The Dept. of Commerce today released its preliminary decision, stating that certain Chinese solar cell and panel producers in four Southeast Asian countries are indeed working in those countries to avoid paying duties on Chinese-made solar goods. Commerce has suggested an extension of antidumping/countervailing duties (AD/CVD) to solar cell and panel imports from specific companies working in Cambodia, Malaysia, Thailand and Vietnam.

Credit: Namaste Solar

AD/CVD have been in place against Chinese solar imports since 2012. Commerce should release its final determination on May 1, 2023.

The tariffs are against crystalline silicon cells produced in the four countries from wafers produced in China and final panels made with wafers produced in China that also use two of the following Chinese-made materials: silver paste, aluminum frames, glass, backsheets, ethylene vinyl acetate sheets and junction boxes. Wafers produced outside of China with polysilicon sourced from China are not considered to be wafers produced in China and are not included in this scope.

Today’s preliminary decision from the Dept. of Commerce cites specific companies actively circumventing previous AD/CVD orders rather than issuing a new blanket order on everything coming from the four countries.

- Companies found to be circumventing the Chinese tariff orders by working in Malaysia: AMC Cincaria, Flextronic Shah Alam, Funing Precision Component, Samsung, Vina Solar Technology (LONGi).

- Companies found to be circumventing the Chinese tariff orders by working in Thailand: Celestica, Green Solar Thailand, Lightup Creation, Thai Master Frame, Three Arrows, Yuan Feng New Energy, Solar PPM, Sunshine Electrical Energy.

- Companies found to be circumventing the Chinese tariff orders by working in Vietnam: Global Energy, GCL, Green Wing Solar Technology, HT Solar, Irex Energy, S-Solar, Venergy, Sunergy, Red Sun Energy.

- Companies found to be circumventing the Chinese tariff orders by working in Cambodia: none.

- Companies explicitly stated within Commerce documents to NOT be circumventing the Chinese tariff orders by working in Southeast Asia and therefore EXEMPT from any additional tariffs: New East Solar (Cambodia), Hanwha Qcells (Malaysia), JinkoSolar (Malaysia) and Boviet Solar (Vietnam).

This investigation has hung over the U.S. solar industry for two years. A group of anonymous solar panel manufacturers first asked Commerce to take a look in 2021 at specific Chinese solar panel manufacturers working in Southeast Asia as a way to circumvent AD/CVD requirements. Commerce rejected that petition because of the anonymous nature of the petitioners. California-based solar panel assembler Auxin Solar then put its name on a new petition in 2022 and became the main voice behind the request. Auxin officials claim that Chinese solar producers working in Southeast Asia are unfairly pricing their products to undercut American manufacturers.

Once the investigation began, module supply from Southeast Asia — a region that supplied 80% of U.S. demand in previous years — became limited. Many manufacturers were waiting to see DOC’s decision before shipping panels (that may have retroactive duties) to the United States. This uncertainty — along with global supply chain issues — led President Joe Biden to announce a two-year pause on any additional tariffs in June 2022. The Biden Administration postponed any tariff initiation to “ensure the U.S. has access to a sufficient supply of solar modules to meet electricity generation needs while domestic manufacturing scales up.” Today’s tariff decision (with its May 2023 final determination deadline) will not go into effect until after June 6, 2024 due to Biden’s executive action.

Credit: S&P Global

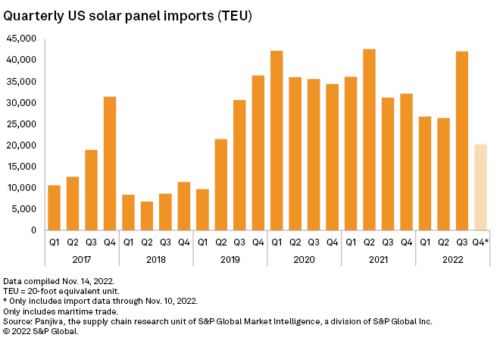

S&P Global analyzed U.S. solar panel imports since Biden’s two-year tariff waiver and found a dramatic spike in imported solar panels in Q3 2022. The number of shipping containers carrying solar panels to U.S. ports jumped 59% from Q2.

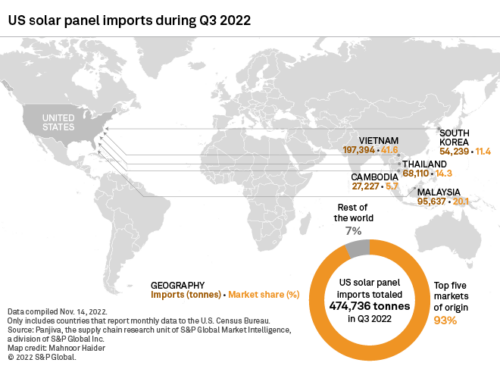

The group found that 82% of solar panels imported in Q3 2022 came from the four Southeast Asian countries at the center of this case. Vietnam accounted for 41.6%, Malaysia was 20.1%, Thailand was 14.3% and Cambodia was 5.7%. Chinese imports accounted for only 0.1% of the U.S. supply during the same period. U.S. module buyers are fully taking advantage of Biden’s pause on tariffs.

Credit: S&P Global

While there have been more announcements for new U.S. solar cell and panel manufacturing outfits since the inclusion of tax credits in the Inflation Reduction Act this past summer, the country’s demand far outpaces supply, and solar panels will must continue to be imported. These new tariffs will touch all markets — residential through utility-scale — beginning in 2024 and beyond.

Today’s specific company outline is good news for South Korea’s Hanwha Group. Hanwha’s large solar cell and panel manufacturing outfit in Malaysia will be able to assist in the company’s U.S. manufacturing expansion efforts without extra tariffs. Maxeon, a Singaporean company that makes solar cells in Malaysia, is also planning a U.S. manufacturing that would depend on Malaysian product during ramp-up. While not mentioned in either the tariffed or nontariffed camp today, Maxeon officials had previously told Solar Power World that the company would try for a tariff exclusion due to Maxeon’s “premium pricing” that could not be interpreted as dumping. We are not aware of what wafers Maxeon uses in its products.

SPW will update this story as more information becomes available.