For a Monday morning at eight o’clock, the midtown Manhattan ballroom was slightly abuzz as a beyond-capacity BloombergNEF New York Summit audience started to pour into the InterContinental New York Barclay hotel ballroom. Fifteen-second advertisements of Our Next Energy incorporating a solar plus storage project in coal country of Jackson County, W.Va. jumped across the screen as attendees sat down with coffee and pastries.

The BloombergNEF Summit on April 24-25, 2023, focused on grid innovations, climate change and renewable energy technology and saw in excess of 800 attendees turn out in person and on a live webcast. The annual event was supported by 26 corporate sponsors ranging from Arcadia Power to solar module producer Tongwei Solar, and for global energy markets, Chevron New Energies to Schneider Electric.

Jon Moore, chief executive officer of BloombergNEF, opened the conference saying that 91% of global carbon emissions are now covered by some form of government legislation such as the Paris Climate Accord, while the net zero cost to decarbonize the world comes at a cost of $196 trillion by 2050.

Lingering behind the optimism around the first day of the annual BNEF Summit, conference panelists and audience surveys revealed that permitting of utility-scale energy projects from utility solar, energy storage to offshore wind, is moving at a snail’s pace, much like further guidance on the dozen or so remaining bullet points from the massive Inflation Reduction Act.

Interconnection queues stretching back multiple years, and the struggle for a universal and rapid permitting system for hundreds of gigawatts of clean energy projects were some of the most prevalent themes at the 2023 BNEF Summit. Patrick Decostre, chief executive officer of Canadian IPP Boralex, and Ammad Faisal, senior managing director of Marathon Capital, both pointed to permitting constraints and lack of guidance on tax credit transferability as two prevalent hindrances to a more rapid proliferation of renewable energy projects.

Sarah Ladislaw, special assistant to the president and senior director for climate and energy, said that while power transmission “is a very boring discussion, with so much of it going on, which is exciting,” it’s also one of the top three topics her bureau is focused on for federal, states and corporations seeking to achieve sweeping decarbonization goals.

Moore told the morning audience that $470 billion was invested into grid modernization efforts last year in the U.S., while so far about $52 billion has been shaken down from the $370 billion IRA package incentives for clean power and grid enhancement efforts.

David Hardy, executive vice president and chief executive officer, Americas for Orsted, said permitting risk is also very high now, with reform needed to regulate transmission and distribution system upgrades as well.

“The permitting process for offshore wind is ten years,” Hardy said. “We really need to change that.”

Financial clout

The recent collapse and insolvency of Silicon Valley Bank and Credit Suisse, and the lack of a strong public capital market since 2021, has amplified setbacks to a rapid decarbonization market, “creating a tale of two cities,” said Nancy Pfund, founder and managing partner of DBL Partners, a clean-tech VC investment firm which counts Tesla, NEXtracker and SolarCity as some of its legacy investments.

With the inability of mature companies to go public through IPO, and clean-tech start-up’s now without the financial support of SVB and other big banks, Pfund said a “dark cloud” over capital markets has forced her to reach out to a SVB contact to check up in recent weeks. Ordinarily it was the commercial bank that was asking Pfund about the financial performance of DBL’s portfolio companies.

“It’s rattled the psychology in Silicon Valley,” she said during a panel entitled, “A New Age of Competition: Energy Transition, Trade and Supply Chains.”

Technology wishlist

During an afternoon fireside chat, Jigar Shah, solar veteran and director of the Department of Energy’s Loan Programs Office, said since joining the government agency in March 2021, the LPO has put $35 billion of capital investment to use in new clean energy technologies and projects, with just $1 billion of which he would consider a loss, “a better rate than most commercial banks,” he told Meredith Annex, head of clean energy, BNEF.

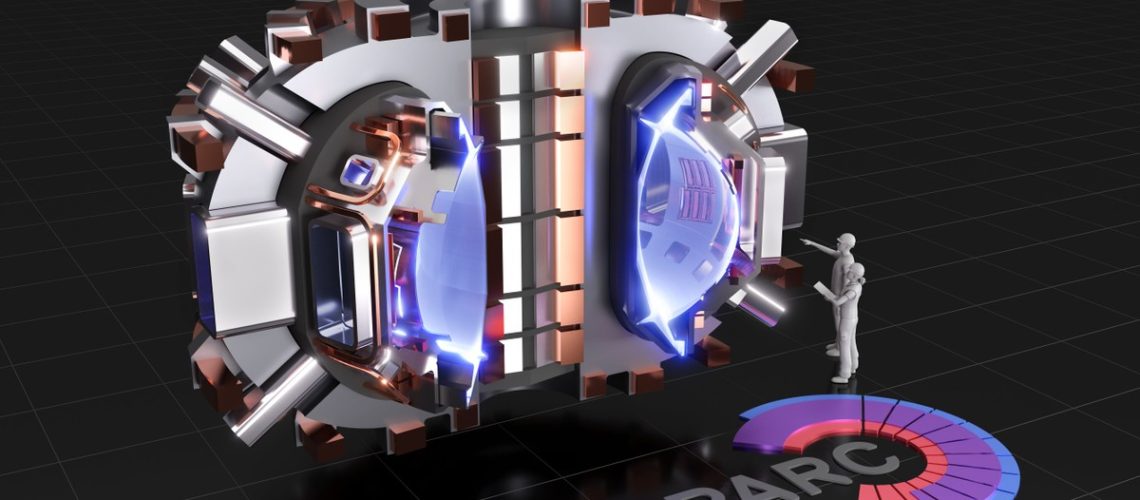

After surveying the audience, Shah said his favorite technology under review at the LPO is small modular reactors (SMR), a fusion energy technology not expected to see commercial operations until the end of this decade.

“Countries that continue to add coal capacity should be doing SMR’s meanwhile,” Shah said.

Shah also pointed to the proliferation of virtual power plants, including the April 20 announcement that the LPO would backstop up to $3.3 billion of solar, storage and VPP assets integrated by Sunnova Energy, as a strong means to rapidly decarbonize while providing grid resiliency and affordable power in disadvantaged communities.