NREL’s final report on the future of storage, drawing from a series of six in-depth studies, presents “key learnings” from across those studies.

The National Renewable Energy Laboratory (NREL) presents eight “key learnings” in a new report, often in the form of projections. Below is a condensed version.

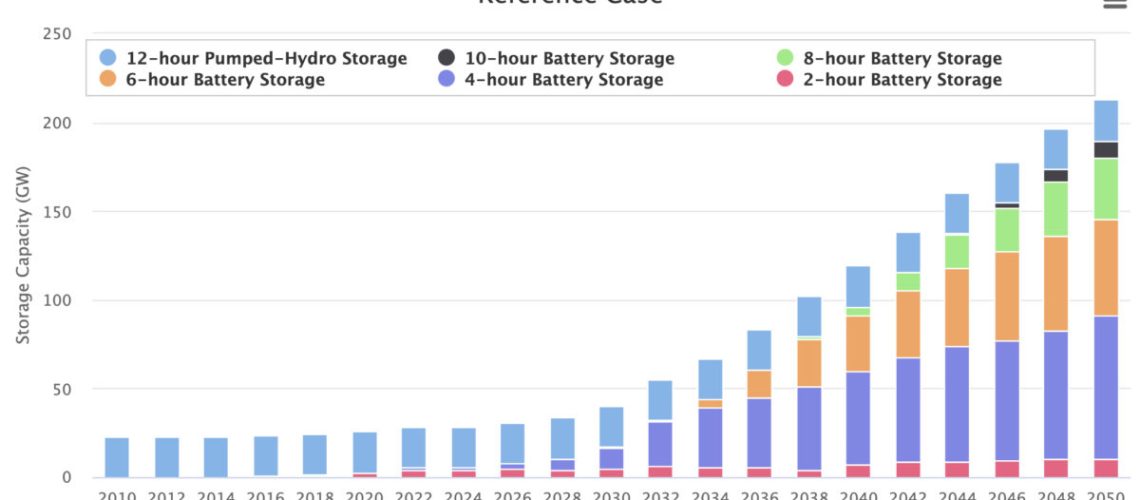

Battery deployments in the US will boost storage capacity to 200GW and 1200GWh in 2050 in the reference case, as shown in the image above. Pumped hydro storage capacity will not increase.

Lithium-ion batteries will continue to have the highest market share “for some time,” as system costs for 4-hour storage, including all system components and installation, fall to $200 perkWh capacity by 2030, and continue to decline. Other technologies “could have new opportunities” if they can compete with battery prices.

The ability to provide firm capacity—which is the greatest value of storage—depends on the fit between storage duration and the duration of the region’s net peak load. Firm capacity enables storage to meet demand during system peak times and to replace gas turbines.

“Time shifting,” or saving energy for discharge at times of high demand, provides a smaller but still significant portion of the value of storage. Providing operating reserves adds minimal value, due to “saturation” of reserve requirements from storage deployed for other reasons. The value of deferring transmission by adding storage was not estimated, as it is “difficult to isolate, and very regionally specific.”

Given the “largely untapped potential flexibility in end-use electricity demand,” storage faces competition from grid flexibility options such as time-varying retail rates and industrial demand response.

Storage and solar power are complementary, as increased deployment of PV shortens the peak net load period, so that shorter-duration storage, at lower cost, can pair with PV to provide firm capacity. The lower costs to provide firm capacity translate to increased storage deployments.

Driving a trend in the opposite direction, as storage deployments increase, the net peak loads become wider, requiring longer-duration storage to provide the same level of firm capacity. As a result, storage durations “will likely increase” as storage deployments increase. As shown in the image above, deployment of 6-hour batteries would start around 2034 in a reference case, and deployment of 8-hour batteries would start around 2040. This dynamic “presents opportunities” for emerging technologies capable of longer durations, “or even for the next generation of existing technologies” such as pumped storage hydropower.

Customer adoption of building-level storage will increase as storage costs decline and if the value of backup power is perceived to be higher. Overall, the customer adoption potential will be lower than the economic potential due to long payback periods. At low battery costs and very low PV costs, distributed storage could reach 82GWh by 2050.

Seasonal storage technologies become “especially important” for 100% clean energy systems, for storing excess generation in the spring and fall and shifting energy supply to the summer and winter. More than 400GW of seasonal storage capacity, such as combustion turbines fueled by renewably derived hydrogen, would be needed for 100% clean energy.

The report concludes by listing remaining uncertainties that “could alter the trajectories for storage growth and evolution.” The report briefly describes each of the six previous NREL studies on which it is based.