A report from the U.S. Energy Information Administration projects about 45 GW of solar projects larger than 1 MWac to be installed in 2024, while Wood Mackenzie estimates 8 GW of small-scale solar.

The U.S. Energy Information Administration (EIA) forecasts the deployment of 45 GWdc in utility-scale solar projects larger than one megawatt in 2024. This is projected increase to about 53 GWdc in 2025, according to the agency’s Short-Term Energy Outlook (STEO).

Adding Wood Mackenzie Power and Renewables conservative projections of 6 GW in residential solar and 2 GW in commercial projects, the total solar capacity expected for 2024 is 53.5 GW.

Projected figures for 2025 suggest a potential total deployment of 65 GW of solar power.

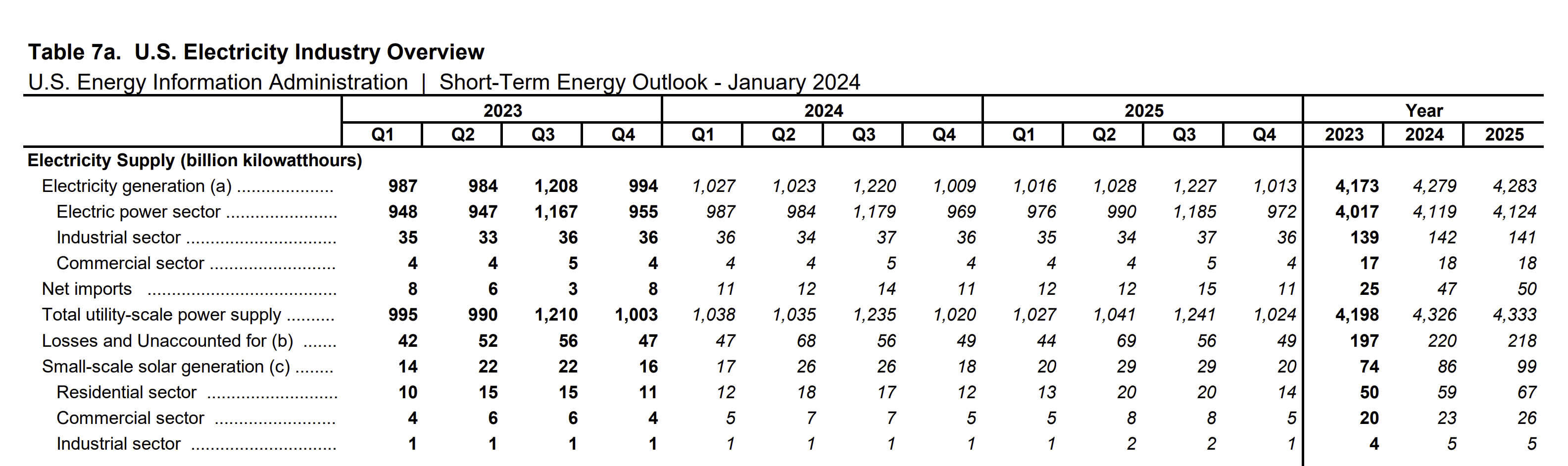

According to EIA, utility-scale solar is expected to constitute 6% of the total electricity generation in 2024 and 7% in 2025. This is set against a backdrop where overall electricity generation is predicted to grow by 3% in 2024 and remain constant in 2025.

Small scale solar generation is anticipated to contribute 2% to the total electricity generation in 2024, increasing to 2.3% in 2025. This suggests that solar power could represent 8% of the total electricity used in 2024 and 9.3% in 2025. If the deployment reaches about 65GW in 2025, solar power could account for nearly 11% of all electricity generation in 2026.

These forecasts are based on end-of-year utility scale capacity figures of 93.2 GWac at the end of 2023, increasing to 129.6 GW in 2024, and 172.2 GW by the end of 2025. The values are derived from data from EIA-860M.

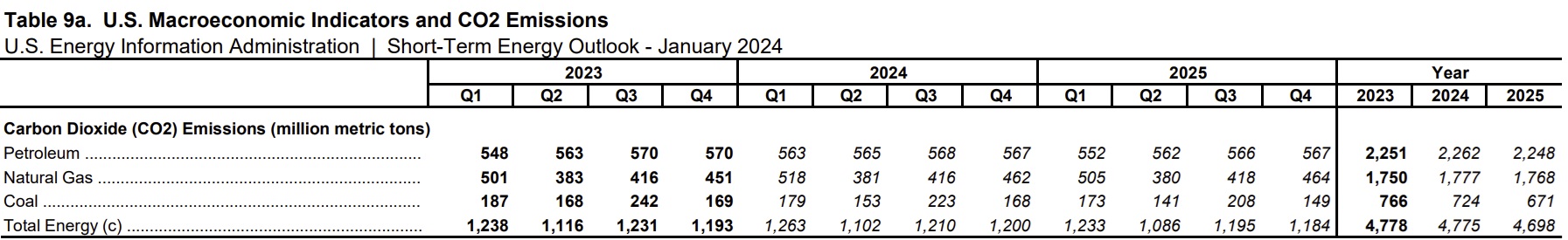

The EIA also predicts that coal’s contribution to electricity generation will fall by 9% in 2024, and another 10% in 2025 due to increasing renewable generation. The EIA believes that natural gas electricity generation will stay that same.

With electricity generation set to increase in 2024 by 3%, along with coal falling 9% and gas staying flat, it means that solar is both replacing the decline in coal, as well, covering the growth of 3%.

This will lead to electricity emissions falling by less than a percent on lower gas and coal usage in 2024, before falling by 2.5% in 2025. Petroleum usage will stay flat during the period though, meaning total emissions are estimated to stay flat in 2024, and to fall by 1.7% in 2025.