Bolstered by private equity and the acquisition of four U.S. manufacturers, ESDEC is seeking further expansion via capital raised from public markets.

Solar racking conglomerate ESDEC is reportedly targeting a $5 billion valuation in preparation for its initial public offering (IPO), following significant acquisition-driven growth in the U.S. and Europe.

According to a report from Bloomberg, JPMorgan Chase & Co. and Morgan Stanley have been hired to manage the process, and is adding further banks to the IPO syndicate

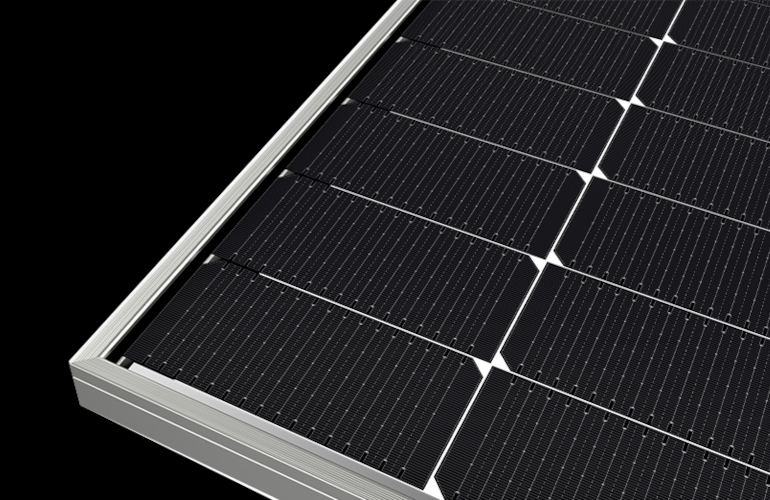

Dutch-based ESDEC has built an impressive solar racking portfolio via a series of strategic acquisitions in the U.S., after making similar purchases in Europe. To date, the firm has bought out four key U.S. racking entities: Ecofasten in November 2018, Ironridge & Quickmount in September 2019, and PanelClaw in November 2020. Notably, in 2020, Quickmount shifted its manufacturing facilities to China.

In 2018, Rivean Capital, a leading European private equity investor, made its first investment in ESDEC, propelling the solar group’s acquisition momentum. Last year, in a significant transaction, Blackstone, dubbed the world’s largest real estate developer and alternative asset manager, alongside Rivean Capital, acquired the ESDEC group, cementing its position in the burgeoning solar market.

This joint acquisition drew close attention from European regulatory bodies. Blackstone emphasized that such strategic acquisitions played a vital role in its growth, as evidenced by the company’s yearly sales leap from approximately €30 million ($28.9 million) in the Benelux regions to €500 million across three continents. The purchase was finalized by the end of 2022. As part of the recent transaction, Rivean Capital not only realized its original investment in ESDEC but also reinvested into the company, demonstrating their continued faith in ESDEC’s potential.

Highlighting the rationale behind the ESDEC purchase, Blackstone’s Senior Marketing Director of Private Equity, Bilal Khan, stated:

We believe this partnership with ESDEC is going to allow access to reliable, low-cost rooftop solar solutions for other businesses Blackstone invests in, creating an opportunity to generate value for Esdec and drive decarbonization across our portfolio.

Blackstone has made multiple investments in the solar industry. The company offered development and construction credit to commercial solar developer Altus Power, put several billion into utility scale developer Invenergy, and launched a $100 billion sustainable credit platform.

pv magazine USA reached out to ESDEC CEO Stijn Vos for further comment.