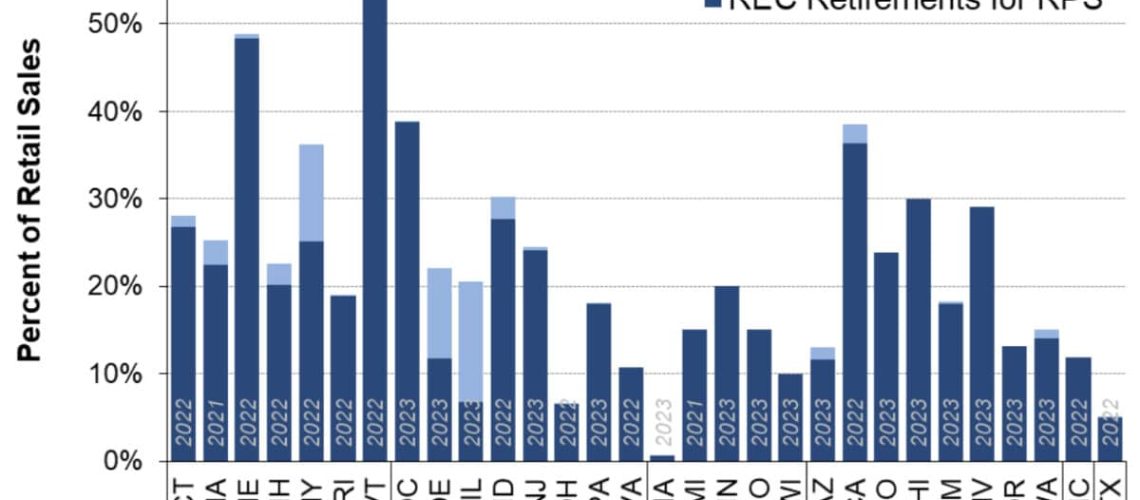

Nearly all states with a renewable portfolio standard have met or nearly met their current standard. Four states have yet to meet their solar carve-out requirements.

All but three of the 29 states plus DC that have a renewable portfolio standard (RPS) are meeting their current targets, according to an analysis by Lawrence Berkeley National Laboratory.

Vermont’s current RPS target of nearly 60% is the highest of any state, as shown in the featured image above, provided in the analysis. Every bar in the image without a light blue segment at the top means that state has met its current RPS.

The study says that “large shortfalls” in New York and Illinois are “expected to close” as contracted projects come online.

The study counts a state as meeting its RPS if the state’s utilities have retired renewable energy credits (RECs) equal to the amount of the RPS requirement. States award RECs for renewable power generation.

A state may also permit utilities to comply with its RPS by submitting “alternative compliance payments.”

Delaware’s “large shortfall,” the study says, is due to its low cost for alternative compliance payments compared to other states in the region.

Puerto Rico is not included in the analysis but also has a large shortfall in meeting its renewables target. The territory stands at 12% renewables, compared to its current target of 20% by 2022.

Solar carve-outs

Of the 15 states plus DC that have RPS carve-outs that require a certain amount of solar and/or distributed generation, all but four have met or nearly met the goals, as shown in the nearby image.

Drivers

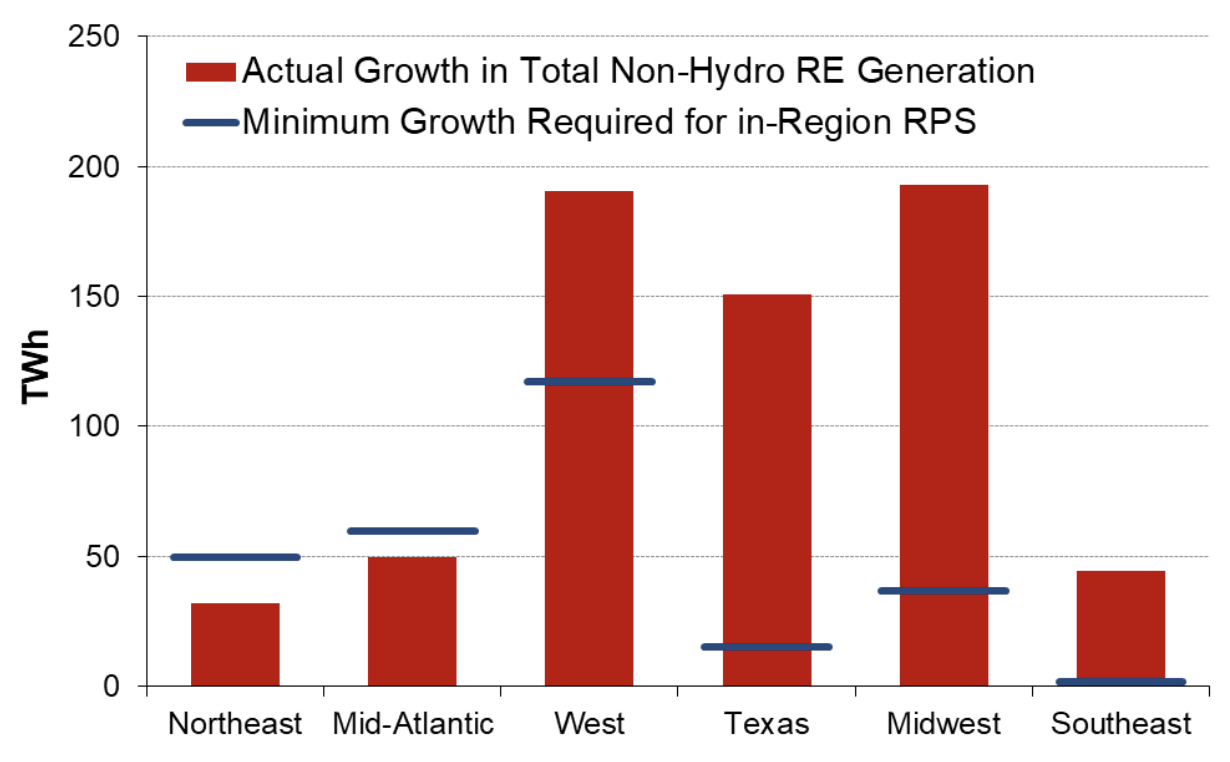

While the study says that “parsing out the incremental impact of individual drivers” for the growth in renewables generation is “challenging,” it observes that RPS policies have been a “larger driver” of renewables deployment in three regions:

- The Northeast, where almost all renewable capacity additions—mostly onsite and community solar in recent years—are serving RPS demand

- The Mid-Atlantic, thanks to solar carve-out capacity and RPS-certified projects with corporate power purchase agreements, which “potentially sell RECs into compliance markets”

- The West, where added renewables are driven by “aggressive” long-term RPS and clean energy standard (CES) targets throughout the region, and where non-RPS additions are mostly onsite solar.

Regions where RPS standards have been a “smaller driver” are:

- Texas, which achieved its final RPS target in 2008, so that all renewables growth since then is not influenced by the RPS

- The Midwest, where there is “lots of wind development,” some of which is contracted to utilities with RPS needs

- The Southeast, where renewables growth is primarily driven by utility procurement and qualifying facilities under the Public Utility Regulatory Policy Act (PURPA).

In all but two regions, renewable generation well exceeds the combined RPS targets for the states in the region, as shown in this graph from the study:

Ultimate targets

Across the 29 states plus DC with an RPS, 16 have ultimate RPS targets of at least 50% of retail electricity sales, and 4 have a 100% RPS. Sixteen states have adopted a 100% clean energy standard, which can be met by renewables and typically also nuclear and hydroelectric generation as well.

RPS and CES policies will require 900 TWh of new clean electricity by 2050, the study says, “equivalent to roughly 3x the historical rate of RPS buildout.”

Berkeley Lab is hosting a webinar on August 28 to present the study’s complete findings. The study is titled “U.S. State Renewables Portfolio & Clean Electricity Standards: 2024 Status Update.”

Popular content