The North American manufacturing hub has added several new producers across the PV module supply chain but analysts see continued cell, wafer and polysilicon capacity constraints. The report is based on announcements of capacities at regional sites that produce solar modules, cells, wafers, ingots, polysilicon and metallurgical-grade silicon.

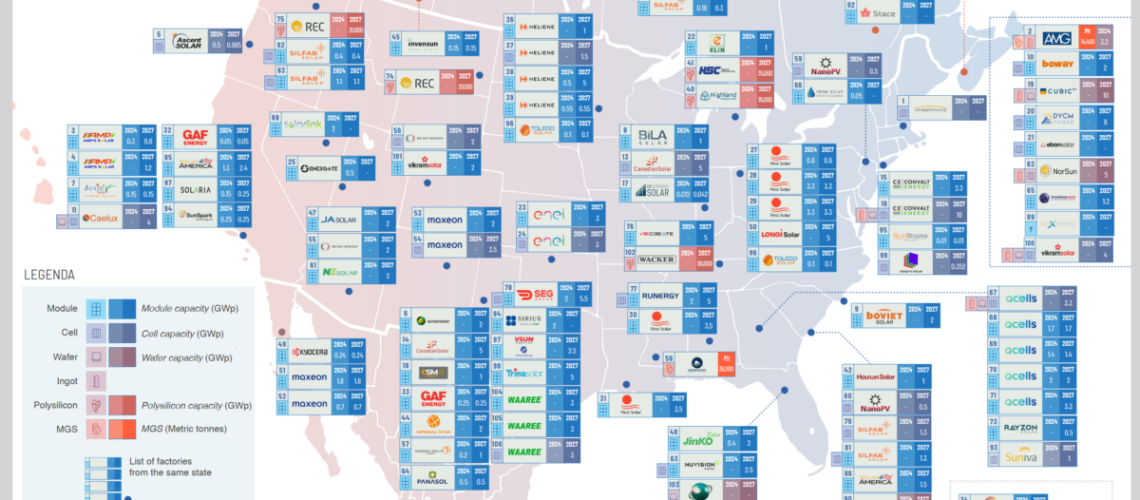

The latest North American manufacturing hub map from Sinovoltaics, a Hong Kong-based technical compliance and quality assurance company, reveals several new entrants to the region and planned capacity growth across the solar-module supply chain.

The Sinovoltaics Supply Chain Map (SSCM) – North America for Q1 2025 tallies 31.92 GW of module production capacity, taking into account announcements of cancelled factories and modified capacity figures across the U.S., Mexico and Canada. A further 97.9 GW in capacity is planned for the coming three to six years, for a total of 129.9 GW capacity for the region.

The map and tables in the report provide details on 106 factories producing solar modules, cells, wafers, ingots, polysilicon, and metallurgical-grade silicon, up from 95 production sites in the previous report.

Several manufacturers were added to the latest North American map, such as Boviet Solar, DYCM Power, Ebon Power, Imperial Star Solar, NuVison Solar, EsFoundry, ReCreate and Toyo/VSUN.

Despite new market entrants, such EsFoundry, and progress in planned capacity, Sinovoltaics analysts noted that cell, wafer, and polysilicon production capacity is constrained and “remains the Achilles heel of the market.” Cell production capacity is slated to grow from 8 GW to 64.9 GW by 2030, and wafer production to go from 3.2 GW to 24.5 GW in the same period. The analysts noted that some manufacturers cancelled projects, such as Switzerland-based Meyer Burger, which had planned a cell production site.

As for polysilicon, Hemlock Semiconductor, Wacker Mississippi Silicon, and Highland Materials are the main suppliers, planning an estimated total of 171,000 metric tons of production capacity.

The Sinovoltaics supply-chain reports are free to download. They track the name of the manufacturer, factory size, location, owner, current and planned capacity. The data is sourced from publicly available sources, as well as Sinovoltaics’ contacts with manufacturers. The figures represent nameplate capacity.

The series of reports are free and also available for India, Southeast Asia, and Europe.