PPA prices are increasing due to rising costs, said a report by LevelTen Energy.

Many large solar projects sell their electricity generation via power purchase agreements (PPA), long-term agreements that typically span about 25 years. LevelTen Energy maintains a large PPA marketplace, and its most recent quarterly report noted an uptick for PPA prices in the United States.

LevelTen said developers are facing rising costs across the board, from financing, to interconnection, to labor and supplies, which has tempered the boost from federal tax credits made available by the Inflation Reduction Act (IRA).

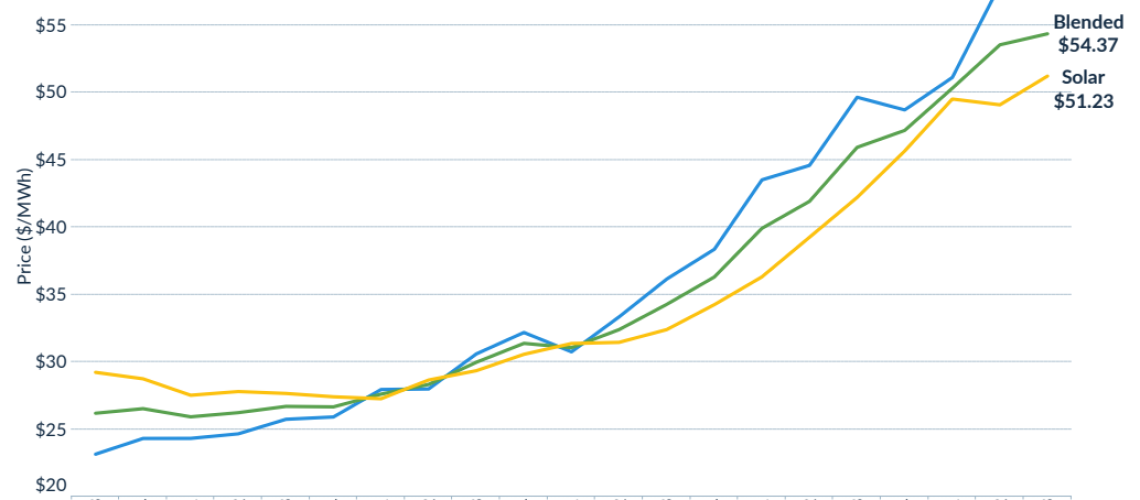

North American PPA prices continued a trend of stabilization in the third quarter of 2023, rising 4% over Q2 prices. Current P25 PPA prices represent a 21% increase year-over-year from 2022 prices.

A P25 price is the 25th percentile of all PPA prices. LevelTen reports its P25 data based on the prices that developers are offering for PPA contracts, not transacted PPA prices.

The report attributed this quarter’s 4% increase in solar PPA prices to increases in independent system operators like PJM Interconnection, Southwest Power Pool (SPP), and ISO-New England. While price increases in the recent quarter were mold mild in some previous quarters, the cumulative impact of price increases are making it more difficult for corporate buyers to secure CFO approval, it said.

“Developers are looking to find ways to provide buyers with some pricing relief, but this is exceedingly difficult amid a wide array of development and financing challenges,” said Gia Clark, senior director of strategic accounts, LevenTen Energy. “Expectations of a prolonged high interest rate environment are pushing developers’ costs up across the board, with energy players of all sizes feeling the heat.”

Prices in the Texas ERCOT region decreased this quarter, drawing back 4%. In Q2, threats from anti-renewables bills led developers to include risk premiums in their prices. Those regulatory threats have since diminished, and average prices have come back down in response.

In PJM, solar PPA prices increased 12% in-quarter. PJM’s solar P25 prices have now risen 31% year-over-year. Permitting challenges, a lack of construction companies available in the region, and a projected increase to PJM electricity prices over the next 10 to 15 years are driving higher prices. A lack of transmission to deliver clean energy to areas with high demand is also driving congestion and basis risks, thereby driving up prices.

“We are clearly in the midst of our energy transition, with significant adjustments occurring in the market each quarter. If corporations want to support clean energy development and ultimately have more PPA options to choose from, they should really be getting creative and looking at purchasing tax credits now,” said Clark.

Clark said that industry headwinds and the overall higher cost of capital and interest rates make it unlikely for PPA prices to go down substantially any time soon. At the same time, buyer demand for PPAs remain high due to corporate goals of decarbonization.

“Buyers know the cost of not decarbonizing will, in the long run, cost far more than procuring now,” said Clark.

Clark said buyers and sellers will need to continue embracing a partnership approach, meeting in the middle to continue closing deals.

“The energy transition is here. Being creative in how both buyers and sellers work together is going to be critical as we navigate through the next few years,” Clark said.