The Department of Energy’s Lawrence Berkeley National Laboratory (LBNL) has released a top ten list of observations on co-located wind or solar plus energy storage (hybrid), with each of the unique ideas referencing a research paper developed by the group.

LBNL is covering this topic primarily due to the recent increases in deployment, and interest in these hybrid facilities. Assuming that future project queues can be used to predict the number of actual hybrid power projects that will get built, then let it be known that hybrid systems already make up 42% of the United State’s future potential 675 GW of solar generation capacity. California’s solar queue, for all intents and purposes, is a solar-plus-storage queue, with its 95% coupling rate.

As of the end of 2021, 5.9 GW of solar was coupled with energy storage, along with 750 MW of wind-plus-solar-plus-storage. LBNL noted the exponential growth of this type of capacity, which is up 133% since the end of 2020.

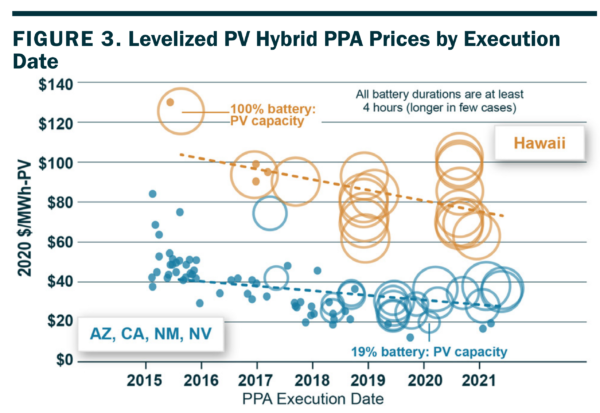

The fundamental reason that solar-plus-storage works is that the price of batteries has come down to a point where it now makes financial sense. Battery pricing has declined by roughly 25%, from $40 to $95/MWh-PV in 2017, to $30 to $75/MWh PV in 2021.

Second, and more importantly, LBNL modeled the revenues versus the costs of adding batteries to solar. They found that the value gained by adding energy storage to solar and wind exceeds the costs.

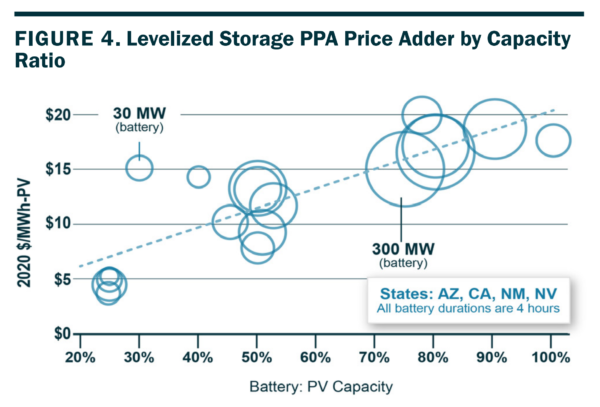

Taking into account the battery inverter versus solar plant inverter size, LBNL found that adding four hours of energy storage to a power purchase agreement (PPA) increased the price of that agreement pretty linearly. Considering the most popular ratio of solar vs battery inverter capacities — 1 MW solar to 0.5 MW batteries providing four hours of storage — the addition of energy storage increases PPAs by 1¢/kWh.

LBNL says that when modeling various markets across the United States, this penny adder is mostly covered as revenue increases from 0.8 to 2.2¢/kWh when adding energy storage to the mix.

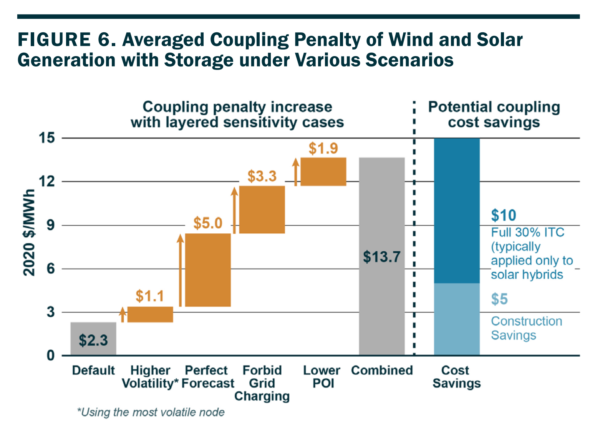

However, LBNL also sees that there are financial penalties associated with the current techniques of coupling solar with energy storage. For instance, if the solar power is fully utilizing the site’s interconnection at any point — the batteries cannot. Also, if the batteries must fully charge from the onsite solar to meet incentive requirements, that can be a penalty for hybrid systems, resulting in a slightly less financially efficient system.

In terms of financial incentives, the Federal Investment Tax Credit seems to be motivating hybridization. Without this incentive, it is hypothesized that there would be more standalone energy storage.

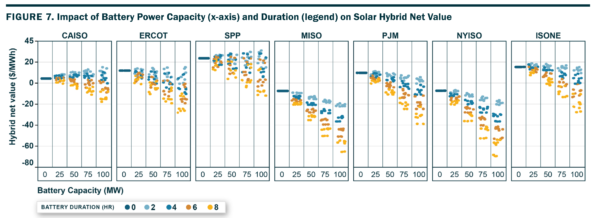

Since California dominates the volumes of hybrid solar plants in the queues, it also heavily influences the averages. Leaving California’s 4-hour heavy market (which is at least partially driven by an evening peak period that lasts 4 to 5 hours), the researchers found that California’s batteries tend to have shorter durations in most other markets.

The chart above models the value of energy being delivered by hybrid systems as more battery duration – from two to eight hours – is added to a facility in various power grid regions around the nation.

There is still a lot of learning going on with these technologies.

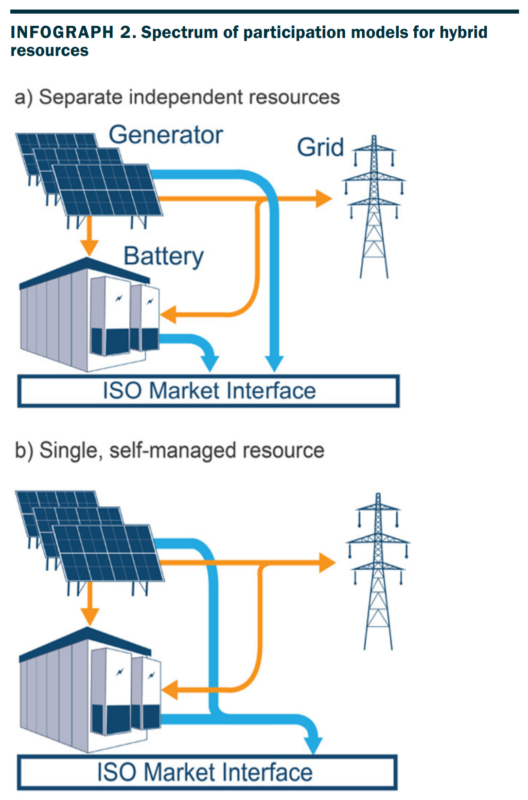

For instance, a 100 MW solar farm plus a 50 MW battery does not equal a 150 MW power plant in terms of capability. Having an intermittent, highly predictable solar generation resource, coupled with an instantly dispatchable multi-talented re-generation battery resource means that sometimes interconnection must be shared — and it’s usually the battery that takes a backseat to the solar facility during generation periods.

This is the hybrid penalization referenced earlier.

Asset owners and markets are still learning how to maximize the utilization of these resources.

The document notes that the ancillary service markets provide valuable revenue streams to this young battery market, but that this service market quickly sells out. These large scale markets of ISOs — where wholesale electricity rates and ancillary services exist — are not where most batteries are earning their revenue these days.

LBNL notes that as of the end of 2020, most operating hybrids earned revenue via incentive programs or capacity & transmission demand charge markets, instead of wholesale market price signals.

For instance, a battery used for peak shaving behind the meter at a business, or to maximize onsite solar utilization, does little for the broader wholesale market — although they do offer some general peak demand reduction. A battery at a home only running during power outages offers far less than a peak shaving solution; however, some VPPs are beginning to step into this space to monetize these underutilized resources.

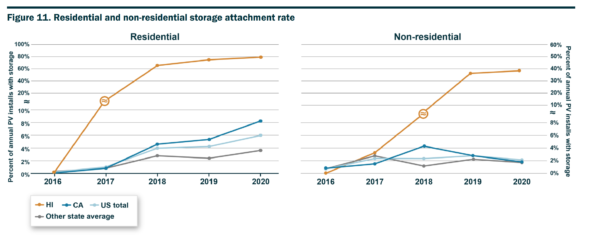

We’re also observing a separation of attachment rates, as residential solar-plus-storage is growing faster than small business, commercial, and industrial. LBNL has also observed that residential energy storage solutions are getting larger.

This split — where residential storage is surpassing commercial and industrial storage — is mirrored by residential solar as well, as it outpaces business, commercial, and industrial solar in terms of capacity deployed annually.