The Green Bank for Rural America will support community lenders in Appalachian communities to finance climate-supporting projects including distributed solar and storage. The bank and four others received a total of $6 billion in federal awards.

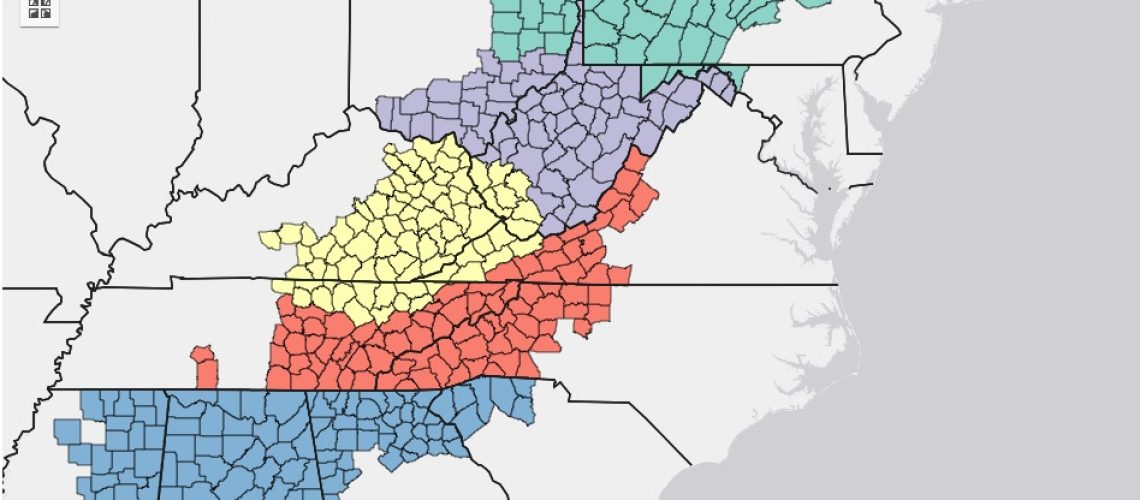

The Green Bank for Rural America has won a $500 million federal award to advance clean energy technology projects in the 13-state Appalachian region and in “energy communities” with a connection to the coal industry.

The green bank expects to leverage private capital to finance $2.25 billion in 2,750 clean energy projects, including distributed solar and storage projects. Other eligible project types under the federal award program are new or renovated buildings with low carbon emissions, and projects supporting zero-emission transportation.

The U.S. Environmental Protection Agency (EPA) made a total of $6 billion in awards to five green banks through the Clean Communities Investment Accelerator, all of which “will flow to low-income and disadvantaged communities,” said a White House press release.

Each of the five green banks receiving the awards will allocate the funds to community lenders, primarily to make loans to projects. A small portion of funds will be used to provide technical assistance to those lenders. The Green Bank for Rural America will provide technical assistance on topics including structuring contracts with local utilities for the sale of solar or wind power.

The Green Bank for Rural America expects to provide capitalization funding to about 100 participating community lenders and investors serving rural areas, with most funding provided in commitments of $10 million or less, and a few commitments ranging up to $50 million. The bank, established by Appalachian Community Capital, will be structured to be a self-sustaining entity.

The support to community lenders will not only finance near-term deployment of climate and clean energy projects, the White House said, but also build the lenders’ capacity to “finance projects at scale for years to come.”

Nationwide, public and private investments in projects supported by green banks reached about $10 billion last year, according to the Coalition for Green Capital.

The five green banks selected through EPA’s competitive application process, most of which have one to five decades of experience, are:

- Opportunity Finance Network ($2.29 billion award), which provides capital and capacity building for a national network of 400+ community lenders in all 50 states and several U.S. territories.

- Inclusiv ($1.87 billion award), which provides capital and capacity building for a national network of 900+ credit unions.

- Justice Climate Fund ($940 million award), a purpose-built nonprofit with a national network of more than 1,200 community lenders, supported by ImpactAssets, a nonprofit with $3 billion under management.

- Appalachian Community Capital ($500 million award), which launched the Green Bank for Rural America to deliver clean capital and capacity building assistance to hundreds of community lenders working in coal, energy, underserved rural, and Tribal communities.

- Native CDFI Network ($400 million award), a nonprofit that serves the 60+ U.S. Treasury-certified Native community lenders, which have a presence in 27 states across rural reservation communities as well as urban communities.