Even before the new home solar mandate, California had achieved groundbreaking levels of solar adoption, largely due to policy and incentives, said report by Lawrence Berkeley National Lab.

Between 2011 and 2021, approximately 1.1 million new homes started construction across the United States each year, and those rates are only expected to continue to grow. These buildings are one of the largest sources of emissions.

The IEA found that in 2021 the operation of buildings accounted for 30% of global final energy consumption. This means that achieving carbon neutrality in the future will require steps that must be actively taken today. A February 2023 report from the Lawrence Berkeley National Laboratory looks at how new homes built with solar provide a ready-made option to achieve these goals.

By assembling a dataset across all new homes and most existing homes through 2020 with solar, where address data was available, the Berkeley Lab found that California had achieved groundbreaking levels of solar adoption.

This success is thanks in large part to state policy. From 2007 to 2018, the California New Solar Home Partnership (NSHP) provided incentives to encourage the adoption of solar on new homes. NSHP offered cash rebate incentives for building new solar homes in the three investor-owned utility (IOU) service areas including Pacific Gas & Electric Company, San Diego Gas & Electric Company, and Southern California Edison. These incentives ranged from $0.50 to $1.25 per watt over the period and were not additional to other incentives available at the time in California.

This policy helped push new home solar penetration to an average of about 40% across California. Of particular note are counties like El Dorado, Placer, Tulare, and Yolo, which exceed 60% solar penetration rates. The report found penetration rates across counties were strongly correlated to areas where NSHP incentives were available and within IOU areas. For example, IOU areas of the state had 50% new solar home penetration rates while non-IOU areas were less than 5%.

Building upon NSHP incentives, the California Solar Mandate required all new homes to have solar energy systems, with few exceptions, starting in Jan. 1, 2020. Outside of California, the peak adoption rates were just 4% in Arizona, 3% in Nevada, and on average about 0.5% across the rest of the United States. Before 2020, there were 18,511 new solar homes in California compared to only 794 new solar homes in other states. Few policies exist across the US that specifically target new home solar, which explains some of California’s success.

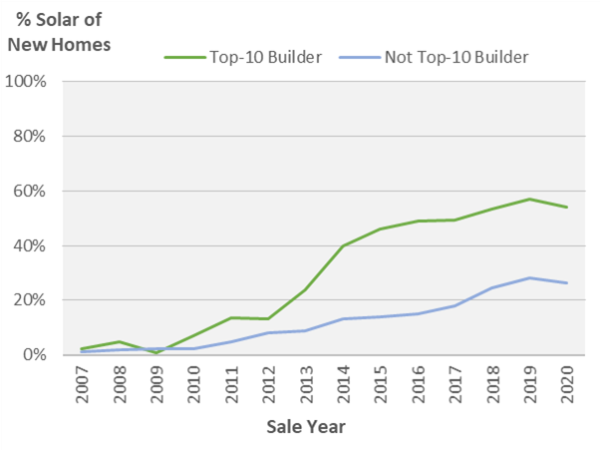

Outside of policy, the strongest correlate driving deployment was the size of market share of the builders involved. As seen above, the top-10 or top-25 largest California builders in the new home market share, for both solar and non-solar, had much higher levels of new solar home deployment. The report found that larger builders were more likely to have the capacity to adapt their practices and to hire new people with experience with solar to utilize the incentives.

When analyzing other variables such as average retail electricity rate, home value, median income levels, and population density the report found relatively weak correlations in comparison to the effects of California’s NSHP program and builder market share. Outside of California, larger builders were not associated with increases in new solar home construction.

Beyond policy, and builder market share, there were important differences in the characteristics among solar and non-solar new homes. The report found that the system size for new home solar was typically smaller, around 4 kW on average compared to 6 kW for installations on existing homes. New homes also had lower battery attachment rates and were more likely to be owned by a third party, like a solar lender. When it comes to the cost of solar systems on new homes, it is comparable to existing homes, but smaller systems benefit less from economies of scale.