Wood Mackenzie said 96% of grid-scale deployments occurred in Texas and California.

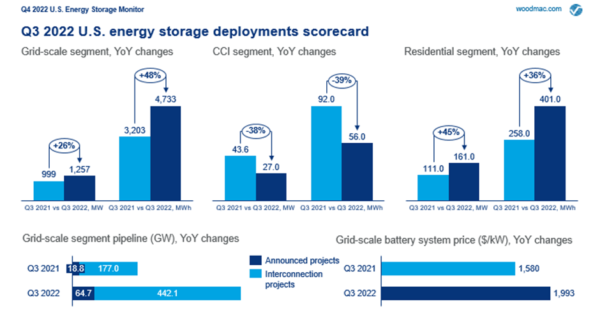

Grid-scale or utility-scale storage has set another record quarter for deployment, installing 4.7 GWh in Q3, 2022, building on the previous record of 4.6 GWh set in Q1, 2021, reported Wood Mackenzie. This is enough battery storage to power 150,000 homes for a day.

“Demand in the grid-scale and residential storage segments continues to increase, despite rising costs and lingering supply chain challenges,” said Vanessa Witte, senior analyst with Wood Mackenzie’s energy storage team.

The market is highly consolidated for grid-scale storage, with 96% of total installed capacity this quarter occurring in California and Texas, which are also the largest markets for utility-scale solar. Front-of-the-meter grid-scale storage is more highly concentrated in these markets than behind-the-meter residential energy storage.

“California’s reliance on energy storage to meet record peak demand this September shows why it’s absolutely critical that policymakers and grid operators remove barriers to supply to ensure reliability,” said Jason Burwen, vice president of energy storage, American Clean Power Association.

Forecasts for 2022 to 2026 increased 109% quarter-over-quarter, with the U.S. market expecting nearly 65 GW over this period. Grid-scale installations are expected to account for 84% of that capacity.

“Installed capacity is expected to more than double next year, driven by new grid-scale project announcements and increased residential and non-residential volumes in CA due to the introduction of a community solar program and NEM 3.0,” said Witte.

Residential energy storage enjoyed a record quarter as well, with 400 MWh installed, hurdling the previous record of 375 MWh from Q2, 2022. California, Puerto Rico, Hawaii, and Texas led the market. Wood Mackenzie forecasts this segment to grow to 2.2 GW in 2026.

Meanwhile, community, commercial, and industrial storage had another quarter below expectations, with 56.6 MWh installed in Q3. Wood Mackenzie said it expects this segment to grow as well, benefiting from demand on the residential and grid scale.

The trend of project delays due to supply chain constraints continues to hamper development in the near term, however 2022-2028 interconnection queues have increased 120% quarter-over-quarter.

“Some developers have considered delaying projects into 2023 to receive tax credits from the Inflation Reduction Act, but this only applies to a very niche segment of projects,” said Witte.

Witte said supply chain issues and interconnection queue backlogs may push project installations ahead in the forecast. Due to this, Wood Mackenzie has bumped up 2024-2026 projections by 9-13% per year.

EIA projections

Grid-scale energy storage capacity is expected to surpass 30 GW, 111 GWh of installed capacity by the end of 2025, according to a report by the Energy Information Administration (EIA). Battery storage capacity in the U.S. was negligible prior to 2020, at which point storage capacity began to ramp up. As of October 2022, 7.8 GW of utility-scale storage assets are operating, with 1.4 GW of additional capacity to be added by the end of 2022.

The EIA forecasts another 20.8 GW of battery storage capacity will be added from 2023 to 2025.

Growth in energy storage capacity is outpacing the pace of early growth of utility-scale solar. U.S. solar capacity began expanding in 2010 and grew from less than 1.0 GW in 2010 to 13.7 GW in 2015. In comparison, the EIA sees energy storage increasing from 1.5 GW in 2020 to 30 GW in 2025.

At present, the 409 MW Manatee Energy Storage in Florida is the largest operating battery storage project in the U.S. Developers have scheduled more than 23 grid-scale battery projects, ranging from 250 MW to 650 MW, to be deployed by 2025.