Mercom Capital’s annual M&A report shows that energy storage, along with smart grid and energy efficiency, is getting significantly increased investment attention.

Mercom Capital has released its fact sheet on battery storage, smart grid, and energy efficiency funding for merger and acquisition activity for 2022, and the energy storage industry is shining.

In total, corporate funding for energy storage was up 55%, with $26.4 billion invested in 2022 compared to $17 billion in 2021. A record of 28 energy storage companies were acquired in 2022, which is the largest number of acquisitions since 2014.

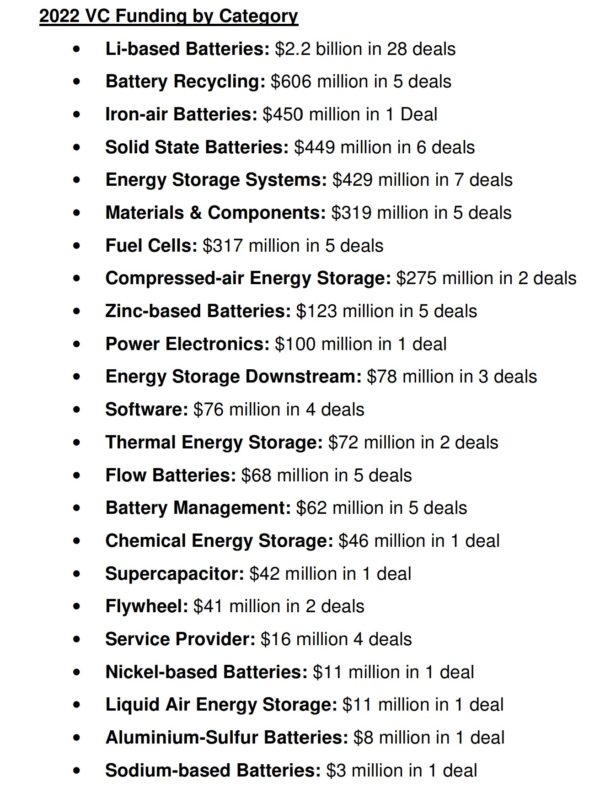

Venture capital (VC) funded energy storage projects with $5.8 billion and 96 deals. While these investments were 35% less than VC funding in 2021 (which was a record $8.8 billion), they represent a tenfold increase over VC funding since 2018, and nearly fourfold increase over VC funding in 2019 and 2020.

One of the more exciting VC deals to receive funding was not a lithium ion product. It was a $450 million investment in Form Energy, which makes a unique 1 MW/100 MWh long-duration energy storage product. The capital will drive the construction of a new manufacturing facility in West Virginia. The company recently signed two deals to install 10 MW/1,000 MWh at retired coal plants in Xcel Energy territory.

Corporate funding of energy storage (which includes VC funding) rose from $17 billion in 2021 to $26.4 billion in 2022, an increase of 55%. In this same period, corporate funding for smart grid companies rose from $2 billion to $4.74 billion, and corporate funding for energy efficiency companies rose from $465 million to $540 million.

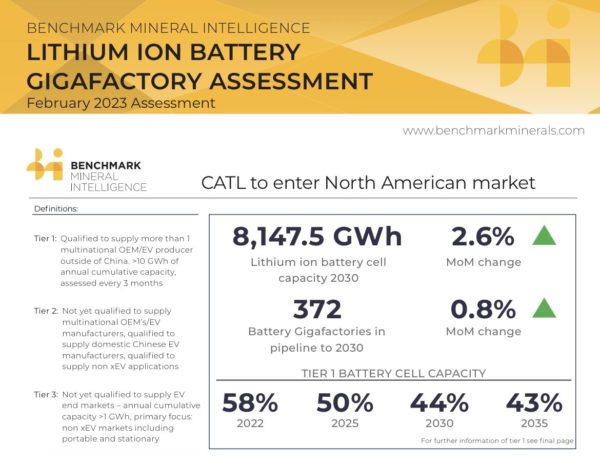

The large growth in funding of lithium ion energy storage doesn’t come as a surprise. Benchmark Mineral Intelligence, which focuses specifically on lithium ion, has shown massive growth over the course of the last year in terms of announced manufacturing capacity. On February 15, 2022, Benchmark shared that approximately 5.1 TWh of lithium ion battery manufacturing capacity had been announced to be deployed by 2031.

By February of this year, Benchmark showed that these projections had grown by almost 60.

While this capacity will mostly be used for transportation, the volume relative to electricity use is revolutionary. Globally, total annual electricity use is in the range of 26,000 to 27,000 TWh, or approximately 72 TWh per day. Therefore, by 2031, the 8 TWh of lithium ion capacity we could be manufacturing annually would equal about 2.6 hours a day of the earth’s current daily electricity usage.

Consider this: In 10 years enough energy storage could be manufactured to store a full day’s worth of energy, which could—hypothetically—be used on a daily basis.

While lithium ion still gets the big volume headlines, the large variety of deals that VCs have invested in is also a point of interest. That such a variety of products can find this level of funding speaks to the rapid scaling of the industry. With so much money pouring into the industry, there’s a lot of space for experimentation.

Some of the “other” energy storage technologies investments include batteries based on zinc, sodium, aluminum-sulfur, liquid air, nickel, flywheels, iron flow, compressed air, and iron air. As the variety and quantity of technologies increases, so too does the number of investors entering the industry. There were 73 investors when Mercom began tracking the number of investors in 2018. Today, there are 233.