The PJM grid operator could enable interconnection of 4.8 GW of solar and 0.7 GW of wind capacity by 2027 through 95 deployments of grid-enhancing technologies (GETs), found an analysis produced by the nonprofit RMI. GETs would also enable 1.1 GW of stand-alone storage plus additional storage co-located with new solar.

The GETs would cost $100 million and yield production cost savings of $7 billion over six years, mostly due to the lower cost of operating renewable energy generators enabled by GETs, the report says. That translates to a 70-to-1 benefit-cost ratio, as shown in the graph below.

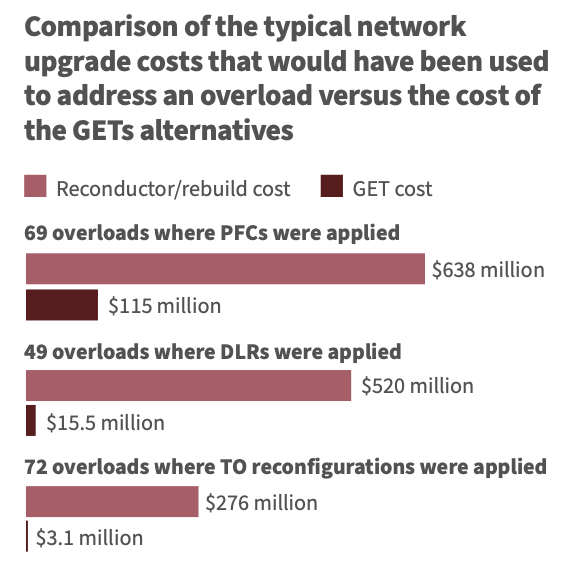

GETs could save project developers collectively “hundreds of millions of dollars” in interconnection costs compared to default network upgrades, the study says, as shown in the image below, while the project-level savings “could be the difference” that allows a developer to build a project “instead of dropping out of the queue.” GETs can also be installed more quickly than other network upgrades.

GETs were compared to the network upgrade options of reconductoring (using existing transmission towers to support new high-capacity advanced conductors) and rebuilding transmission lines (replacing both the towers and the conductors). These other options would yield an approximate 10-to-1 benefit-cost ratio, as indicated in the image above comparing their costs to GETs costs.

The $7 billion in production cost savings from installing GETs would not accrue to project developers, although under the current participant-funded upgrade paradigm, developers would pay for the $100 million in GETs installation costs.

GETs can enable rerouting of power flows to avoid congested lines, and provide real-time weather data to enable more power to flow through a line when conditions allow, for example due to the cooling effect of wind. The three GETs considered are dynamic line ratings, advanced power flow controls, and topology optimization, all of which are explained in the report. GETs have been used in Europe for decades, the report says.

To take advantage of GETs, the study says grid operators and utilities will need to adopt new modeling approaches, such as including GETs in power flow studies, and operational changes such as integrating GETs into existing energy management system software.

A previous study by The Brattle Group found that GETs could enable 40 MW more solar and 2.6 GW more wind power in Kansas and Oklahoma within four years.

Federal Energy Regulatory Commission (FERC) Order 2023 requires transmission providers such as PJM to evaluate, when conducting interconnection studies, several advanced transmission technologies listed in the order, according to the law firm Hunton Andrews Kurth. The listed technologies include advanced power flow control devices and advanced conductors but not dynamic line ratings or topology optimization, the firm says, noting that the order requires transmission providers to explain their evaluation results, but gives them sole discretion whether to use any given technology.

The RMI report says PJM and other grid operators “should build on FERC’s order and include GETs as standard network upgrade options for generator (and new load) interconnection.” RMI adds that “enhanced transmission planning and build-out is the long-term solution to addressing our capacity-constrained electric grid.”

Methods

In what the study says is a first-of-its-kind analysis, Quanta Technology started with a dataset of projects in five states that are waiting in PJM’s interconnection queue. Quanta conducted power flow modeling—a key step in any interconnection study—to consider each GET individually and then in combination. Quanta projected cost savings through production cost modeling.

RMI said its goal was to develop a “transparent and replicable approach” for analyzing GETs in interconnection studies.

Amazon provided funding for the analysis and report, in line with its commitment to power its operations with 100% renewables by 2025, said Abhishek Sharma, head of energy strategy for Amazon Web Services. An Amazon executive previously described how artificial intelligence could speed interconnection studies for large-scale renewables projects.

Other contributors to the study included GETs vendors such as LineVision and Smart Wires, which provided data and technology-specific information for the modeling, and NewGrid, which conducted topology optimization modeling.

RMI offered detailed recommendations for applying the study’s findings within PJM and nationwide:

- PJM should institute robust evaluation of GETs for interconnection and transmission planning

- Transmission owners should deploy their first GETs projects and create systems for routine deployment

- Renewables project developers should propose GETs as part of their interconnection requests

- State regulators should provide utility oversight and guidance to maximize the potential for cost-saving GETs adoption

- FERC should pursue a comprehensive national regulatory framework that supports GETs adoption.

PJM is the world’s largest wholesale electricity market, the report says, serving 65 million people; its service area is shown on the nearby map. Wind and solar combined provided less than 5% of generation in the PJM region last year. PJM has instituted a pause on new interconnection applications until 2026.