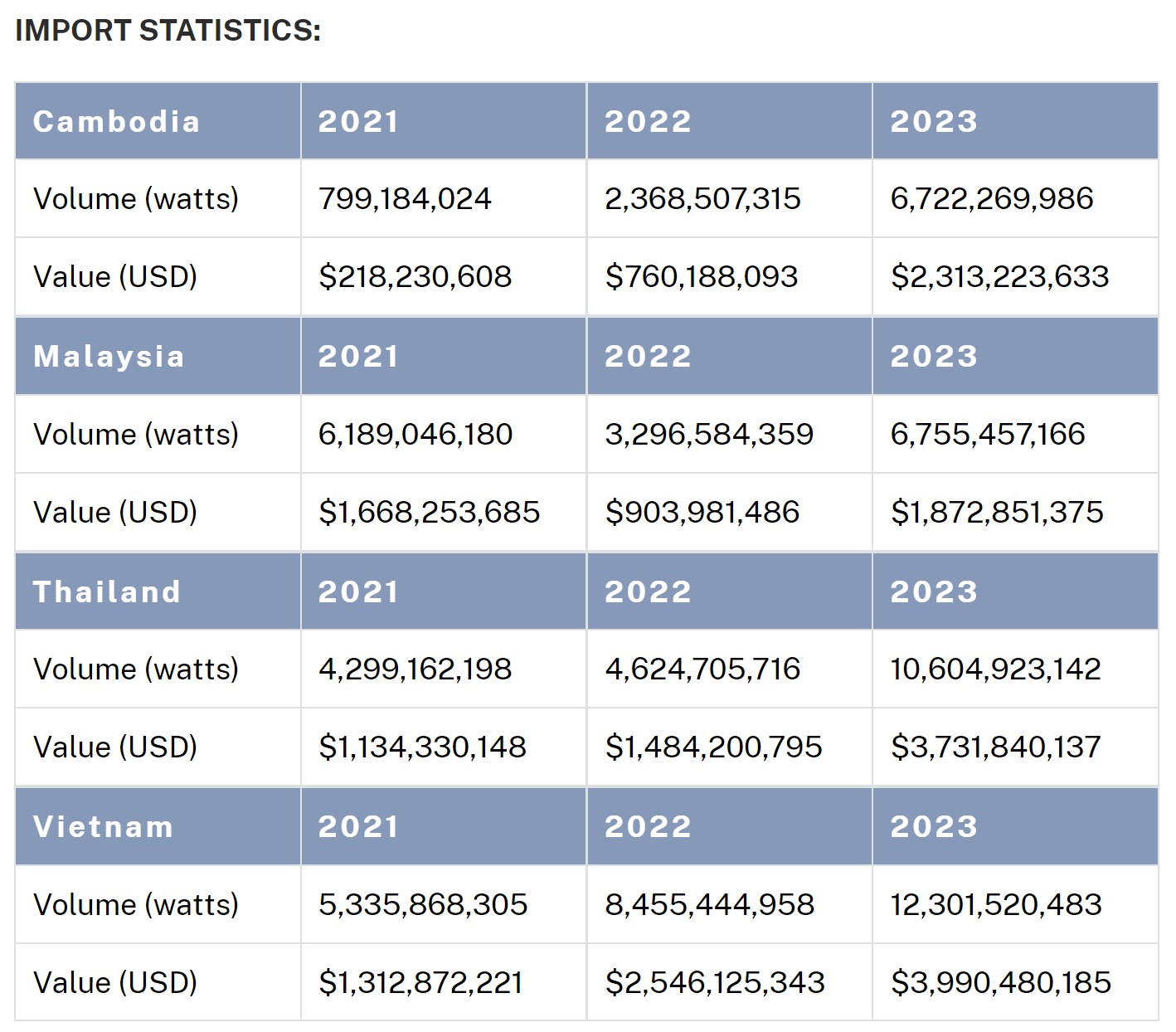

In its initial filing, the USITC reported that over the past three years, the four countries have exported 71 GW of solar modules to the U.S., valued at $21 billion. During the same period, the U.S. installed a total of 83.8 GW of solar capacity. Suggested by USITC data, there’s an estimated 50 GW of solar modules currently stored in warehouses across the country. The U.S. Energy Information Administration projects that more than 50 GW of new solar capacity will be installed in the U.S. in 2024.

A significant portion of these imported solar modules is used in utility-scale solar projects.

The merchandise under investigation includes crystalline silicon photovoltaic (CSPV) cells and modules, as well as laminates and panels containing these cells. Excluded from this investigation are thin-film photovoltaic products made from materials such as amorphous silicon, cadmium telluride, or copper indium gallium selenide, typical of products manufactured by First Solar. Off-grid CSPV panels are also excluded from this investigation.

Currently, the cost of importing solar panels into the U.S. could increase dramatically, according to Clean Energy Associates, if the panels originate from China. The collective effect of multiple tariffs – including Section 201, 301, Anti-Dumping, and Countervailing Duties, could raise the price of imported panels by 15% with no Chinese connections, and up to 286% for Vietnamese modules, should the proposed rates be approved.