A new report on the U.S. solar and storage market shows an improving return on investment for solar and storage investments, bolstered by declining hardware prices and increasing utility rates — even amid California’s transition to NEM 3.0.

Enact Solar has published its 2023 U.S. Solar and Storage Market Intelligence Report, which offers an overview of the solar energy landscape in the United States. Enact customers are seeing a shorter payback period now, around 5.5 years, when compared to around 7.6 years under NEM 2.0.

This comprehensive report provides invaluable insights into the trends, challenges and advancements shaping the American solar and storage market, underlining the pivotal role of Enact’s innovative platform in the clean energy transition. The 2023 report found the Enact platform has proposed over $996 million worth of projects in the U.S. and over $12.8 billion globally, as of Dec. 31, 2023. The platform has monitored over 110 MW of systems.

“The 2023 report indicates that the U.S. residential consumer’s transition to solar and storage has become increasingly complex, with a growing number of brand choices, complex NEM rates, and widely varying installer service levels,” said Deep Chakraborty, Enact CEO. “However, as energy consumption patterns rise and solar/storage hardware prices decline, the consumer’s ROI is steadily improving.”

Highlighted within the report is the notable proliferation of energy storage options, with an over 100% increase in the number of brands proposed on the Enact platform between 2022 and 2023. This surge in options creates heightened complexity for both consumers and installers, emphasizing the need for trusted sources in the industry.

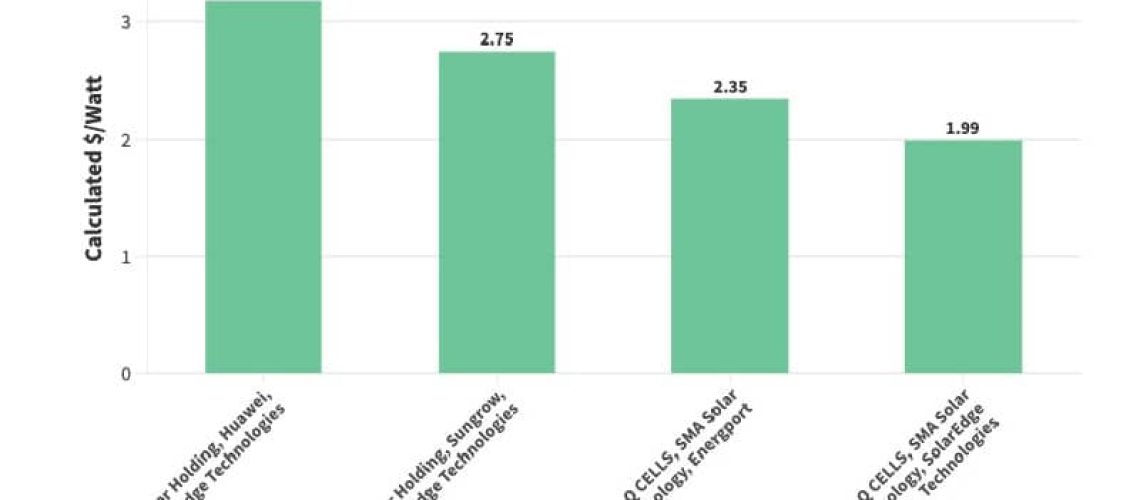

The Enact report underscores the escalating spread in pricing across brands, including in residential sales with storage paired with solar. The average pricing for solar-plus-storage systems was around $3.60/Watt and peak pricing around $5.85/W for residential projects. There was a wide range in residential pricing for solar-only systems, with average pricing at $3.33/W and peak pricing at $5.12/W.

The report compared the average consumer pre-project energy consumption with electric bill values for customers. Enact found a 5% increase in the median bill and a 37.72% higher pre-solar consumption for customers seeking solar and/or storage options in 2023, when compared to 2022. Increasing consumption — along with increasing utility costs and climate change — have increased demand for solar solutions.

The Enact Platform evaluation revealed a significant variance in service levels among installers, emphasizing the critical need for reliable data and guidance in the selection process. As consumers navigate the complexities of transitioning to solar and storage solutions, Enact remains steadfast in its commitment to providing trusted advice and facilitating seamless experiences through its innovative platform.

For more information and to access the full report, please visit https://enact.solar/enact-2023-u-s-solar-and-storage-market-intelligence-report/.