According to the U.S. Solar Market Insight Q2 2024 report, solar module manufacturing production capacity increased by over 11 GW.

The U.S. Solar Market Insight Q2 2024 report says 11 GW of new solar module manufacturing capacity came online in the United States during Q1 2024, the largest quarter of solar manufacturing growth in American history.

The report, released by the Solar Energy Industries Association (SEIA) and Wood Mackenzie, estimates that total U.S. solar module manufacturing capacity now exceeds 26 GW annually.

In addition to solar manufacturing, the U.S. is also quickly ramping up solar installations. With 11.8 GW of new solar capacity installed thus far in 2024, total capacity now stands at 200 GW in the United States. The utility-scale segment alone accounts for nearly 10 GW of the new capacity added.

The report shows that the U.S. added over 40 GW of new solar capacity last year, and Wood Mackenzie now projects that the U.S. is on target to achieve the same goal in 2024.

“This quarter proves that new federal investments in clean energy are revitalizing American manufacturing and strengthening our nation’s energy economy,” said SEIA president and CEO Abigail Ross Hopper. “Whether it’s a billion-dollar investment in a nearby solar project or a new manufacturing plant employing hundreds of local workers, the solar and storage industry is uplifting communities in every state across this country.”

The report points to Florida and Texas as leaders in new solar capacity in Q1. Florida installed 2.7 GW in Q1 and Texas 2.6 GW. California, historically a solar leader, falls into third place with 1.4 GW of new installs; however, it is notable that in 2023, Texas installed nearly 12 GW, while California was about 6.4 GW. New Mexico is another leading market with 686 MW installed in Q1, with Ohio following close behind at 546 MW. Bringing up the bottom is North Dakota, Alabama and Alaska.

“The U.S. solar industry continues to show strength in terms of deployments,” said Michelle Davis, head of global solar at Wood Mackenzie and lead author of the report. “At the same time, the solar industry faces a number of challenges to its continued growth including availability of labor, high voltage equipment constraints, and continued trade policy uncertainty.”

The residential solar segment has been hard hit by high interest rates and unsupportive state policies. California, where the highly controversial NEM 3.0 went into effect, experienced its worst quarter in two years. Overall the residential sector installed 1.3 GWdc in Q1, reflecting a 25% decline year-over-year and 18% quarter-over-quarter but going forward residential solar is expected to be steady.

Commercial solar showed 23% growth in 2023 and expected to grow by another 14% in 2024. This sector is somewhat buoyed by California projects that were submitted under NEM 2.0 still being in the interconnection queue.

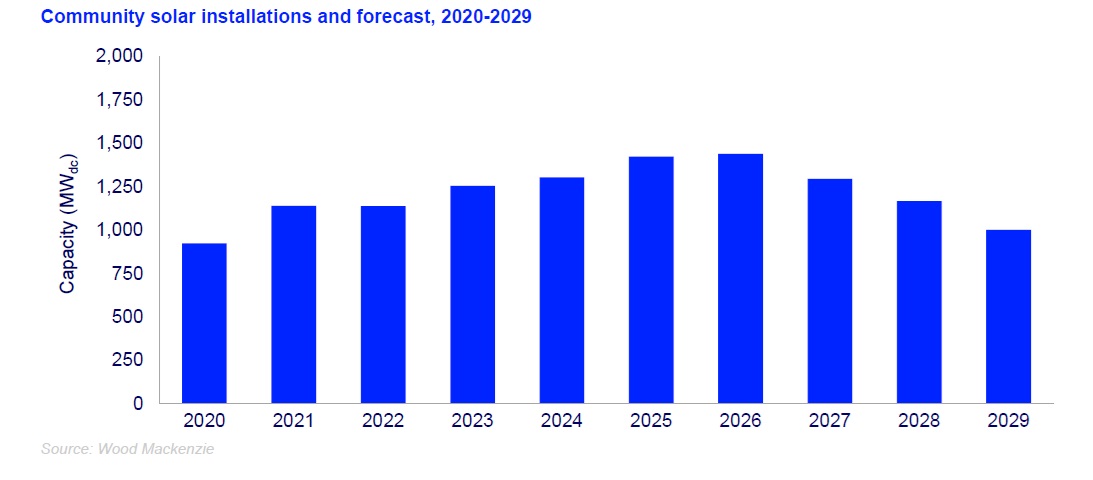

Looking at community solar, installations resulted in 279 MWdc of new capacity in Q1, with New York topping the charts at 17% year-over-year in Q1 2024, making up 46% of national installed capacity.

Again, state policy changes in California are punching holes in a previously growing market. As a result of the CPUC’s vote on AB 2316, the report authors revised their five-year outlook for California and now expects just 200 MW rather than the 1.5 GW—an 87% decline. Overall the community solar market is expected to grow 4% in 2024, exceeding 1.3 GWdc of annual capacity.

Questions and challenges

With many unanswered questions about tariffs on imported solar modules and other components, the report contends that a tariff increase will not have a significant direct impact on the U.S. solar industry, given that the U.S. is importing less than 0.1% from China at the present time.

Moving forward, the report’s five-year outlooks expects the U.S. industry to install around 40 GWdc a year for the next five years. Trade policy uncertainty coupled with shortages in workers as well as high-voltage equipment, will keep overall growth in the single digits through 2029. The five year projection, however, is for U.S. solar capacity to grow to 438 GW by 2029.