Forecasts from the U.S. Solar Energy Industries Association (SEIA) show sustained growth through 2030.

Solar energy continues to charge ahead, increasingly becoming an essential part of the energy mix both globally and in the United States. The U.S. Solar Energy Industries Association (SEIA) reported that in Q3 2024, the nation installed 8.6 GW of solar capacity, setting a new Q3 record and climbing 21% compared to Q3 2023.

Solar accounted for 64% of all new electricity-generating capacity added to the grid through the first three quarters of 2024. Cumulatively, the United States has enough solar capacity to power roughly 37 million homes, ]SEIA said.

Solar has grown considerably, yet it still represents less than 6% of U.S. electricity generation. SEIA provided several forecasts in its recent Solar Market Insight Report.

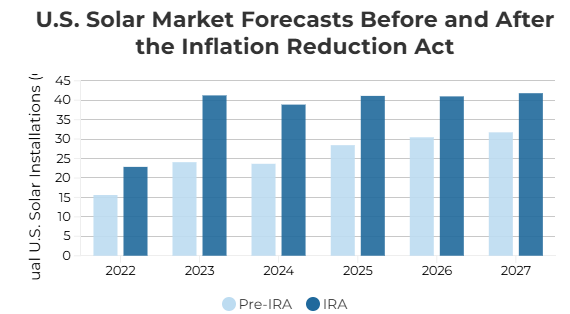

The solar industry has leapt from installing about 10 GW in 2018 to roughly 40 GW in 2023. Since then, growth has slowed, but SEIA expects about 40 GW to 45 GW of annual solar installations through 2029. The Inflation Reduction Act of 2022 provided some long-term policy certainty that supports this growth, while challenges in interconnection, high voltage power equipment procurement, and labor availability present the biggest headwinds to faster growth, SEIA said.

The Inflation Reduction Act (IRA) of 2022 has provided market certainty in the form of long-term tax credits and manufacturing support on the supply and demand side. SEIA estimates that solar installations have increased by about 46% due to IRA support.

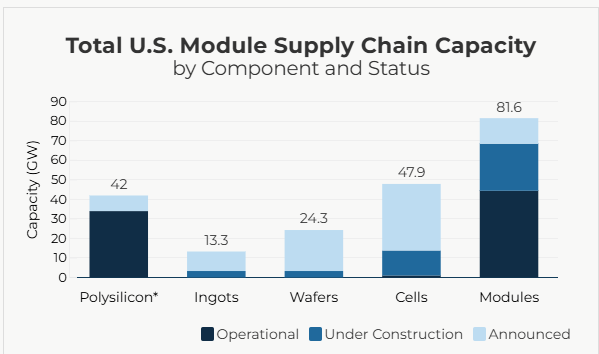

The United States is actively pursuing the onshoring of manufacturing jobs, and solar energy is playing a large role. To secure a domestic energy supply chain, the U.S. will need to bring online manufacturing capacity for every leg of the supply chain, from raw polysilicon mining to solar module assembly.

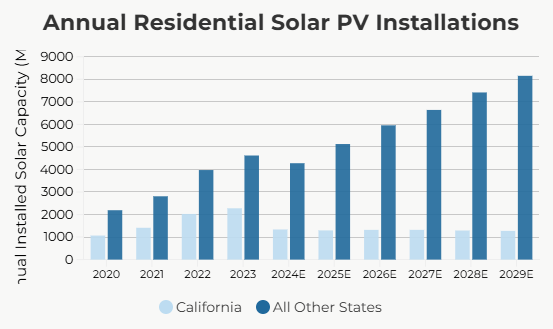

Residential solar is expected to grow, though no thanks can be given to California, which was once the darling state for rooftop residential solar. SEIA expects residential solar to double nationwide from just over 4 GW in 2024 to as much as 8 GW in 2029. However, California installations are expected to remain flat at roughly 1.2 GW per year, down from more than 2 GW in 2022 and 2023. California pulled the plug on rooftop solar when it phased out net metering in 2023, making the return on investment for rooftop solar murkier for homeowners.

“2024 will be a down year for residential solar, emergent state markets will drive growth in the second half of the 2020s,” SEIA said.

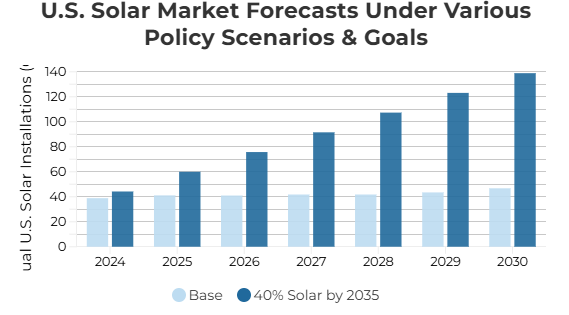

Despite growth, the pace of installations is far behind what it needs to be to achieve goals of a 100% emissions-free electricity system by 2035 and for solar to reach 40% of the electricity mix.

SEIA forecasts that annual installations would need to reach 140 GW by 2030, a far cry from the 40 GW annually through 2029 that SEIA forecasts. The U.S. will need to reach 800 GW of solar cumulatively by the end of the decade to reach the 40% solar goal, up from the 220 GW installed cumulatively today.

Popular content