Following the Federal Reserve’s interest rate hikes, the loan products of the residential solar finance company Sunlight Financial are at risk of being sold for a loss. This has led the firm to question its ability to continue operating.

Sunlight Financial Holdings, known for its residential solar financing, has raised substantial doubts about its future operational viability. Their 10-Q financial documents, released on August 9, 2023, highlight a “going concern” regarding the company’s ability to raise cash for new loans.

The primary concern for Sunlight is their “Indirect Loan” product. Starting in the second half of 2022, this product has been at the forefront of Sunlight’s offerings, and they’ve now acquired nearly $550 million worth of them. Yet, it has simultaneously placed the company in a precarious financial position. Sunlight has been holding these loans on its balance sheet, awaiting the right opportunity to sell them and thereby raise cash for the issuance of new loans – however – to date, the company has struggled to find buyers at a profitable price.

Recent Sunlight stock performance paints a grim picture: a 23% drop in the past five days and a staggering 96.4% plummet since its January 2021 launch. Roth MKM, a focused solar power analyst, once maintained a neutral stance toward Sunlight. However, post this disclosure, they’ve shifted Sunlight’s status to “Under Review”, citing unreliability in their data.

According to Sunlight’s 10-Q, the company faces difficulty in selling these Indirect loans:

- at or above previously forecasted pricing

- at or above Sunlight’s cost basis in these Loans

- within previously forecasted timeframes.

The Federal Reserve’s decision to raise interest rates is playing the leading role in this challenge. With interest rates climbing from 0% in March of 2022 to a substantial 5.25% today, the financial environment has turned volatile. Sunlight’s process means that loan approvals preceded specific cost amendments, meaning that Sunlight adjusted rates slower than the Federal Reserve escalated theirs.

To mitigate the ongoing rate increases, Sunlight took “pricing actions” on these loan products. The expectation was to offload these loans at a profit, but prevailing market conditions hindered such sales. As a result, Sunlight now has a backlog, with products valued (as per their former evaluations) at $550 million on their balance sheets. Although their financial partners have waived a cap surpassing $500 million, Sunlight clarifies that this is a short-term concession.

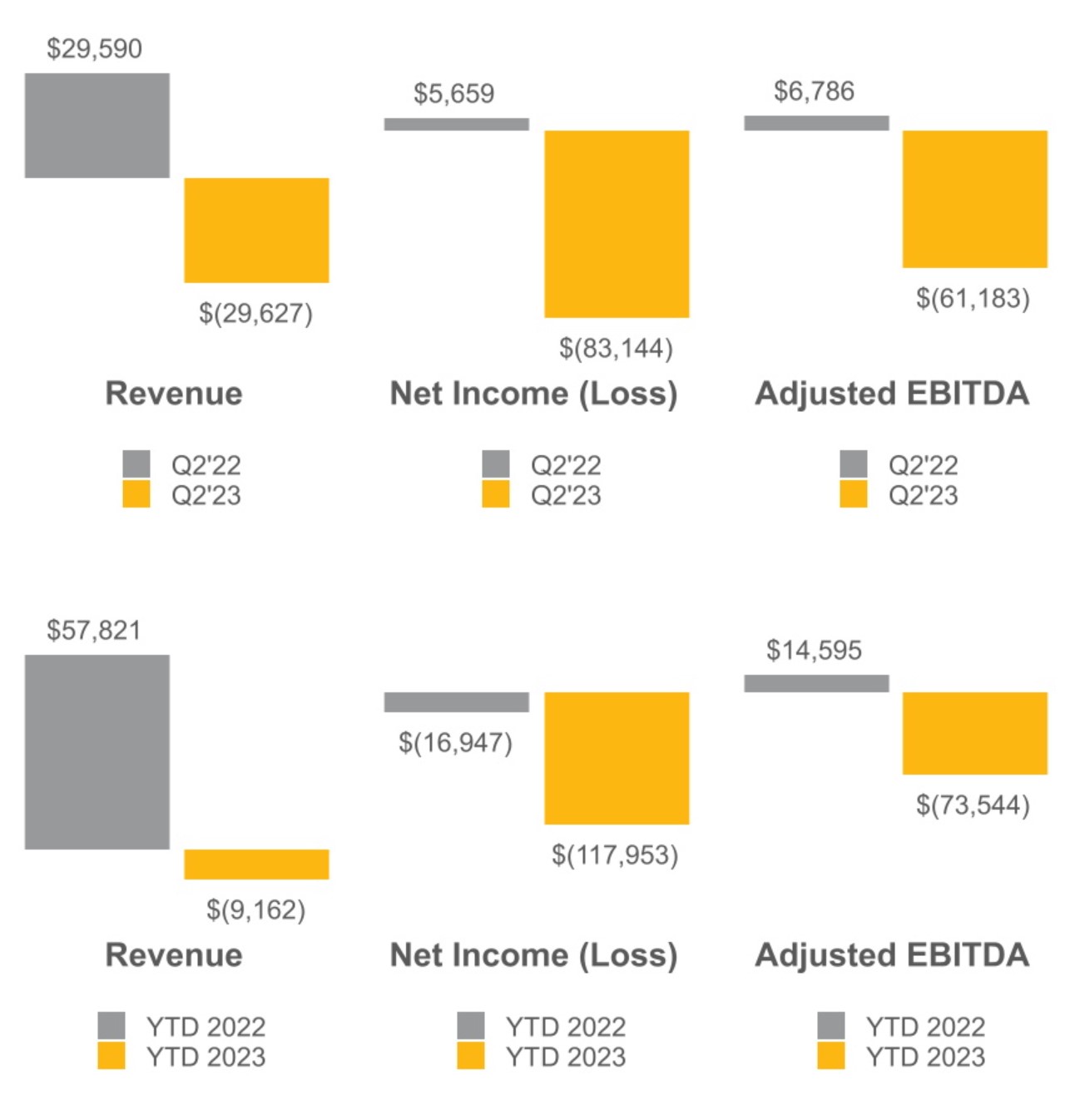

The 10-Q further sheds light on Sunlight’s Q2 performance. Key metrics, such as revenues, net income, and adjusted earnings before interest, taxes, depreciation and amortization (EBITDA), are all down significantly.

In 2022, the residential sector was the bright spot in the U.S. solar market, boasting a 40% increase in installed solar capacity. This growth came even as the nation’s overall solar installations dwindled due to challenges from solar module import tariffs. Pioneering market leaders like Sunlight contributed to this rise, leveraging aggressive financing strategies to offer affordable loans to homeowners eager to invest in solar power.

For example, SolarEdge witnessed record revenue growth in 2022, buoyed largely by its U.S. sales volume. Yet, despite posting record revenue and experiencing global growth, their most recent quarterly report indicated softness in the U.S. market, which subsequently impacted their stock price.

Industry analysts, such as Ohm Analytics, have noted a shift: residential solar contractors are transitioning away from challenging solar finance states like Texas and Florida. Instead, they’re gravitating toward states offering greater incentives or those with elevated electricity prices to augment sales. This shift follows a conundrum for companies that relied heavily on loan financing structures, such as upfront payments upon deal closure, from entities like Sunlight Financial. Without a steady influx of capital, these companies are grappling with operational challenges.