Many US states offer incentives to promote residential rooftop solar adoption; however, as prices of solar have declined, the incentives have phased down or out. The truth remains, though, that for low- to moderate-income (LMI) households, the relatively high up-front costs of going solar are often a deterrent.

Eric O’Shaughnessy, a researcher at Lawrence Berkeley National Lab, studied the importance of subsidies in driving solar adoption among LMI households. His report, “Rooftop Solar Incentives Remain Effective for Low- and Moderate Income Adoption,” indicates that incentives drove adoption for about 80% of LMI households that otherwise would not have gone solar – implying that ongoing incentive support will be rewarded by strong solar policies.

Definitions vary, though a common definition for low- to moderate-income in the United States is earning less than 80% of the area median income. In California’s San Francisco County, for example, the household would have to make less than around $95,310 to qualify. In Connecticut’s Fairfield County, the cutoffwould be around $78,031.20.

According to another recent LBL report, “Residential Solar-Adopter Income and Demographic Trends: 2022 Update” a large number of solar adopters in 2020 could be considered “middle income” – 32% have household incomes in the $50,000 to $100,000 range. Solar adopter incomes skew high relative to the population at large: Median income of all US households was $63,000 in 2020, compared to $115,000 for 2020 solar adopters.

According to O’Shaughnessy, it was important to study LMI solar incentives to understand whether these incentives are still driving adoption. Broader incentives have phased out because incentives become less influential in adoption decisions as prices decline. It is generally inefficient to continue offering incentives to households who would have adopted otherwise. However, even if incentives no longer drive adoptions among high-income households, incentives could still play a role in supporting LMI solar markets.

Two programs

Many states offer some form of incentives to help LMI households go solar including rebates, production-based (such as a renewable energy certificates), or tax credits. “A real disadvantage for LMI households is that many lack the tax appetite to directly benefit from tax credits,” said O’Shaughnessy. His Berkeley Lab study focuses on the California Single-Family Affordable Solar Homes program and the Connecticut Solar for All program, examining the impacts these programs have had on LMI solar adoption. He chose these programs because they’re relatively large and have many years of data.

California has by far the largest subsidy program, putting aside 10% of its California Solar Initiative funds to support LMI. “The maximum deployment could be 10% of the program’s total, but in reality, it is far less,” O’Shaughnessy said. He explained that to subsidize a typical relatively highincome adopter, “they were motivated by partial subsidies that reflected relatively small portions of the system cost.” But with the LMI programs, which are trying to promote equity, the subsidies are more generous per customer. “When a state has a 10% carve-out for LMI program funding but LMI incentives are higher per customer than other incentives, you’ll have proportionally fewer installations,” said O’Shaughnessy.

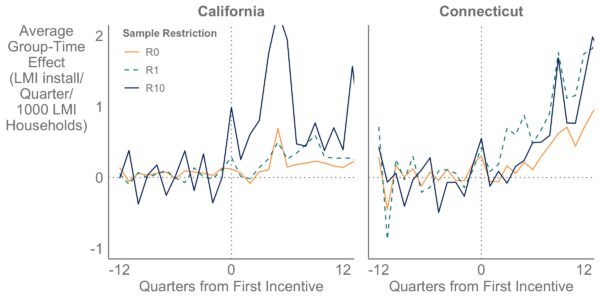

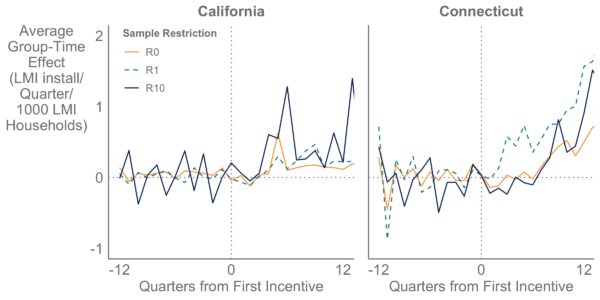

The study found that in the cases of California and Connecticut, LMI solar subsidies increased solar adoption. Through econometric analysis, the Berkeley researchers estimate that roughly four of five LMI subsidy recipients in California and Connecticut would not have adopted solar without some kind of subsidy. In addition, the research shows that the programs had sustained impact over several years, showing spikes that occur at the time the subsidies are offered, and then adoption spikes back up.

Eventually you

are giving incentives

to households who

would have adopted

anyway and at that

point the incentives

aren’t effective

anymore. Eric O’Shaughnessy

The reason for the spike could be that the programs continue to reach new people, that installers continue to market in specific LMI areas, and that some wait until others have successfully navigated the process before jumping in themselves. Another effect of LMI incentive programs is that some LMI households chose to adopt solar even without receiving subsidies, and this is called “spillover.”

Spillover theory

In his report, O’Shaughnessy directly tests the spillover hypothesis by looking at areas where LMI incentives are offered and then exploring changes in adoption patterns among households that did not receive incentives. Previous research shows that when a neighbor sees that a neighbor has installed solar, they become interested and are “primed” for adopting solar themselves. It appears that is still true for LMI households, O’Shaughnessy said. Some of the spillover customers will qualify for incentives, and others may even install it themselves without incentives, according to O’Shaughnessy.

Targeted incentives

While the overall conclusion of the report is that targeted incentives are a key component of nascent LMI rooftop markets, the question remains as to how long these markets will be nascent. O’Shaughnessy said that they still are, but that may be changing. The study found that eight out of 10 recipients would not have installed solar without some form of incentive, but that will decline over time.

O’Shaughnessy explained that, for example, the number of households that would not install solar without the incentive would soon be seven out of 10, then six out of 10, and so forth. “Eventually you are giving incentives to households who would have adopted anyway and at that point the incentives aren’t effective anymore,” said O’Shaughnessy. “It’s not effective because those customers don’t need the incentive, prices have come down and the market has taken over.”

The issue of rooftop solar equity is an emerging trend that has somewhat tarnished the image of solar and undermined public support because people see solar customers as those with high incomes. Utilities and regulators are obligated to deliver energy that is just and reasonable to everyone, regardless of income.

The Rooftop Solar Incentive report notes that fewer than a quarter of PV adopters are LMI households. “If solar were perfectly equitably adopted then 50% of adopters would earn less than the national median, but instead about a quarter earn less than the median – so there is the equity gap,” O’Shaughnessy said. The good news, though, is that it is changing. Just like any technology, O’Shaughnessy said, “it expands and diffuses.” As you get more LMI households adopting solar, the average income of adopters goes downyear over year.