The U.S. solar industry had its lowest quarter of installations since the start of the coronavirus pandemic, according to the “U.S. Solar Market Insight” report released today by the Solar Energy Industries Association (SEIA) and Wood Mackenzie, a Verisk business. In Q1 2022, price increases and supply chain constraints continued to suppress the solar market as the industry installed 24% less solar capacity than Q1 2021.

The White House’s executive action this week to provide a two-year suspension of any new solar tariffs gives businesses certainty to accelerate projects delayed by the Department of Commerce’s anti-circumvention investigation. Without this action, massive project delays and cancelations would have continued throughout 2022, putting President Biden’s climate goals at risk.

Since the case was initiated in March, most solar module manufacturers have halted shipments to the United States, causing an industry-wide module shortage. These supply constraints are expected to ease as manufacturers ramp up shipments to the U.S. in the coming months.

Since the case was initiated in March, most solar module manufacturers have halted shipments to the United States, causing an industry-wide module shortage. These supply constraints are expected to ease as manufacturers ramp up shipments to the U.S. in the coming months.

“The solar industry is facing multiple challenges that are slowing America’s clean energy progress, but this week’s action from the Biden administration provides a jolt of certainty businesses need to keep projects moving and create jobs,” said SEIA president and CEO Abigail Ross Hopper. “President Biden has clearly taken notice of how drags on the industry are hampering grid resiliency. By acting decisively, this administration is breathing new life into the clean energy sector, while positioning the U.S. to be a global solar manufacturing leader.”

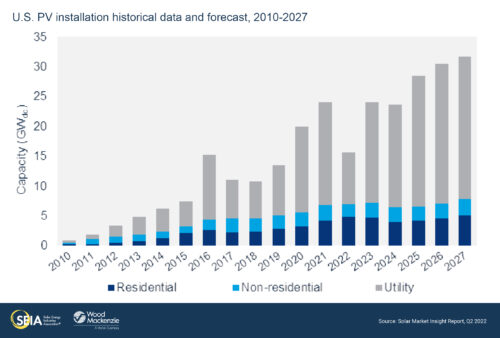

Over the last nine months, 2022 forecasts have been cut in half due to continued supply chain challenges and the anti-circumvention inquiry.

“The White House’s executive action brings relief to the U.S. solar industry, which has been steeped in uncertainty regarding the anti-circumvention investigation initiated by the Department of Commerce in late March following a petition filed by Auxin Solar, a domestic module manufacturer,” said Michelle Davis, Wood Mackenzie’s principal analyst. “Despite this, this announcement is expected to create approximately 2 to 3 GW of upside potential to Wood Mackenzie’s 2022 base case outlook, assuming the global market resumes normal operations.”

The down numbers are due to the utility-scale market seeing its lowest quarter since Q3 2019 with 2,173 MWdc installed, a 41% decrease from Q1 2021 and a 64% decrease from Q4 2021. The utility-scale market is seeing the lowest number of new projects added to the pipeline since 2017.

The commercial market is also down: installing just 317 MWdc, down 11% year-over-year and down 28% quarter-over-quarter. Community solar installed 197 MWdc, up 16% year-over-year but down 59% quarter-over-quarter.

Residential solar, in comparison, had its largest quarter in history with 1,200 MWdc installed, a 30% increase over Q1 2021 and a 5% increase over Q4 2021, demonstrating the robust strength of the residential segment — a market less suspectable to price fluctuations.

With trade certainty in place, the solar market is eying the fate of clean energy policies in a federal reconciliation bill. Long-term tax credits, manufacturing incentives, and other provisions will significantly boost solar and storage deployment and help keep pace with President Biden’s clean energy goals.

News item from SEIA

<!–

–>