Researchers suggest that from 2008 to 2020, the globalization of solar module manufacturing has saved $67 Billion for U.S., German, and Chinese solar installers, even as it was heavily dominated by China’s investments.

Researchers from UCLA have developed a model that shows how much more the world would pay for solar modules if countries were to implement trade limiting policies. The group estimates that from 2008 to 2020, the United States saved between $19 to $30 billion on solar module pricing due to the free flow of capital, talent and innovation. Germany saved $5 to $9 billion, and China saved $26 to $46 billion.

The groups suggest that if the three nations had “adopted strong nationalistic trade policies”, then module pricing in 2020 would be 107% higher in the U.S., 83% higher in Germany, and 54% higher in China.

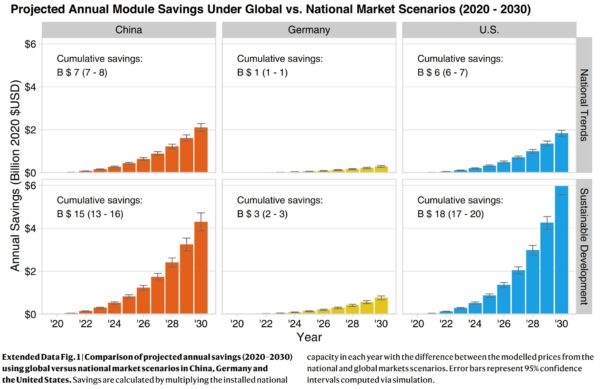

Going forward, the analysis – Quantifying the cost savings of global solar photovoltaic supply chains – suggests that if the world were to localize its supply chains, we could expect the price of solar to increase 20 to 25% by 2030.

Credit Suisse estimates that structural conditions in the USA resulted in a 33% higher price for solar panels through the end of the decade, when compared to China.

The researchers arrived at these numbers by estimating what they believe would be the costs of legislative actions taken in favor of “localizing benefits such as economic growth, employment, and trade surpluses.” The variance – $50 to $85 billion in savings from 2008-2020 – is based on varying levels of isolation from the global market’s learning curves. Nearly 800 GW of solar capacity was deployed during this period.

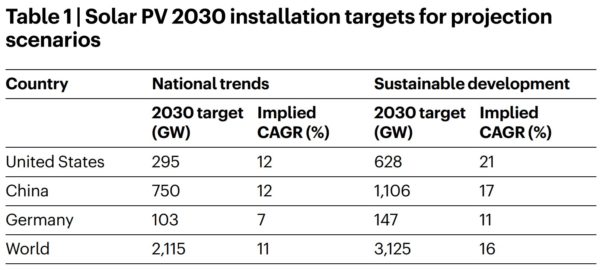

Going forward, an additional 1.3 to 2.3 TW of capacity deployments are projected in the next decade, depending on how various policies facilitate that deployment.

The logic behind this study is as follows: if the manufacturing of a product is heavily localized within a country, then the global learning curves associated with that product will only be affected by solar modules deployed in that country. (Each doubling of deployed capacity is estimated to lower prices by 20%). Since each country is a part of the whole volume deployed, limiting trade lowers learning curves and raises prices.

When these models consider nationalized policies, they predict that by 2030, China’s price of solar modules could be 16.2¢ per watt instead of 13.5¢. In Germany, the model predicts 29.8¢ per watt instead of 25.1¢, and in the United states, it predicts 32¢ per watt instead of 26.2¢.

Researchers found that in a fully integrated global market scenario, global learning curve savings could exceed $10 billion in 2030 alone (per the chart, above). The researchers found that in a heavily nationalized market, those savings could shrink to $4 billion.

The researchers also created an online tool that visualizes these equations. On the Projections tab, it is possible to adjust the percent of a benefit a country gains from global innovation versus being more nationally focused.