Using its own database of price quotes, the Anza Q2 Pricing Insights Report highlights the first price increase in years as a result of AD/CVD petition and the reinstatement of bifacial import duties.

Anza, a solar and energy storage supply chain platform, Q2 Pricing Insights Report aggregates data from 95% of the U.S. solar module supply year to date to provide pricing changes that result from market forces and regulatory changes. With the Q2 report on the U.S. solar module market shows the first price increase in years. Anza attributes this to the latest AD/CVD petition and reinstatement of bifacial import duties.

“After years of record low pricing, we’re seeing the market start to rebound as domestic manufacturers have less pricing pressure from foreign producers that are subject to tariffs,” said Mike Hall, CEO of Anza. “We’re expecting to see this upward price trend continue from here, making it critical for new projects to consider current pricing and potential tariff impacts when sourcing materials.”

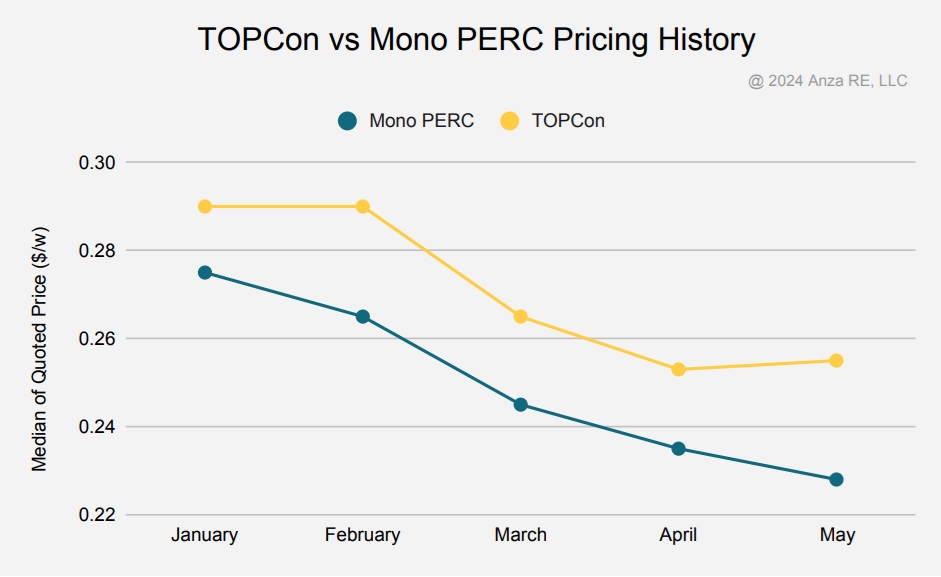

Anza’s Q2 report looks at module pricing trends from March to May 2024 and finds that while there was a downward pricing trend in March and April, prices bounced up in May.

Looking at the period from February to May 2024, the median module price dropped from 27.9 cents per watt to 25 cents per watt, marking an 11% decrease. The most substantial change occurred between February and March 2024, when prices fell by 2.5 cents or 8.6%.

The report noted that while TOPCon prices remained steady from January to February, they dropped right alongside PERC through April. Anza attributes advancements in TOPCon manufacturing and increased competition from foreign suppliers as driving these price declines.

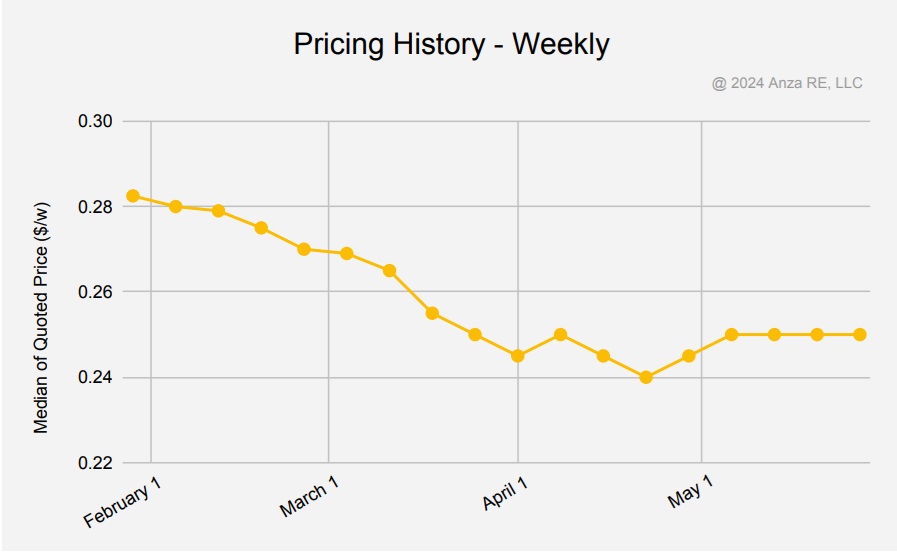

Then in May, following the AD/CVD petition, prices began to rise again at about 2%. Anza report authors acknowledge that while this is only a small increase, it is significant because it is the first time since late 2022 that prices have increased.

The report drills trend data down to a weekly basis, which that the median price dropped to 24 cents per watt the week of April 22, hitting what Anza suggests is the pricing floor. Since that time prices have climbed back and held at 25 cents per watt through the end of May; an increase of 4%. Anza anticipates that this upward trend due to the looming AD/CVD petition.

The report contends that “new solar module tariffs and regulatory changes have materially affected pricing, though we are only starting to see early signs of those impacts”.

The tariffs referred to include the new bifacial tariff as well as the looming fallout from an AD/CVD petition officially filed on April 24, 2024, against Cambodia, Malaysia, Thailand, and Vietnam. The report notes that while preliminary antidumping determinations for this case are not expected until Q4 of this year, additional duties could be applied retroactively as early as May or June 2024.

AD/CVD laws assess tariffs on goods that are found to be dodging import duties by dumping products in other countries before shipping them to the U.S. In the previous AD/CVD proceeding, four Southeastern Asian countries, Vietnam, Cambodia, Thailand and Malaysia, which were responsible for roughly 80% of the U.S. supply of solar components, were alleged as potentially harboring dumped products from China.

The recent AD/CVD petition filed by the American Alliance for Solar Manufacturing Trade Committee, which includes First Solar, Qcells, Meyer Burger, REC Silicon, and others, claims that the U.S. “manufacturing renaissance” is threatened by heavily subsidized Chinese cells and modules.

[Read more about AD/CVD history in Solar panel import tariffs are affecting the industry by increasing prices by up to 286%]

Anza’s quarterly Pricing Insights Report looks at the impact of both government incentive programs, such as the IRA, and AD/CVD tariffs—in addition to the recently reinstated tariffs on bifacial solar modules, which generate electricity on both sides of the panel. Bifacial solar modules were previously exempt from tariffs, and the removal of the exemption reinstates a 15% tariff.

The report also compares Tier 1 module pricing to that of Non-Tier 1, and finds that the gap between the two has closed in the near term. The report finds that Tier 1 module prices dropped from 29 cents per watt to 25 cents per watt, marking a 14.8% decrease. Meanwhile, Non-Tier 1 module prices fell from 25 cents to 24 cents per watt, a 4.1% reduction.

In 2023 Anza was spun out of Borrego Solar after Borrego developed the solar and battery storage online marketplace and optimization solution. The proprietary software that drives the digital marketplace identifies the most optimized solar module and storage components based on customer-provided project details.