The year 2022 represented a turning of the page for the solar industry. The beginning of the year was marked by lingering COVID-19 related delays, trade law enforcement, supply chain issues, and price hikes for components and shipping. Many of these headwinds led to delays and cancellations, and project deployments fell short of initial projections.

The second half of the year was characterized by a renewed optimism as the landmark Inflation Reduction Act of 2022 was passed, allocating a record $369 billion in spending for climate and energy measures. Abigail Ross Hopper, president and CEO of the Solar Energy Industries Assocation has dubbed the forthcoming ten years as the “Solar + decade” as solar and energy storage buildout is expected to continue to build momentum, now energized by the spending package. What can be expected for 2023?

All eyes on California

As is often the case with new technology policy and adoption, the country will look to California as a case study for where things may head for the solar industry. Specifically, Net Energy Metering (NEM), which is instrumental to the value of rooftop residential solar, will be a policy to watch again this year.

Just before the clocks changed to 2023, the California Public Utilities Commission (CPUC) unanimously approved NEM 3.0, altering the mechanism by which rooftop residential solar customers are paid for sending their excess generation to the grid.

Under the new NEM 3.0, Californians who install their project after April 15 this year will be paid on average 75% less for their exported solar production as compared to the previous regime. This damaging effect on customer value has led ROTH Capital Partners to project a 30% year-over-year decrease from 2022 residential solar installations in the state.

The nation will watch California’s residential solar industry closely to see how it will adapt to the loss in system value. A spike of installations can be expected before April as Californians rush to secure the NEM 2.0 credit value for the next 20 years. After that, the industry could suffer a precipitous drop off in installation requests, as happened in Nevada in 2017 when it made a similar cut to net metering.

California will act as a proving ground to show if the CPUC was correct in its judgment that solar- plus-battery systems will rise in adoption as NEM is cut. Recent analysis has shown that an increase in adoption is highly unlikely as the value to the end-user has been damaged by the new structure.

Last year, NEM policy changes occurred or were blocked in Florida, Georgia, Idaho, Michigan, Vermont and many other states, and 2023 will likely prove another battleground year for this policy.

Inflation Reduction Act rollout

The Inflation Reduction Act of 2022 set aside a record $369 billion to support climate and energy goals. Implementation of this package will take time as the industry sorts out the finer details on how to meet certain requirements in the Act to qualify for significant tax credit incentives and value adders.

The Biden Administration is continually working with industry stakeholders to understand how to best implement the law. The White House released a guidebook in late 2022 to help industry members navigate the complexities of its many offerings.

The way the law is interpreted and implemented will be watched closely in 2023 to determine its final impact. For example, major microinverter provider Enphase Energy said it plans to add between 4.8 GW to 7.2 GW of manufacturing capacity in the United States, depending on the interpretation of the Production Tax Credit (PTC).

Enphase chief executive officer Badri Kothandaraman said that the company will not make a significant investment in U.S. manufacturing unless his firm can secure a significant return on investment and retain 50% or more of the Inflation Reduction Act’s Production Tax Credit (PTC) value.

(Read: “The role of solar in the Inflation Reduction Act”)

“With long-term incentives for clean energy deployment and manufacturing, the solar and storage industry is ready to create hundreds of thousands of new jobs and get to work building out the next era of American energy leadership,” said Ross Hopper.

Module supply

Perhaps the most difficult headwind faced by the solar industry in 2022 was the lack of steady supply of modules and other solar components caused by lingering COVID-19 related delays, increased commodity and shipping costs, the threat of tariff implementation, and the enforcement of the Uyghur Forced Labor Prevention Act (UFLPA).

Some of these headwinds are calming in early 2023, as shipping costs are cooling and polysilicon, the essential component in solar panel manufacturing, continues to fall in price. This trend may continue, as global polysilicon capacities are expected to double by the end of this year to 536 GW.

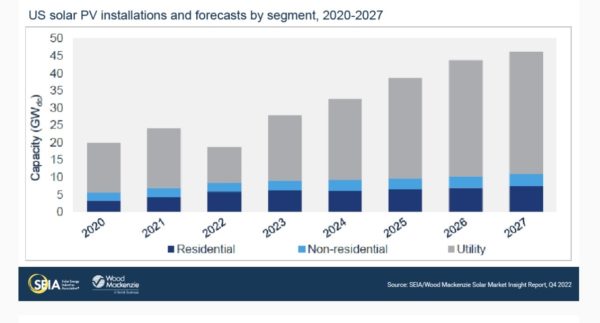

Wood Mackenzie said that supply chain issues may ease by Q2 2023, and at that point the firm may positively revise solar installation projections to reflect this and the implementation of the Inflation Reduction Act incentives.

However, it remains unclear how much of an effect the UFLPA will have on the ability of components to pass U.S. Customs and enter the market. The UFLPA places a “rebuttable presumption” that goods from the Xinjiang region of China, home to roughly 50% of the global polysilicon supply chain, are made with forced labor. The act places the burden of proof on buyers to show that the imported goods have no connection to forced labor whatsoever.

“It has proven more difficult and time-consuming to provide the proper evidence to comply,” said Michelle Davis, principal analyst, solar, Wood Mackenzie.

Recently, Customs cleared a meaningful supply of JinkoSolar modules made with Wacker polysilicon for the U.S. market. While this clearing of goods was a good sign for solar module supply, there is a significant backlog of modules remaining to be cleared.

In November , Reuters reported that over 1,000 shipments of solar energy components, valued in the hundreds of millions of dollars, have been blocked in U.S. ports under enforcement of UFLPA. ROTH Capital Partners said in August that as much as 3 GW had been held in Customs since the law was enacted.

ROTH warned that following the release of JinkoSolar goods, Customs Border Patrol may now turn its attention beyond the top solar component importers. “We could end up being in a two steps forward, one step back situation,” said Phil Shen, managing director, Roth Capital Partners.

The lack of clarity on exactly how UFLPA and anti-circumvention tariffs will be implemented makes this another major story to watch in 2023.