SEIA’s white paper on solar and storage manufacturing includes an interactive map showing that the momentum has begun for a transformational buildout of domestic solar and storage manufacturing.

The vision and goal of the Solar Energy Industries Association (SEIA) is that by end of this decade, the U.S. will be the most competitive and collaborative solar and energy storage industry in the world, and that will be accomplished with a workforce made up of American workers and its allies. In the white paper, American Solar and Storage Manufacturing Renaissance: Managing the Transition Away from China, SEIA points out that the move away from over-reliance on imports for solar energy is beginning. And while we will not completely abandon global markets and supply chains, the momentum will build to the point where we can reduce our reliance on China for solar and energy storage equipment and raw materials.

SEIA reports that the U.S. has capacity to produce many of the elements that are key to the solar industry: metallurgical grade silicon, polysilicon, steel, aluminum, resins, racking and mountings and other key materials. There is already a modest capacity to produce modules, inverters and trackers, and a limited source of domestic specialty glass. However, other elements have been missing almost entirely from the U.S. supply chain, such as solar ingots, wafers and cells.

The Inflation Reduction Act provides myriad incentives for the build out of U.S. manufacturing, and it has effectively stimulated a number of companies to announce the intent to set up domestic manufacturing facilities.

The buildout takes time, however, and for the next few years we will remain dependent on imports to fuel the rapid deployment of solar energy systems needed for the energy transition.

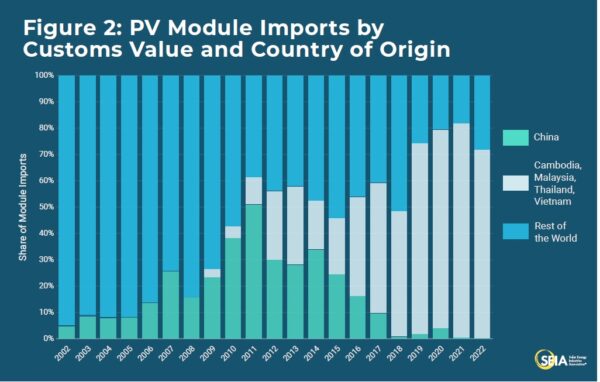

The largest source of solar cells and modules is currently Southeast Asia, which has manufacturing facilities run by Tier 1 manufacturers that have demonstrated the quality, financial stability, and compliance necessary to underwrite warrantees for their products demanded by U.S. consumers.

While sourcing product from Southeast Asia is preferable to China, it means that the U.S. is still beholden to other countries to help fuel our energy transition. This presents risks, as witnessed by the supply chain challenges faced by Southeast Asia manufacturers over the past few years. According to SEIA, the best way to limit risks and build more resilient supply chains is to significantly expand domestic manufacturing.

Reshoring manufacturing

The manufacturing announcements stimulated by the IRA will amount to what SEIA estimates at 47 GW of new modules, over 16 GW of cells, more than 16 GW of ingots and wafers, nearly 9 GWac of inverters and well over 100 GWh of battery manufacturing (which serves the solar as well as the electric vehicle industry). SEIA also estimates that we can anticipate more than 20,000 tons of annual domestic polysilicon capacity coming back online and a multitude of new investments in tracker and racking capacity. And this is just the start—SEIA forecasts that we will see exponential growth in all of these sectors.

Timelines

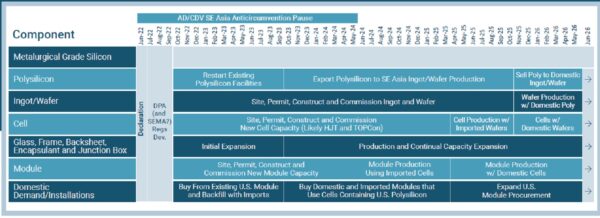

As the chart above shows, it will take some time before domestic manufacturing fills in the gaps across the entire domestic supply chain. Polysilicon production, for example, will take until the fall of 2025 before U.S. production will be sold to domestic ingot/wafer manufacturers. And it will be after that that we begin to see any capacity in domestically produced ingots, wafers and cells. In the meantime, U.S. module makers will have to rely on imported ingots, wafers and cells. Similarly, inverter manufacturers will have to import chips, capacitors and transformers before factories supported by the CHIPS and Science Act of 2022 are commissioned. SEIA notes that it’s essential to allow necessary and ethical imports to continue during this transition period.

For more on timelines read Can the U.S. fill domestic supply chain gaps?

As we shore up the domestic supply chain, SEIA cautions that manufacturers will need reliable access to components, materials, and consumables, which will require having multiple sources and suppliers. In the short to mid-term, we will remain dependent on imports, yet bringing more robust solar manufacturing to the United States will avoid some of the risks the industry has faced in the past three years by heavy dependence on imports.