When Russia cut off a key flow of cheap natural gas this year following its invasion of Ukraine, many European countries were left scrambling for fuel as prices soared, raising serious questions about the continent’s energy future.

But gas wasn’t the only fuel to face a major test this year. Nuclear and hydropower faltered amid maintenance delays and extreme weather, while record wind and solar power generation saved Europe from a far worse fate, according to data from Ember, an energy think tank.

Europe’s Energy Mix During Its Year of Crisis

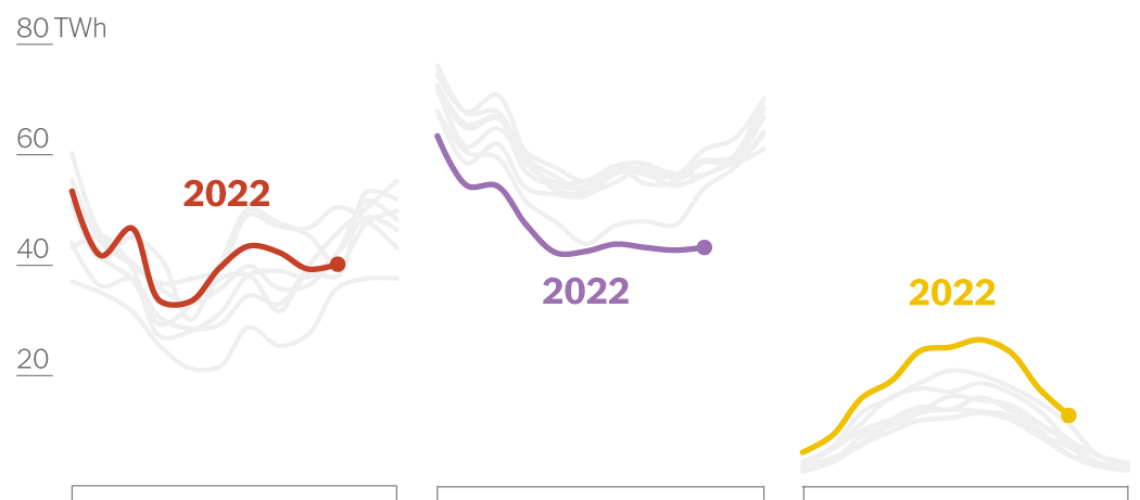

Despite major disruptions and price spikes, gas power remained stable this year and an early uptick in coal-generated electricity didn’t hold.

In terawatt hours of energy per month

Previous years

since 2015

But nuclear energy and hydropower hit their lowest levels in a decade, in part because of extreme heat and drought across the continent.

In terawatt hours of energy per month

Previous years

since 2015

Soaring wind and solar cushioned the continent from a far worse crisis.

In terawatt hours of energy per month

Previous years

since 2015

Despite major disruptions and price spikes, gas power remained stable this year and an early uptick in coal-generated electricity didn’t hold.

In terawatt hours of energy per month

Previous years

since 2015

But nuclear energy and hydropower hit their lowest levels in a decade, in part because of extreme heat and drought across the continent.

In terawatt hours of energy per month

Previous years

since 2015

Soaring wind and solar cushioned the continent from a far worse crisis.

In terawatt hours of energy per month

Despite major disruptions and price spikes, gas power remained stable this year and an early uptick in coal-generated electricity didn’t hold.

In terawatt hours of energy per month

Previous years

since 2015

But nuclear energy and hydropower hit their lowest levels in a decade, in part because of extreme heat and drought across the continent.

In terawatt hours of energy per month

Soaring wind and solar cushioned the continent from a far worse crisis.

In terawatt hours of energy per month

Despite major disruptions and price spikes, gas power remained stable this year and an early uptick in coal-generated electricity didn’t hold.

In terawatt hours of energy per month

Previous years

since 2015

But nuclear energy and hydropower hit their lowest levels in a decade, in part because of extreme heat and drought across the continent.

In terawatt hours of energy per month

Soaring wind and solar cushioned the continent from a far worse crisis.

In terawatt hours of energy per month

Source: Ember

Note: Data show fuel energy sources for electricity generation in the European Union, and does not include fuels used in transportation or other sectors.

Europe’s energy crisis has stabilized for now, but uncertainty over the continent’s power supply could linger for years. High inflation has added to the pressure for leaders to diversify energy sources.

The response of some European countries’ to the crisis has complicated their positions at this year’s U.N. climate summit, currently underway in Sharm el-Sheikh, Egypt. European countries outspent rivals to stockpile gas ahead of winter this year, seeking out new supplies from the United States to Africa, and pricing many poorer countries out of the market.

But the European Union’s long-term policy commitments have doubled down on renewables since the start of the war — at least on paper. Analysts suggest the shocks from the Ukraine war seem likely to accelerate, not slow, Europe’s transition to clean energy.

Making that transition economically and sustainably will require balancing the role of each energy source on Europe’s path to reaching net zero carbon emissions.

Gas: Stabilized, for Now

Gas power remained stable across much of Europe, but it took a major effort and billions of euros to secure alternatives to Russian gas.

As percent of total generation mix

For decades, Europe grew heavily dependent on Russian gas. The low prices were tempting. So was the idea that, as the “cleanest of the fossil fuels,” gas gave progressive leaders an off-ramp from dirtier coal. By last year, the European Union depended on Russia for 40 percent of its total gas consumption.

Russia started to throttle its gas supply to Europe, and after invading Ukraine, the country cut gas flows further in retaliation against European sanctions. Pipelines connecting the regions, the Nord Stream 1 and 2, were sabotaged by a series of explosions in September.

Changes in the Gas Market Led to Price Spikes

Russian gas imports started a decline as early as Spring 2021, around the same time gas prices were on the rise due to LNG

When Russia cut back gas shipments following its invasion of Ukraine, the scramble for imported gas caused prices to spike

Russian gas imports started a decline as early as Spring 2021, but fell precipitously after the invasion of Ukraine.

The war in Ukraine set off a scramble for imported gas that sent electricity prices soaring.

E.U. monthly

average prices

Russian gas imports started a decline as early as Spring 2021, but fell precipitously after the invasion of Ukraine.

The war in Ukraine set off a scramble for imported gas that sent electricity prices soaring.

E.U. monthly

average prices

Russian gas imports started a decline as early as Spring 2021, but fell precipitously after the invasion of Ukraine.

The war in Ukraine set off a scramble for imported gas that sent electricity prices soaring.

E.U. monthly

average prices

Sources: Bruegel, Ember

Note: Price data reflect monthly average wholesale day-ahead electricity prices for the European Union

To fill the gap, Europe had to go searching for new sources and found it primarily in liquefied natural gas from the United States, where production is expected to hit a record high this year. LNG is about 600 times more compact than its gaseous form and can be moved anywhere in the world through specialized ships and ports.

That portability meant that Europe had to compete for LNG against many different bidders.

Europe had no option but to pay up. Beyond its use in generating electricity, many homes are still heated with gas, and some industries depend on it both as a power source for factories and as a raw material. Businesses across Europe were among the hardest-hit, with manufacturers pausing or shutting down factories over sharply rising costs.

Since the start of the war, Europe has also used more coal. Power generation from coal has increased more than 12 percent compared with the same period last year.

Europeans and key industries also lowered their energy use since the start of the war. A mild start to winter has also lessened gas demand at the same time Europe has filled their reserves, helping to alleviate the gas crunch ahead of winter.

Nuclear: At Historic Lows

Nuclear power struggled this year, especially in France, a major producer.

As percent of total generation mix

France was supposed to be insulated from fossil fuel price shocks, like the Russian gas cuts, thanks to its large fleet of domestic nuclear power plants. Typically, more than 70 percent of its power generation comes from nuclear, and the country is a net-exporter of electricity.

But currently half of France’s aging nuclear reactors remain offline for repairs and scheduled maintenance that had been delayed because of the coronavirus pandemic, which plagued the fleet all year. An extreme summer heat wave put added stress on the system by limiting power plants’ cooling capacity. Labor strikes further exacerbated the nuclear energy crunch.

Nuclear power plants are also expensive to build and run. France’s state-backed nuclear energy operator is nearly €45 billion in debt and will become fully nationalized to ensure a steady energy supply.

While nuclear power can be safe and stable under most circumstances, it has long been controversial among environmental activists because it carries other risks.

In Germany, nuclear power generation has been declining for years. While nuclear power used to supply over a quarter of the country’s energy in the early 2000s, Germany’s anti-nuclear movement exerted political pressure to close its reactors following the nuclear meltdown in Fukushima, Japan.

Though Germany was set to close its three remaining nuclear reactors this year, Chancellor Olaf Scholz ordered an extension to their operation until spring next year, in light of the current crisis.

Hydro: Strained by Heat and Drought

Unprecedented heat and drought spurred on by climate change and three straight years of La Niña also became a major setback for hydroelectric power. Rivers in southern Europe reached record lows.

As percent of total generation mix

The lack of hydro and nuclear power was a real problem amid the gas crisis, said Carlos Torres Diaz, head of power markets research at Rystad Energy, an independent energy consultancy. “If these two sources were at the normal level, then Europe probably would not have needed so much gas.”

Europe is warming around twice as fast as the rest of the world. The glaciers that help store and release meltwater are diminishing quickly, and hot, dry summers like this year’s could become more common.

A study last year found that global warming would lead to decreased annual stream flows in Southern Europe by the end of the century, affecting hydroelectric power, but suggested Northern Europe would see increased flows.

In 2017, wind surpassed hydroelectricity as the largest renewable source of power for the European Union.

Solar and Wind: Rising

A record year for solar and wind power saved the European Union €11 billion in gas costs this year, generating around a quarter of total electricity since the war began. It still wasn’t enough to offset the losses from nuclear and hydropower this year, or curb consumption of fossil fuels.

As percent of total generation mix

As percent of total generation mix

Some critics, including the C.E.O. of Exxon Mobil, have blamed the current energy crisis at least partly on the transition to renewables, arguing that European countries have underinvested in fossil fuels. But other energy experts argued that Europe has not transitioned to renewables quickly enough, noting that more domestically-produced wind and solar power could have blunted the effects of Russia’s gas cuts.

“People who point their finger at renewables as the source of the problem — that’s really exactly the wrong direction,” said Lion Hirth, a professor of energy policy at the Hertie School in Berlin. “The problem is that we have too little renewables, and built too little and too slowly over the past 10 years, not too much and too fast.”

In May, the European Commission put out a plan for achieving energy independence from Russia that leaned further into the renewable energy transition. Known as REPowerEU, it encourages diversifying fossil fuel sources and accelerating the adoption of renewable energy sources like wind and solar, and also pushes for greater energy savings.

The plan would also help Europe move closer to reaching its ambitious climate goals.

But major challenges remain. Solar power, in particular, has supply chain risks of its own. China has a near-monopoly on the raw materials and technical expertise to produce photovoltaic cells for solar panels. An analysis from Bloomberg BNEF found it would take nearly $150 billion for Europe to build the plants to manufacture enough solar capacity and storage to meet demand by 2030.

Achieving energy security and meeting climate goals will take far greater investment and cooperation between European countries than ever before, according to energy experts.

“One of Europe’s founding fathers — Jean Monnet — used to say that Europe would be made out of crisis,” said Simone Tagliapietra, a senior fellow at Bruegel, an energy think tank. “Europe will come out of this energy crisis more united when it comes to energy and climate policy.”