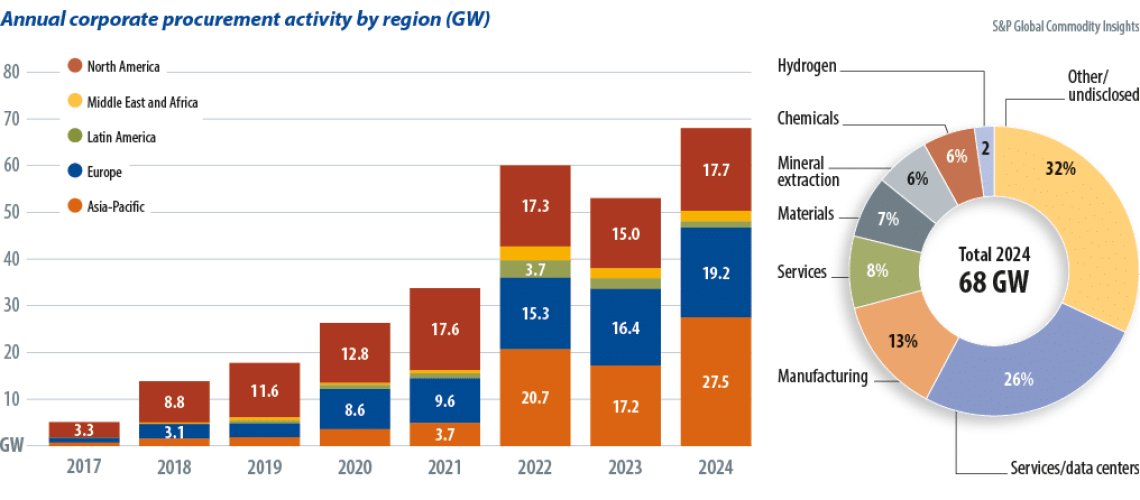

In 2024, the global corporate clean energy procurement market grew strongly, with a record 68 GW of power purchase agreements (PPAs) and other clean energy procurement deals announced. That amounted to 29% growth against the previous year. Caroline Zhu and Bruno Brunetti, of S&P Global Commodity Insights, examine the trends behind these numbers.

Solar accounted for roughly half of the total energy capacity procured by corporates in 2024. Since 2019, solar has emerged as the favored technology for corporate energy procurement, due to generally easier permitting processes and shorter construction timelines.

Data centers continue to lead global corporate clean energy procurement efforts, with more than 17 GW of deals contracted in 2024, largely driven by demand in the United States. The data center sector accounted for almost 60% of the corporate deals in the United States in 2024, up on the previous year’s average of around 50%. Globally, data centers have also been a driving force behind corporate procurement, accounting for more than a quarter of announced capacity globally, predominantly through direct, third-party PPAs.

Amazon, Google, Meta, and Microsoft led the clean energy offtaker list, collectively announcing 15 GW of generation capacity with deals signed in the Asia-Pacific, Europe, and North American regions. That does not include the 10 GW energy framework agreement that Microsoft announced with Brookfield earlier in May 2024.

While solar remains the predominant generation technology, data centers are eyeing hybrid solutions which include solar with energy storage, or a combination of solar and wind. Some are also investing in nuclear, such as Google and Amazon, which have both signed agreements to develop and source nuclear power in the United States.

Despite uncertainties around the overall size of demand growth tied to artificial intelligence, data centers are expected to drive corporate clean energy procurement. They’re projected to contract 300 TWh of additional clean energy per year by 2030, compared to approximately 200 TWh per year contracted as of the end of 2024.

The manufacturing sector is another leader in global procurement, especially outside of North America. The scale is significantly below that of data centers, however, with just 9 GW globally – more than 60% of which is in the Asia-Pacific region. Services and mineral extraction sectors also show momentum. Trade-related emission regulations such as the European Union’s Carbon Border Adjustment Mechanism (CBAM), and EU Battery Regulation, are placing pressure on affected companies and they have responded by accelerating efforts to prepare for potential risks.

In North America, corporate procurement totaled 18 GW in 2024, an 18% increase from the previous year. Solar accounted for more than half of contracted capacity. Hybrid contracting activity grew strongly, with 2 GW contracted in 2024, of which 80% were solar-plus-storage hybrid projects. Currently, onshore wind faces challenges, recording the lowest level of activity since 2016. The decline is likely influenced by difficulties in securing new projects due to long permitting processes and opposition from local communities. Contracting activities surged in the second half of the year, likely due to an Inflation Reduction Act (IRA) rule change effective Jan. 1, 2025.

The introduction of technology-neutral production and investment tax credits could support the development of zero-emission generation and energy storage technology and expand the pool of financially viable projects. Meanwhile, developers have been motivated to accelerate project timelines to take advantage of the new tax credits before any potential policy changes under president Donald Trump’s administration.

PPA transactions data available under the Electric Quarterly Reports used by the US’ Federal Energy Regulatory Commission, show that average solar PPA prices (both for utilities and corporates) trended upward, to just slightly under $50/MWh. That was well above prices seen in prior years and rebounded to 2019 levels.

PPA prices are likely to remain elevated in the near term due to rising demand for power and the risk of potential repeal or scale-back of the clean energy tax credits available under the IRA.

About the authors: Bruno Brunetti leads PPA market analysis and environmental market research, which includes forecasting of European Union and United Kingdom renewable energy guarantees of origin and renewable energy credits globally. He spent more than five years at S&P Global Platts, leading long-term power modeling and renewables capture price forecasts. He also led the global wind and solar outlooks while expanding analytical coverage into global power markets.

Caroline Zhu is a senior analyst with S&P Global Commodity Insights, covering clean energy procurement, with a focus on energy certificate markets. She was previously a manager at the Rocky Mountain Institute nonprofit, primarily working on renewable energy procurement, power market reform, and heavy industry decarbonization in mainland China. She also has experience in market and policy research related to hydrogen technology, with electrolyzer company Proton OnSite, since acquired by Nel.

Popular content