Through the first nine months of 2023, $28.9 billion of venture capital, public market, and debt financing was injected into solar, said a report from Mercom Capital Group.

Solar energy continues to attract more funding as the world moves along the transition from fossil fuels to renewable and emissions-free energy. This year, through nine months, over $28.9 billion in venture capital, public market, and debt financing was invested in the solar industry worldwide.

Mercom Capital Group reported that this level of funding represents a 55% growth over the first nine months of 2022, which totaled $18.7 billion. The number of deals decreased 5%, according to the report, but the 124 deals inked thus far in 2023 represented a significant leap in capital injection over last year.

“Despite inflationary challenges, financing in the solar industry has remained robust through the first three quarters of 2023 thanks to a strong global push toward decarbonization and substantial incentives created by the Inflation Reduction Act,” remarked Raj Prabhu, chief executive officer, Mercom Capital Group. “M&A activity, on the other hand, has faced adverse effects, especially in the realm of project acquisitions, due to increased due diligence, higher costs, delays, and a tight labor market.”

Through nine months of 2023, venture capital (VC) funding activity rose 4% year-over-year, with $5.7 billion across 51 deals, said the Mercom report. Solar downstream companies led activity in this area, closing 28 deals worth $2.8 billion over the period.

The largest VC deals included $471 million raised by 1KOMMA5°, $428 million raised by Enfinity Global, $375 million raised by Silicon Ranch, $360 million raised by CleanMax, and $350 million raised by Juniper Green Energy.

Public market financing over the report period reached $7.2 billion across 19 deals, a 47% leap year-over-year.

Debt financing had the most robust growth, totaling $16 billion over 54 deals, an impressive 93% growth over 2022 first-nine-month totals.

Securitization deals totaled $3.2 billion over the first nine months of 2023, increasing 39% year-over-year.

Over the report period 75 solar merger and acquisition transactions occurred, representing a pullback from the 90 deals struck over that period in 2022. The largest transaction was Brookfield Renewable’s acquisition of Duke Energy’s unregulated utility-scale renewables business, which was valued at $2.8 billion.

Over 31.6 GW of projects were acquired through the first three quarters this year, a significant increase over the 52.1 GW acquired through three quarters in 2022.

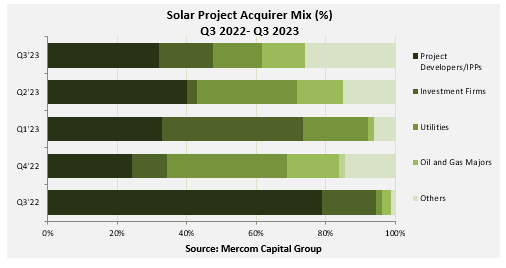

“Project Developers and Independent Power Producers (IPPs) were the most active acquirers of solar projects in Q3 2023, picking up 2 GW, followed by insurance companies, pension funds, energy trading companies, industrial conglomerates, and IT firms with a total of 1.6 GW. Investment firms acquired 959 MW; electric utilities acquired 877 MW; and oil and gas companies acquired 759 MW of projects,” said the Mercom Capital report.