Each year, IHS Markit, an S&P Global Company, offers 10 trends in cleantech for the year. This year, solar and energy storage-related stories dominated the list. Below are four top trends in solar and storage in 2022.

Distributed generation 45% of new additions

Distributed generation (DG), defined by IHS Markit as PV systems below 5 MW, was estimated to grow by 20% in 2022. The segment continues to demonstrate strong resilience through the pandemic and a challenging high-cost environment.

While many projects at the utility-scale were delayed or cancelled over the last two years, distributed generation did not lose traction. “This difference reflects both the DG policy push of individual markets and many consumers’ concerns over high electricity prices and the climate footprint,” said IHS Markit.

About 60% of the DG growth occurred in China and Germany, where both markets are pursuing policies to make DG a central part of renewables targets. Brazil is another high-profile DG market, as net-metering systems installed through 2023 remain exempt from grid charges. Conversely, the segment may recede considerably this year in the United States, as net metering is stripped from many major state markets.

“Even at higher capex levels, DG systems generate electricity that remains competitive with retail electricity prices across many markets, meaning the DG segment is less price sensitive than utility-scale PV,” said IHS Markit.

Renewables grow despite capex increases

Despite higher-than-expected capital expenditures in 2022, a new paradigm of renewables growth emerged. Renewables are already the cheapest source of new power generation globally, and cost declines due to technology evolutions and policy advancements have triggered further capacity additions and price drops.

In solar, investors have come to expect continuously lower capital expenditures, but as the technology has matured, capex is declining at a slower rate. This combined with supply chain hurdles and rising shipping and materials costs led to a higher-than-expected capex of solar projects this year.

As the penetration of renewables increases, the focus is not so much on the cost, but on the value provided to the system. IHS Markit said, “In a moment of high volatility, the predictability in operating renewables is valued.”

Investors also value investments in renewables as a measure to meet climate commitments and de-risk portfolios. IHS Markit said consolidation in renewables banking alongside a strong push for green financing has brought down the cost of capital for renewable power projects. Recent volatility and spikes in electricity prices have improved the captured prices for renewables.

“These perceived values counterbalance the industry’s higher-than-expected capex and underpin the continued build-out of new renewables capacity,” said IHS Markit.

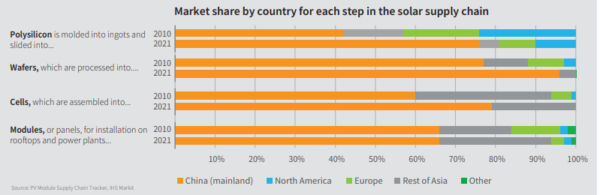

Manufacturing closer to end market

Supply chain woes, trade barriers, and geopolitics have been driving PV manufacturing capacity closer to the end-user. IHS Markit said supply chain tightness may persist for some time, but there are some positive developments easing this, including:

- The ramp-up of new polysilicon capacity is happening more aggressively than expected.

- New entrants to the wafer segment will increase capacities and price competition.

- PV manufacturing in China will now be excluded from energy intensity and energy consumption power restrictions.

Announcements of new ingot, wafer, cell, and module capacity in India, the United States, Europe, and Southeast Asian countries will continue in 2023 as the supply chain continues growing and adapting to the new international trade environment.

Energy storage system costs rise

Lithium-ion batteries have reversed their trend of lowering in cost, rising about 15% in late 2021. A surge of raw materials prices across the board pushed prices higher in 2022. Cost increases are primarily for lithium-ferro-phosphate (LFP) batteries, which is favored for the grid-scale storage segment and is in-demand for the EV segment as well.

Price declines may not resume until 2024, said IHS Markit, and this is subject to LFP manufacturers quickly scaling up and energy storage integrators securing supply agreements with a wider range of providers not captured by EV demand.

“Nonetheless, battery energy storage costs remain competitive with the alternative technologies. The bigger threat to growth is the ability of system integrators to procure the required volumes of batteries,” said IHS Markit.

pv magazine USA offers three solar industry trends to watch in 2023 here.