According to the Solar Means Business 2022 report, released today by the Solar Energy Industries Association (SEIA), companies in the United States have installed nearly 19 GW of on-site and off-site capacity, which doubles the amount that had been installed through 2019. Of the 19 GW, more than half was installed since 2020—and those numbers would have been higher if it were not for the Covid-19 pandemic, resulting supply chain challenges and trade disputes.

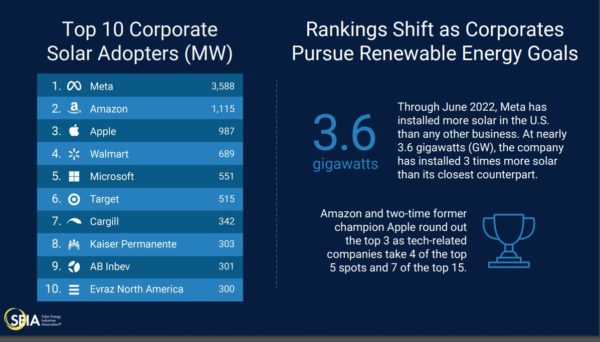

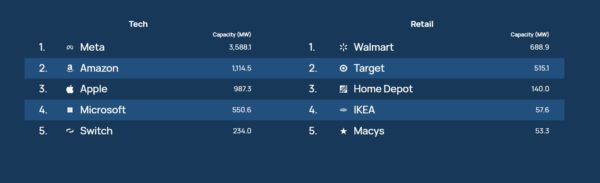

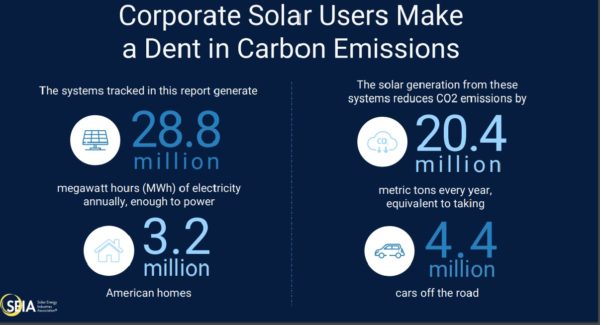

The report tracks over 47,000 corporate solar installations nationwide, which generate enough electricity to power 3.2 million homes and offset 20.4 million metric tons of carbon annually. Analyzing commercial solar adoption, the report names Meta (Facebook), Amazon, Apple, Walmart and Microsoft as the top five corporate solar users in the country. The report said recent growth is due to the expansion of off-site corporate solar procurement, which now represents 55% of all commercial solar use. Almost 70% of all off-site corporate solar has been brought online since 2019.

While off-site solar saw the strongest growth, on-site commercial solar has averaged a steady 3% growth over the last five years. Target, Walmart, and real estate firm, Prologis, make up the top 3 companies for solar installed on site. The report notes that nearly 30% of Target stores have rooftop solar installed. Cold storage and logistics company, Lineage Logistics, has recently made a huge jump in its on-site solar, with over 87 MW installed in the past two years.

“About half of all corporate solar has been installed in the last two and half years,” said Abigail Ross Hopper, SEIA president and CEO. “Solar Means Business highlights the incredible flexibility of solar, whether it’s installed on a warehouse roof, on a carport or at an off-site facility, showing the various ways that companies are meeting their needs with clean, affordable energy. From data centers to industrial freezers, the most energy-intensive business operations are turning to solar as the most reliable and affordable way to power their infrastructure.”

Meta (formerly Facebook) increased its installed solar capacity from 177 MW in early 2019 to 3.6 GW in 2022 and now has the largest corporate solar portfolio in the United States. Target remains the top onsite corporate solar user, while Microsoft joins the top 10 after installing 479 MW of new capacity since 2019.

“We are proud of the work we have done to add new solar energy to the grid, bringing additional investment to rural areas and helping support the transition to renewables,” said Urvi Parekh, head of renewable energy at Meta. “As we continue to fulfill our goal to support our global operations with 100% renewable energy, we look forward to working with others, including SEIA, to facilitate the energy transition and support a sustainable, affordable and reliable electricity grid.”

Walmart is no stranger to the list, as it has been in the top 5 for the last decade.

“Solar energy is a key part of Walmart’s commitment to become a regenerative company, powered by 100% renewable energy by 2035,” said Vishal Kapadia, senior vice president, energy transformation at Walmart. “Our onsite and offsite solar projects have helped us deliver strong progress toward our goal, with 46% of our global electricity needs supplied by renewable energy as of 2021.”

Many top companies, including Intel, Google, Switch and Digital Realty, have embraced solar energy to power data centers. The food and beverage giants Ab Inbev and Starbucks, health care companies including Kaiser Permanente and DaVita, and other top brands such as Home Depot and T-Mobile are all top 25 corporate solar users.

Energy storage

In addition, the report now tracks commercial solar projects that are paired with battery storage. In California, the percentage of on-site commercial solar installations that are paired with storage has jumped from 0.5% in 2015 to nearly 4% in 2022. The average battery size in 2022 was over 500 kWac. Off-site commercial solar installations are also increasingly paired with storage, and the numbers are expected to rise as utility-scale storage costs continue to fall.

With the emergence of large corporate buyers, the utility-scale solar space has been dramatically altered. It used to be that utilities were the off takers for large-scale solar projects, but in 2021, nearly a quarter featured at least one commercial buyer. Out of the top 25 companies in this report, 18 are pursuing 100% renewable energy or carbon neutrality. And 13 of the top 25 corporate solar users have joined the RE 100, an initiative of businesses that are committed to 100% renewable energy.

Future growth

Buoyed by the Inflation Reduction Act, both on-site and off-site solar markets are expected to double again over the next three years. Total commercial solar installations are expected to double again over the next 3 years with nearly 27 GW of off-site corporate solar projects scheduled to come online by 2025. The on-site market is expected to grow over 24% in the next five years, and off-site by 51%, although some projects will be delayed due to trade disputes, supply chain issues, and rising prices.