The Inflation Reduction Act (IRA) is incentivizing solar energy adoption, in addition to adding bonuses for use of domestic content, however, there are not enough American-made solar components to supply the rapid buildout. A recent report from Origami Solar and Wood Mackenzie says the IRA missed the mark by not incentivizing use of U.S. steel module frames, as the U.S. steel industry has the capacity and it would reduce our dependence on imports.

The recent report Energy security and the solar supply chain: The urgent case for onshoring, notes that a total of 138 GW of U.S. module manufacturing capacity has been announced since passage of the IRA, with plans to be operational by 2027.

While Wood Mackenzie expects only about 65 GW of module capacity to come online by 2027, it is still a huge increase from the 2023 U.S. module capacity of 13 GW and the 9 GW produced domestically before the IRA became law.

In the meantime, as new manufacturing facilities began full-scale production, the U.S. solar industry remains beholden to imports. China currently dominates the supply chain from critical minerals to solar cell and wafer production and solar panel assembly, which includes the commonly used aluminum frames.

While the U.S. is working toward building up its domestic module manufacturing, thanks for the IRA, the report says that a less well-known problem is U.S. dependence on aluminum module frames. The majority of these are currently imported from East and Southeast Asia, and the report notes that they are all made from carbon-intensive aluminum.

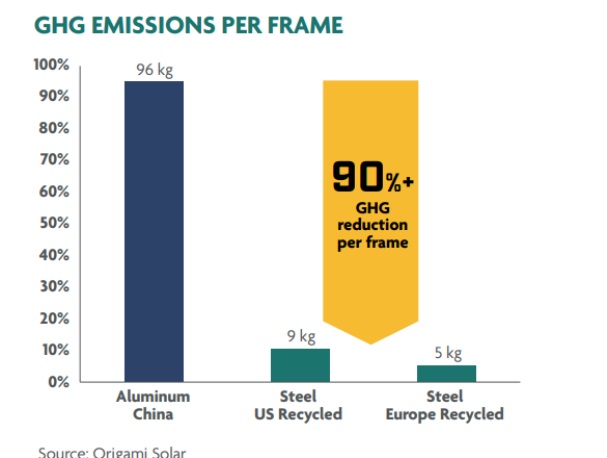

It should be noted that Origami Solar, based in Bend, Oregon, is a manufacturer of steel frames, which are said to lower cost and improve module performance. The company reports that the frames are made of “green” recycled steel, thereby reducing greenhouse gases by up to 93%, representing a reduction of 80 kg per module or 200 metric tons per MW.

The report advises that if the U.S. solar industry switched from aluminum to recycled steel frames, it would no longer be dependent on foreign imports because “the massive, well-established U.S. steel industry is positioned to easily meet the demand of domestic manufacturers with a more reliable, durable, less carbon-intensive, and readily available product”.

According to Wood Mackenzie, the aluminum frame accounts for over 13% of the cost of a 555 W single-glass PERC module made in China.

The report states that the U.S. steel industry “is prepared to quickly supply affordable, reliable, and far lower carbon intensive frames,” and it points out that the IRA provides a domestic content adder for trackers and racking systems that use domestic iron and steel.

Securing steel fabrication to alleviate supply chain concerns and shipping volatility is an emerging trend in the tracker and racking space, and the report notes that the domestic steel industry’s partnership with tracker manufacturers has demonstrated its readiness to supply U.S. module producers. According to Wood Mackenzie, the proposed annual tracker manufacturing capacity in the U.S. is between 70 GW and 100 GW.

Nextracker, a U.S.-based tracker provider, recently reported that its NX Horizon utility-scale solar trackers are now available with up to 35% lower carbon footprint because it is using recycled steel produced in facilities strategically sited near the project sites,

Another tracker provider, Terrasmart, fabricates its own steel structures in house. Terrasmart President, Ed McKiernan told pv magazine USA that such an approach allows his company to switch up their operations “on a dime,” and to accommodate design and timeline changes for customers.

A recent report by the Solar Energy Manufacturing Association (SEMA) supports a switch from aluminum to steel frames for solar modules because it will decrease dependence on China and give the industry a domestically sourced solution.

To stick with aluminum frames means continued dependence on China, as the report notes that China commands nearly 60% of the global aluminum supply, with the U.S. producing just 2%.

In October of 2023 the U.S. Department of Commerce also announced the initiation of an antidumping duty and countervailing duty (AD/CVD) investigation into aluminum extrusions from several countries. The report states that it is alleged that the imported extrusions are purportedly 375% cheaper than their actual cost of production and that Chinese producers receive subsidies of 170%.

The report also points out the high cost of transporting aluminum frames from Asia—both in terms of dollars and greenhouse gas emissions (GHG). It points to a recent report by Boundless Impact Research & Analytics that found that a domestically produced, 2 by 1 meter steel frame emits 90% fewer GHG than a foreign-produced aluminum module frame of the same size.

While some may consider using domestically produced aluminum for solar module frames, the report offers several reasons why that would be a challenge. It contends that aluminum production cannot meet the demand. For example, in 2023 the U.S. consumed 5.8 megatons of aluminum, yet produced only 0.915 megatons, according to the report. Scaling the industry to keep up with the solar market demands would be “expensive and time consuming,” the report says estimating that to meet the projected 50 GW of solar capacity expected in the U.S. by 2031, we’ll need 400,000 miles of frames.

In conclusion, the report makes the case that U.S. aluminum manufacturing cannot meet the needs of the U.S. solar industry, while the domestically sourced roll-formed steel industry can. Recent data from Wood Mackenzie shows the U.S. steel industry houses 143.62 megatons of crude steel capacity and produced 80 megatons of steel in 2023. Additionally, Wood Mackenzie indicates that the U.S. steel industry’s total capacity is forecast to grow by over 10% from 2021 to 2027.