The growing need for virtual power plants, which dispatch energy when and where it is needed, is giving rise to opportunities for software companies, such as Leap, to handle the complexities of navigating energy markets.

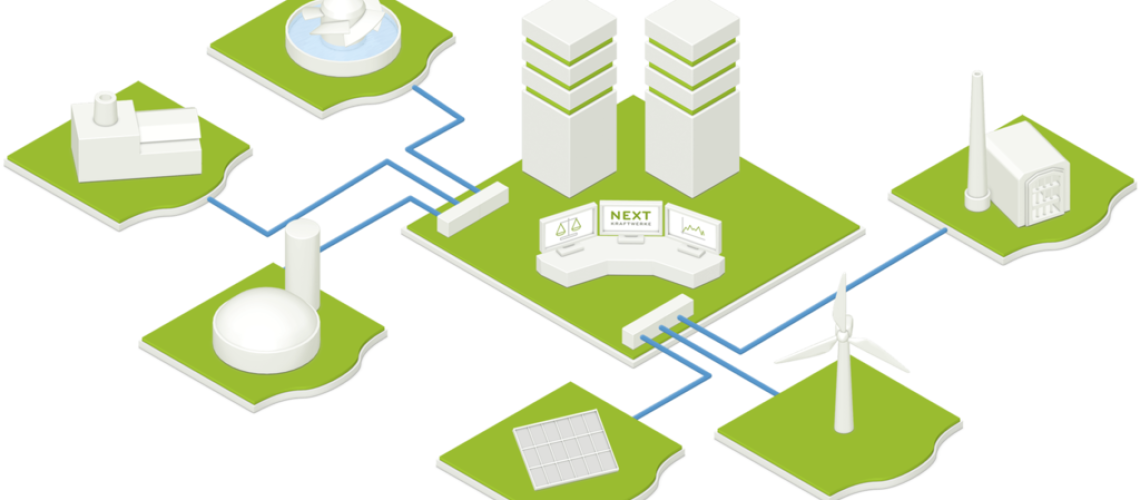

Virtual power plants are networks of distributed energy resources (DER) such as rooftop solar, smart thermostats, water heaters, electric vehicles, and batteries. The VPP network is actively controlled by utilities and energy service providers to benefit consumers, the power system and the environment.

According to Jigar Shah, director of the U.S. Department of Energy Loan Programs Office, VPPs “increasingly give grid operators a large-scale and utility-grade alternative to new generation and system buildout through automated efficiency, capacity support, and non-wire alternatives. By deploying grid assets more efficiently, an aggregation of distributed resources lowers the cost of power for everybody, especially VPP participants.”

A recent Brattle report, Real Reliability: The Value of Virtual Power, modeled the value and performance of a VPP network versus conventional resource adequacy options. The consulting group compares the net cost of providing 400 MW of resource adequacy from three resource types: a natural gas peaker, a grid-interconnected battery system, and a VPP composed of residential demand flexibility technologies. They found that the net cost to the utility of providing resource adequacy from a VPP is roughly 40% to 60% of the cost of the alternative options; 60 GW of VPP deployment could meet future U.S resource adequacy needs at $15 to $35 billion less than the cost of the alternative options over the ensuing decade. An added benefit is that 60 GW of VPP systems could provide over $20 billion in additional societal benefits, such as those related to emissions and resilience, over ten years.

The VPP market spells opportunity for businesses that manufacture and manage energy assets to create new revenue streams. One of those providers is Leap, or Leapfrog Power, Inc., a software platform that connects DERs to energy markets. Increasingly, companies like Leap are connecting VPPs to electricity markets, which is beneficial to the electric customer because the software provider can respond to pricing signals reflecting real-time energy needs, as opposed to relying on a directive from the utility.

Leap offers a single interface that can connect thousands of DER products to power markets and utilities. The software is a solution for DER technology and service providers, enabling them to earn revenue through the wholesale market and other programs from utilities, municipalities and community choice aggregators.

VPPs are designed to make their aggregated energy available at times of high demand, such as on hot California days when air conditioners are running full tilt. In the age of fossil fuels, peaker plants sit idle waiting to be called into duty on demand. A 2020 report, “Dirty Energy, Big Money” found that New York City’s peaker plants cost residents more than $4.5 billion over the last decade, despite only being active four to 30 days a year. VPPs act as a “virtual peaker plant,” thus eliminating carbon spewing into the atmosphere and capturing value from the many DERs already being deployed on the grid for other purposes.

Leap aggregates the grid interactive devices enrolled on its software platform into a VPP, then sells its energy to utilities and into wholesale energy markets, sharing the revenue earned with its technology partners. In times when emergency energy is needed, such as what happened in September 2022 when California experienced an extreme heat wave, Leap reports that it was able to dispatch energy from thousands of residential and commercial sites on demand.

The opportunity extends beyond grid emergencies. Many customers and device types, such as energy storage, have the ability to participate and dispatch on a regular basis without sacrificing their originally intended value. Leap enables these devices to compete in the energy markets each day, just like traditional thermal generation but without the carbon footprint.

GridPoint is a specialist in building energy management and optimization technology that decarbonizes commercial buildings. Its platform connects the built environment and DERs with energy grids. With its platform deployed in 17,000+ commercial buildings across multiple industries, including myriad retail brands, it turned to Leap to maximize the value of the grid-interactive technologies in the buildings. GridPoint allows Leap to navigate the complexities of the regulatory and operational requirements in energy markets so GridPoint can more easily expand its grid services offerings where it has customers.

Another company that benefits from Leap’s API is Nuvve Holding, a vehicle-to-grid (V2G) specialist, which manages power among electric school bus batteries and the grid. It partnered with Leap on a unique demand response (DR) project with resources inside a microgrid at the University of California, San Diego. Leap collaborated with the California Public Utilities Commission, utility San Diego Gas & Electric, and the university to overcome baselining challenges and metering obstacles to successfully activate the site in the market.

In April, Leap announced that it joined the Virtual Power Plant Partnership (VP3), founded by Rocky Mountain Institute (RMI) to help advance VPP solutions to help decarbonize the electricity sector. Through this collaboration, Leap will work closely with energy technology companies, including current technology partners Google Nest and Sunrun, to accelerate the growth of the VPP industry.

VPPs also offer an opportunity for DER companies who partner with a company like Leap to sell more of their products and services. Since the revenue generated typically passes to the DER provider, rather than directly to the customer, companies can use the new revenue from VPPs to provide a more attractive offer to their customer. End customers still receive the value, but often in the form of reduced upfront costs for new hardware or lower ongoing services or subscription costs.