A report from Clean Energy Associates explains direct cost versus safe harbor methods of achieving the domestic content bonus, along with noted risks and challenges in each.

Key provisions for the U.S. solar industry in the Inflation Reduction Act (IRA) of 2022 are the clean energy manufacturing and production tax credits, along with the domestic content bonus. For projects that meet domestic content requirements, developers can combine the three credits to cover as much as 50% of installed system costs. The impetus behind these credits is not only to stimulate clean energy production in the U.S., but also to build out a domestic supply chain, which reduces reliance on foreign imports.

The IRA was passed as bi-partisan legislation under the Biden Administration, but since the 2024 election there’s been much speculation about what will happen to the IRA under the new administration. In the recent report “Domestic Content Insights Navigating Strategies and Challenges in U.S. Domestic Content Compliance for PV Solar,” Clean Energy Associates (CEA) notes that there are several ways the investment tax credit (ITC) and domestic content bonus could change. While it could be repealed altogether, CEA sees an “early sunset” more likely and that domestic content may be required to achieve the 30%.

With the domestic content bonus currently in place, developers who seek compliance are facing several challenges. First of all, there’s limited availability of U.S.-made solar components across the supply chain.

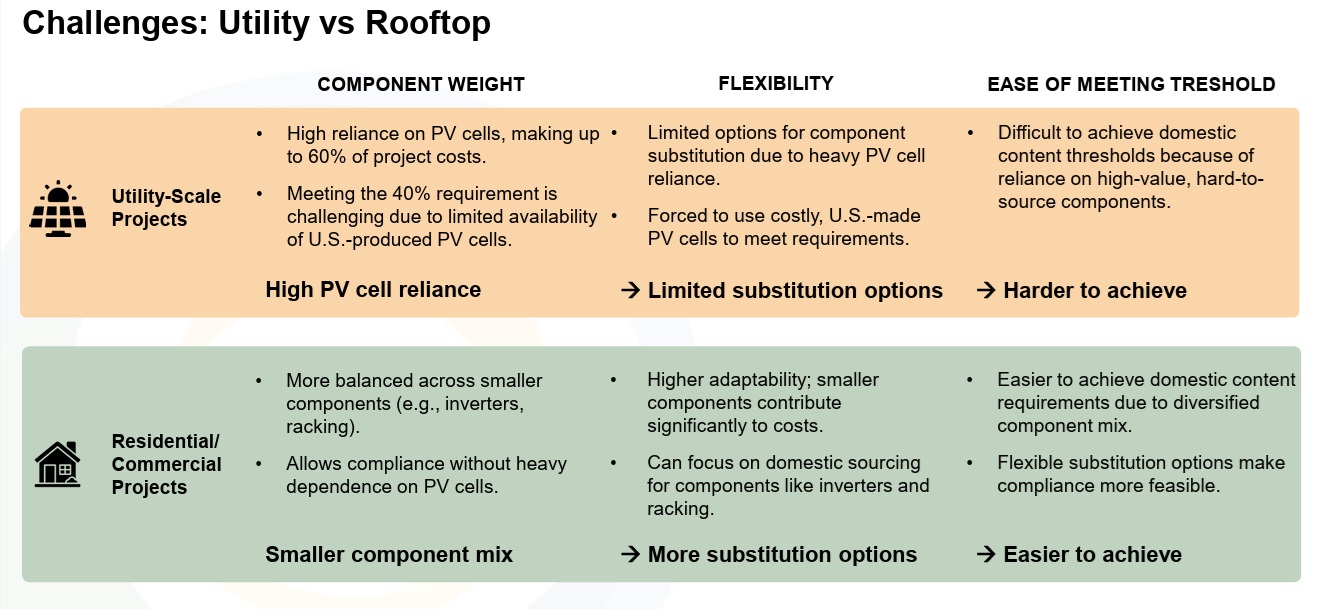

During the session “A Solar-Powered Economy” during pv magazine USA Week, panelists agreed that it is not currently possible to build a utility-scale solar plant that qualifies for the domestic content adder. The first sector where projects will quality for domestic content will be in rooftop mounted PV, which Christopher Colavito, VP of engineering at Standard Solar said can be done in early 2025 with domestically produced racking and inverters and module-level power electronics. “Fixed tilt ground mount won’t be happening until we can get a domestic cell and we need to be confident that we can get that because according to the safe harbor percentages, 49% of the value comes from the cell,” said Colavito. “Without it you’re dead in the water,” he added.

The CEA report notes that the limited supply of U.S-made components drives up costs, which affects the financial viability of projects and can increase costs for consumers.

Regulatory complexity is another challenge, as noted in the pv magazine USA week session by Michael Carr, executive director of the Solar Energy Manufacturing for America Coalition (SEMA). Carr said domestic content approach is very new and since the Department of Treasury has “zero experience in this area, they’ve had to get up to speed very quickly.”

Another stumbling block is the criteria for what counts as direct costs or domestic content and inconsistent interpretations of direct costs can result in audits down the road, CEA noted. Furthermore, suppliers who are not transparent about cost data can rack up costs for developers who have to turn to third-parties for verification.

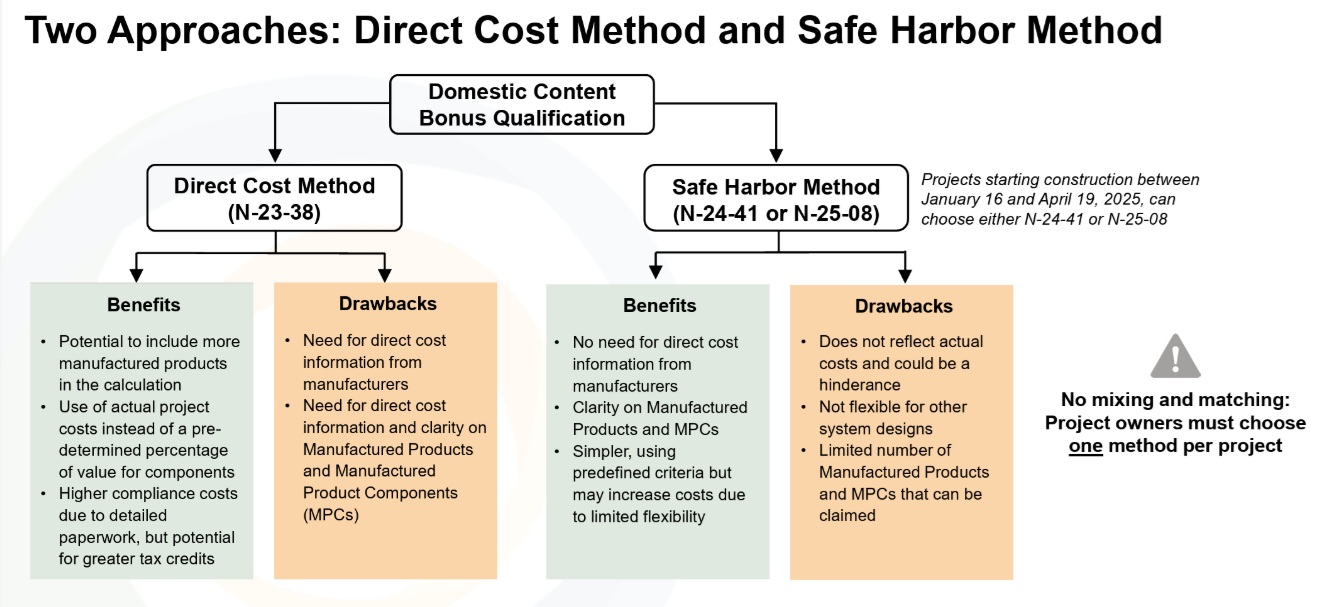

Two methods are available for calculating domestic content: direct cost and safe harbor. The direct cost method requires that suppliers disclose a breakdown of their internal cost structure, distinguishing between direct and indirect costs. The CEA report describes direct costs as expenses directly tied to manufacturing, such as raw materials and labor specifically for product assembly. Indirect costs, on the other hand, are described as broader expenses that support operations. These would include facility overhead and administrative costs.

The safe harbor method uses government-defined percentages for specific components, based on whether they were domestically manufactured. The CEA report says that this approach “reduces risk by eliminating the need for detailed cost analysis and instead relies on pre-determined component percentages.”

The direct cost method comes with risks including the complexity of validating costs and challenge of obtaining accurate information. These issues can cause delays and errors, which the report notes can force developers to build in a safety margin to ensure compliance. This tactic, however, can increase project costs. On the other hand, documentation inconsistencies can cause problems in the event of an audit.

While new 2025 guidance that increases projects likelihood of qualifying for domestic content if a domestic wafer and cell is used, the CEA report says that planned U.S. wafer manufacturing capacity “will be inadequate to serve more than a portion of the U.S. market.”

The safe harbor method comes with less risk but perhaps more challenges, especially for utility-scale projects compared to residential and commercial projects, as noted in the chart below.

In conclusion, the report provides two case studies: one with a developer seeking the domestic content under safe harbor and the other under the direct cost method. In both cases the goal was to achieve the adder while also reducing CapEx. CEA evaluated suppliers in both scenarios who claimed to have domestic content available and found that not every supplier is amenable to providing direct costs. CEA also noted that for those seeking domestic content under either method, supplier transparency and flexibility in the bill of materials is imperative.

Popular content