Total corporate funding in the solar industry reached $22.3 billion over the first nine months of 2024, representing a 23% year-on-year decrease. Mercom Capital Group says that while global uncertainties are affecting investor confidence, an increase in debt financing and resilience in newly-announced large-scale project funding remain bright spots for the sector.

From pv magazine Global

Total corporate funding in the solar sector across the first nine months of 2024 (9M 2024) stood at $22.3 billion, according to figures released by Mercom Capital Group.

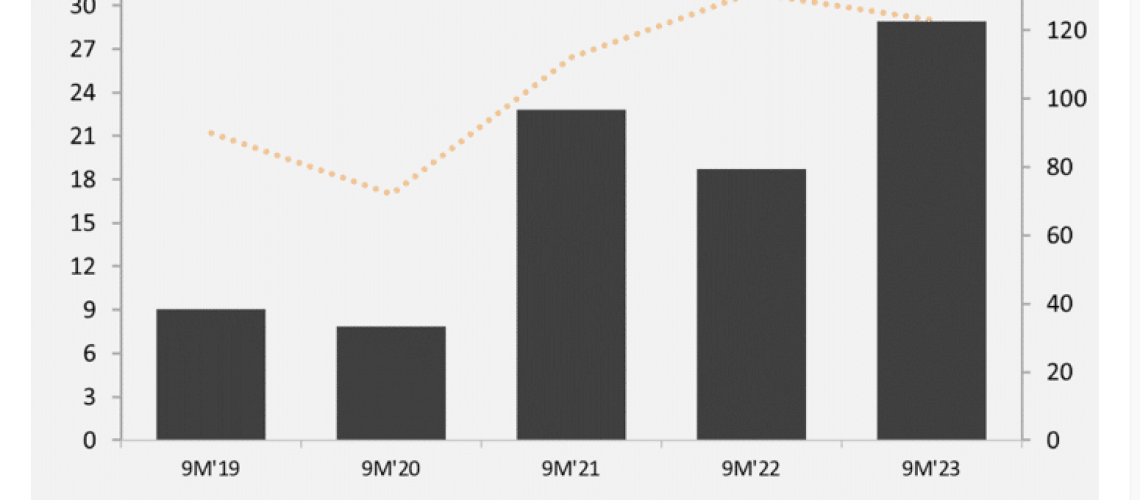

The total figure, which includes venture capital/private equity funding, public market and debt financing, represents a 23% year-on-year decline compared to the first nine months of last year (9M 2023), when $28.9 billion was raised. The number of deals has also decreased, by 6% year-on-year, with 117 deals in 9M 2024 compared to 124 deals in 9M 2023.

This year’s result to date is largely driven by a 39% year-on-year decrease in solar venture capital funding, which has reached $3.5 billion across 39 deals so far this year, and a 71% year-on-year decrease in solar public market financing, which stands at $2.1 billion across 10 deals this year to date.

But an increase in debt financing reverses this year’s downward trend. Mercom recorded $16.7 billion raised across 68 deals in 9M 2024, compared to $16 billion raised across 54 deals in 9M 2023.

Raj Prabhu, Mercom Capital Group CEO, says the solar sector is grappling with significant tax uncertainties.

“Regulatory concerns around antidumping and countervailing duties and tariffs, the U.S. Section 45X guidance, potential policy shifts due to election outcomes, unpredictable global trade policies, supply chain disruptions, higher costs, tight labor markets, and ongoing project delays have all dampened investor confidence and delayed key investment decisions,” Prabhu said. “While the recent 50 basis points rate cut is hopeful, the market needs more clarity and direction on future rate cuts to spark a resurgence in investment momentum.”

Despite the decline in overall funding, Mercom Capital Group’s analysis adds that announced large-scale project funding is showing resilience this year, reaching $34.3 billion in 9M 2024, an increase on last year.

Mercom Capital Group also recorded 62 mergers and acquisitions (M&A) transactions executed in 9M 2024, compared to 75 in 9M 2023.

Almost 28.3 GW of solar projects were acquired in 9M 2024, compared to 31.6 GW in 9M 2023. The number of project acquisitions across the first nine months of both years was the same, standing at 166.