High interest rates, an uncertain rate trajectory and timeline, increasing trade barriers, supply chain challenges, concerns about the presidential election’s impact on the sector, and constantly evolving trade policies have created a climate of uncertainty.

From pv magazine Global

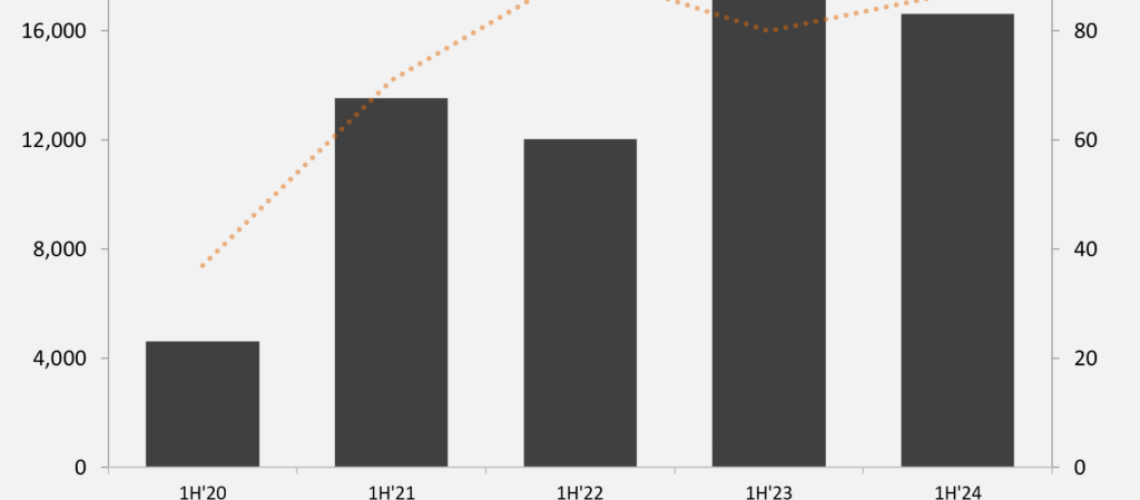

Total corporate funding in the solar sector reached $16.6 billion in the first half of 2024, according to data released by Mercom Capital Group in its latest solar funding and merger and acquisition (M&A) report.

The total figure, which includes venture capital/private equity funding, public market, and debt financing, is 10% lower year on year than the $18.5 billion raised in the first half of 2023. However, the number of deals increased 9% year on year with 87 recorded in the first half of 2024, compared to 80 deals during the same period last year.

VC funding activity decreased 29% year on year in the first half of 2024, with $2.7 billion raised in 29 deals. Solar public market financing hit $1.7 billion across eight deals in the first half of 2024, down 75% from $6.7 billion across 14 deals in the first half of 2023.

Solar companies raised $12.2 billion across 50 debt financing deals in the first half of 2024, marking a 53% increase from the $8 billion raised in 33 deals during the first six months of 2023. According to Mercom Capital Group, this period represented the highest first-half total for solar debt financing in a decade.

“Financing activity in the solar sector remains restrained despite tailwinds from the Inflation Reduction Act and favorable global policies,” said Raj Prabhu, CEO of Mercom Capital Group.

Prabhu added that high interest rates, an uncertain rate trajectory and timeline, increasing trade barriers, supply chain challenges, concerns about the US presidential election’s impact on the sector, and constantly evolving trade policies have created an “unpredictable and uncertain climate … This has slowed down development, investments and decision-making.”

There were 40 solar M&A transactions in the first half of this year, down from 48 in the same period of 2023. The largest deal involved Canada’s Brookfield Asset Management acquiring a majority stake in French renewable company Neoen for over $6.5 billion.