The U.S. Internal Revenue Service (IRS) and the Department of the Treasury recently introduced guidance on its Domestic Content Bonus Credit. Initial industry feedback suggests that securing the 10% tax bonus, tied to the 40% domestic content requirement, might be challenging.

Structural steel and iron – 100% made in the USA

All steel and iron used in projects must undergo their complete manufacturing processes in the U.S., with the exception of certain metallurgical processes related to steel additives. This primarily applies to construction materials used for racking and foundation components anchoring solar panels. However, this stipulation doesn’t extend to steel and iron components categorized as “manufactured products” in solar projects.

Keith Martin, in Norton Rose Fulbright’s analysis, simplifies the classification of steel and iron construction items by saying, “If they are removed, things fall down.”

Interestingly, tracker motors, which turn the torque tubes that re-orient solar panels, will be classified as a manufactured good, subject to only the 40% domestic content rule.

While the IRS guidance doesn’t explicitly address the issue of rooftop solar racking, often made of aluminum and steel with electrical grounding requirements, must also be 100% American made. However, most analysts assume that it will fall under the structural steel and iron regulations.

Source: Internal Revenue Service

An important reminder: For projects exceeding 1 MWac, the full 10% dometic content bonus is attainable only if they meet prevailing wage requirements. Otherwise, the bonus tax credit drops to 2%.

Manufactured products – 40% American-Made

The major hurdle for the domestic content bonus lies in defining and reaching the 40% domestic content threshold for ‘manufactured goods’. The Treasury acknowledges this is just the initial guidance, and more comprehensive updates are on the horizon. They also express openness to revisions based on industry feedback.

Going forward, the 40% minimum domestic content requirement is set to increase annually, to 45% for projects starting construction in 2025, 50% in 2026 and 55% thereafter.

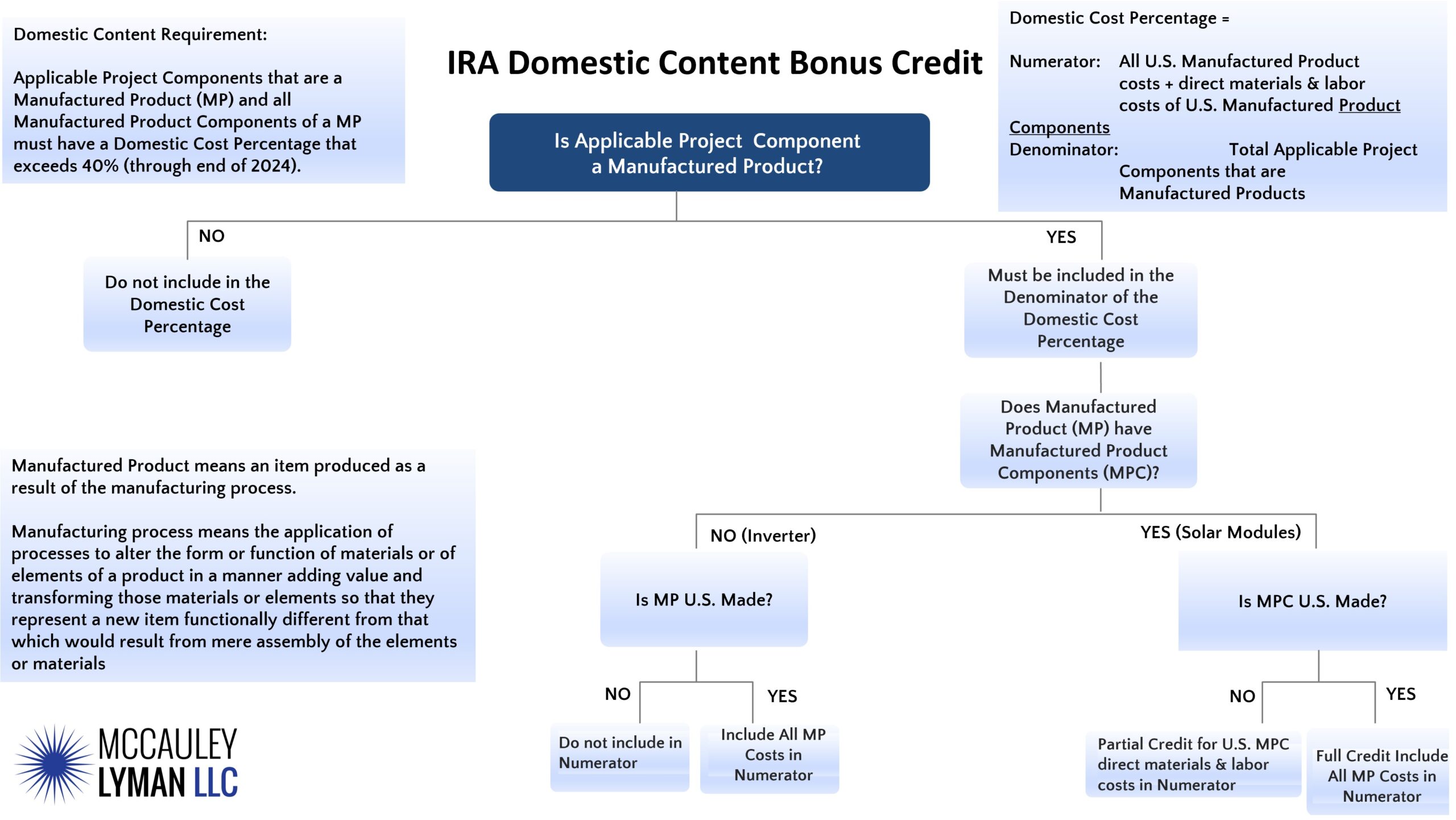

Manufacturers and developers must grapple with multiple considerations. Maria Bries of McCauley Lyman LLC recently illustrated some of these complexities in a recent graphic, highlighting challenges of determining actual domestic content percentages.

Manufacturers must determine the percentage of their products that are American-made. This not only involves tracing the origin of each component but also understanding the labor implications of its inclusion in the final solar product. Christian Roselund of Clean Energy Associates points out that if even one component in a manufactured product is imported, none of its associated labor counts toward the 40% quota.

Transparency in cost is another significant challenge. While larger players might have the leverage to demand cost breakdowns, smaller entities could be at a disadvantage. To fully trust and utilize the 10% bonus, concrete proof of product origins will be essential.

A call for U.S. based solar cell manufacturing

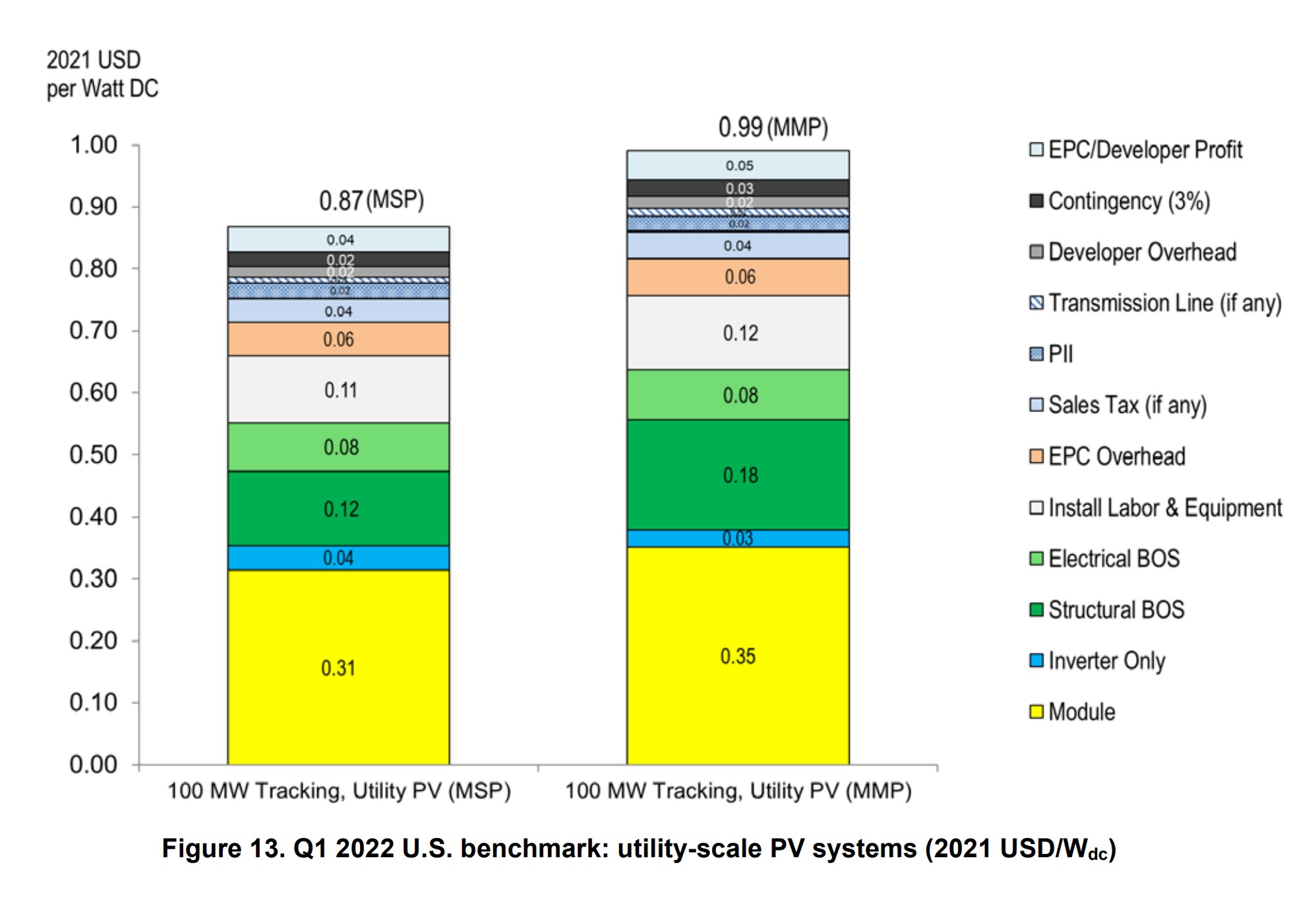

The IRS’s stance on solar panels is particularly significant. The guidance will assess both the origin of the final project purchased by developers, such as a U.S.-manufactured solar module, and its constituent components, like solar cells. This approach extends to other parts of the solar module, including the glass, frame, junction box, encapsulant, and more.

While the focus remains on the origin of the solar cell, the guidance doesn’t mandate a U.S. origin for the solar wafer, allowing panels with foreign-made solar wafers. This tacitly excludes polysilicon from sourcing requirements, even though it’s a significant cost driver for solar panels. The American thin-film solar module manufacturer First Solar has criticized this allowance.

Source: National Renewable Energy Laboratory

Source: National Renewable Energy Laboratory

Given the substantial investment solar panels represent, there’s mounting pressure within the industry to kickstart U.S. solar cell manufacturing. This is especially true for manufacturers who share financial risks with solar developers in the production of solar panels.

Following the IRS guidance, Meyer Burger announced a 2 GW solar cell factory in Colorado complementing its Arizona-based 2 GW solar module factory.

Additional components and the 40% threshold

In recent webinars hosted by Roth MKM’s Phillip Shen, featuring guest Keith Martin from Norton Rose Fullbright, discussions delved into other components that might contribute to the 40% target. Companies like Shoals, specializing in custom wiring for solar projects, could help meet this quota. Shen also theorized that incorporating a U.S.-manufactured Enphase inverter into a solar module might enhance compliance.

Items like copper wiring, conduit, disconnects, electrical panels, fuses, fencing, step-up transformers also count as manufactured goods and contribute toward the 40% goal.

Rooftop solar racking is another focal point. Discussions with a custom commercial rooftop solar racking company informed pv magazine USA that many developers are examining this product class more closely, eager to understand the key components and sources that make up these products.

Some have speculated that Goldman Sachs’ acquisition of inverter manufacturer EPC Power was a play to tap into the dometic content potential.

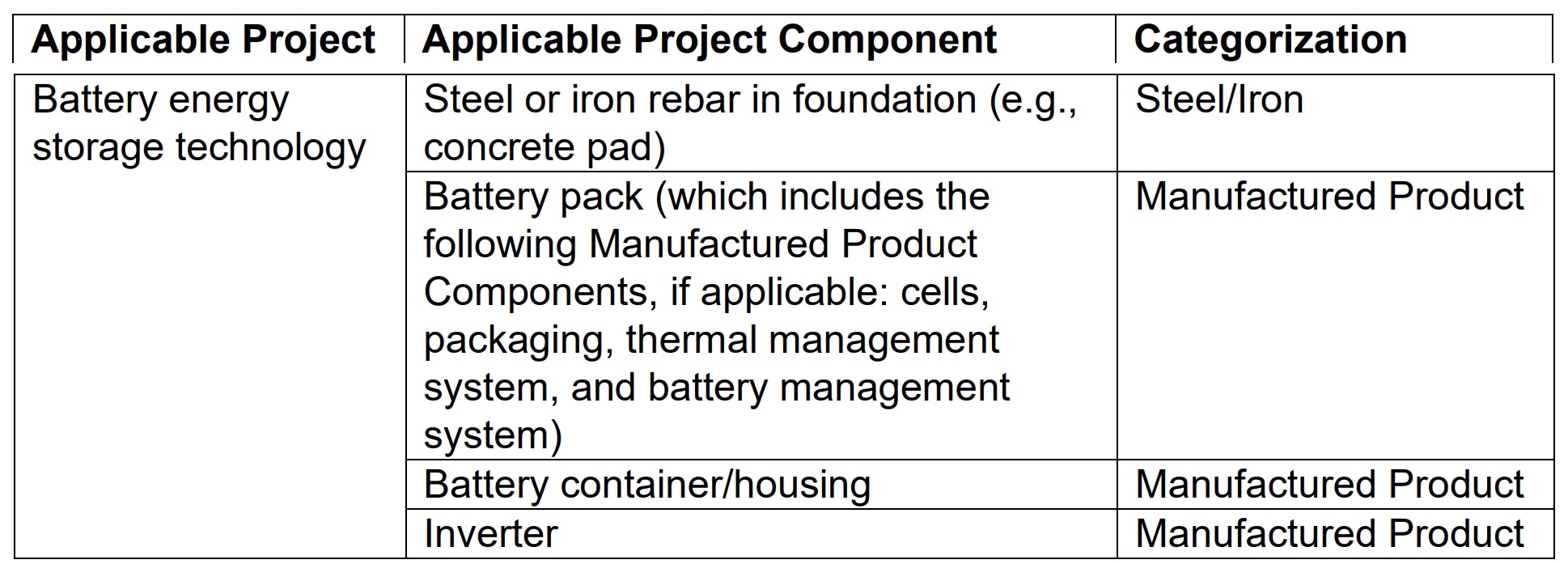

Batteries, integral to a vast number of upcoming projects, are classified as manufactured goods. It’s important to highlight that batteries have their own 30% tax credit, complemented by a 10% domestic content bonus. Developers therefore face a strategic decision: Should they integrate batteries with their solar projects or keep them as standalone units? Where batteries can operate independently, a detailed cost-benefit analysis might be required to determine the optimal approach.

Fluence’s new Oregon battery facility emphasizes its alignment with domestic content guidelines and its eligibility for the $10/kWh manufacturing tax credit.

The IRS specifically clarified that the 100% steel and iron requirement does not extend to items within manufactured parts. Components “such as nuts, bolts, screws, washers, cabinets, covers, shelves, clamps, fittings, sleeves, adapters, tie wire, spacers, door hinges, and similar items that are made primarily of steel or iron,” but not serving a structural function, are exempt.