A final decision from the Dept. of Commerce on an antidumping/countervailing duties (AD/CVD) circumvention investigation that has hung over the solar industry for the last year should finally be announced on August 17. On July 18, the DOC held a public hearing on the issue of whether solar cell and panel manufacturers are working in Southeast Asia as a way to avoid paying long-standing tariffs on Chinese-made goods.

Credit: Namaste Solar

The case was first brought to Commerce by California-based solar panel assembler Auxin Solar in March 2022. Auxin officials claimed that Chinese solar producers were performing “minor or insignificant” work in Southeast Asia in order to move the country-of-origin of the solar panel outside of China. Commerce took up the investigation and preliminarily decided in December 2022 that Chinese solar cell and panel producers were, in fact, working in Cambodia, Malaysia, Thailand and Vietnam as a way to avoid paying duties on Chinese-made solar goods that have been in place since 2012.

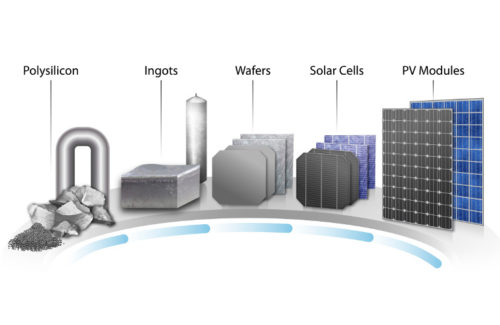

Commerce initially suggested AD/CVD to crystalline silicon cells using Chinese wafers and final panels made with Chinese wafers that also use three of the following Chinese-made materials (“wafer-plus-three”): silver paste, aluminum frames, glass, backsheets, EVA sheets and junction boxes. Wafers produced outside of China with Chinese polysilicon were not considered to be wafers produced in China by the DOC.

The tariffs were suggested for all exports out of the four Southeast Asian countries, except from four individual companies that were investigated and found to not be circumventing the tariffs: New East Solar (Cambodia), Hanwha Qcells (Malaysia), JinkoSolar (Malaysia) and Boviet Solar (Vietnam).

The public hearing on July 18 brought both sides of the tariff battle to the table. Lawyers representing Auxin Solar were on the affirmative, while many more players went on-record as against all or portions of Commerce’s preliminary decision. Law firms representing Silfab Solar, NextEra Energy, JinkoSolar, Hanwha Qcells, Canadian Solar, Trina Solar, Red Sun (Vietnam manufacturer), Boviet Solar, Vina Solar/LONGi, Sunergy and BYD were among those who participated in the hearing on the side against the tariffs.

Auxin Solar and its pro-tariff side

Illustration showing the stages of creating silicon solar panels. Illustration by Al Hicks/NREL

While Commerce’s preliminary decision to extend AD/CVD to solar cell and panel exports coming from Southeast Asia was considered a win for original petitioner Auxin Solar, lawyers representing the solar panel company stated in the hearing that there is still “room for improvement in the final determination.”

The company is pushing for solar panels using any Chinese component — all the way back to polysilicon — to be forced under the tariffs, even though Commerce had previously determined in its 2012 decision that a solar panel’s manufacturing country of origin does not begin until the p-n junction is activated, which happens at solar cell development. Commerce had already taken the significant step in its 2022 preliminary decision to move the country of origin back to the wafer stage but did state that wafers produced outside of China with Chinese polysilicon were not considered to be wafers produced in China.

Auxin believes solar wafers cut in Southeast Asia and made with Chinese polysilicon should be included in the orders, as Auxin says that it takes minor effort to slice wafers and should therefore not cancel out the Chinese origins of the material.

“Under Commerce’s preliminary determinations, a CSPV cell or module producer in Cambodia, Malaysia, Thailand or Vietnam can rely exclusively on Chinese-origin inputs so long as the slicing of Chinese-origin polysilicon ingots takes place in a country other than China. Such an absurd outcome is clearly at odds with Congress’ stated intent in adopting the circumvention statute to combat the diversion and circumvention of the AD/CVD laws,” stated Daniel Calhoun with law firm Cassidy Levy Kent.

Auxin is not in support of Commerce suggesting only solar panels assembled in Southeast Asia that also use three Chinese-made subcomponents would be under the AD/CVD order. The company said this “wafer-plus-three” framework for solar panels “provides a path for further circumvention of the orders as the purchase of four of the designated inputs for non-Chinese sources would constitute a small proportion of the overall cost of materials.” Instead, Auxin suggests Commerce adopt a value-added proposition such that at least 50% of the value of the merchandise is sourced from non-China sources in order for the panels to not have additional tariffs.

Auxin also takes issue with certain companies being excluded from the orders, like Hanwha Qcells and Boviet Solar. “Anti-dumping orders apply to products. They do not apply to companies,” said Chase Dunn with law firm Cassidy Levy Kent on behalf of Auxin Solar. Although the companies do not have company-origins in China, Auxin says that their Southeast Asian-manufactured solar products do.

Finally, Auxin hammered home that it wants to include production of solar-grade polysilicon into the final AD/CVD determination, citing again that solar cell and module manufacturing is “relatively minor or insignificant.” A submitted report to the DOC stated that polysilicon production accounts for 40% of the energy needed to produce a solar panel; ingot and wafer account for 30%; cell and module account for 30%. This, Auxin says, means that the cell and module manufacturing happening in Southeast Asia is insignificant, and Commerce should look at things happening further back on the chain.

The “other side” against extended tariffs

The anti-tariff side of the hearing was represented by U.S. and foreign solar panel manufacturers and outspoken solar project developer and contractor NextEra Energy. Most of the solar panel manufacturers wanted to reiterate that potential extended tariffs would damage the growing U.S. manufacturing industry. Silfab, which has solar panel manufacturing operations in Washington and is planning a new plant in South Carolina, stated that since the United States has no functioning silicon cell producers at the moment, companies like Silfab have to rely on imported solar cells, which are largely coming from Southeast Asia.

Other companies, like Jinko and Hanwha, which were granted exclusions from any potential tariffs, made sure to tell Commerce it did the right thing there. Hanwha stated that it has a 14-year history of producing solar cells in Malaysia, including three years before the initial AD/CVD orders were imposed. It did not move operations to Malaysia to avoid AD/CVD in China.

Many of the companies continue to take issue with Commerce’s new “wafer-forward” ruling. The AD/CVD parameters of 2012 placed tariffs on the silicon cell and forward to the module. Solar panel manufacturers supplying the U.S. market based their manufacturing locations to comply with the original AD/CVD orders with the cell-forward ruling. Companies found to now be circumventing the tariffs with the new wafer-forward suggestion were previously under compliance based on the cell-forward requirements. Solar manufacturers asked the DOC to take a second look at its preliminary decision.

Lawyers representing NextEra said in the hearing, “Creation of the p-n junction is the key step in CSPV production. Before that step, in the words of SolarWorld, the original petitioner, a wafer is no more capable of producing electricity than a sliver of river rock.”

Next steps

The Dept. of Commerce is expected to release its final determination on August 17. President Joe Biden did issue a 2022 executive action that paused additional tariffs for two years — until June 6, 2024. When the AD/CVD investigation first began, solar module supply from Southeast Asia effectively stopped. The four countries had previously supplied at least 80% of the solar panels installed in the United States, so Biden’s two-year pause allowed modules to continue to be imported without the threat of retroactive duties. Both congressional chambers voted to overturn Biden’s executive action, but Biden vetoed their attempt. The pause in retroactive duties still stands today.