For context, the state has about 43 GW installed cumulatively to date, according to SEIA. The state’s new 2035 electricity emissions goals include 19 GW of new solar power, 20.6 GW of new wind and 15.7 GW of new battery power.

The California Public Utility Commission (CPUC) has set a target to reduce emissions to 25 million metric tons of carbon dioxide equivalent (MMT) emissions by 2035, as outlined in the CPUC’s recent document on the 2023 Preferred System Plan and related matters.

This target will guide utilities in choosing electricity sources, with projections for solar power capacity reaching a potential 76.9 GW in a “low gas” scenario by 2035.

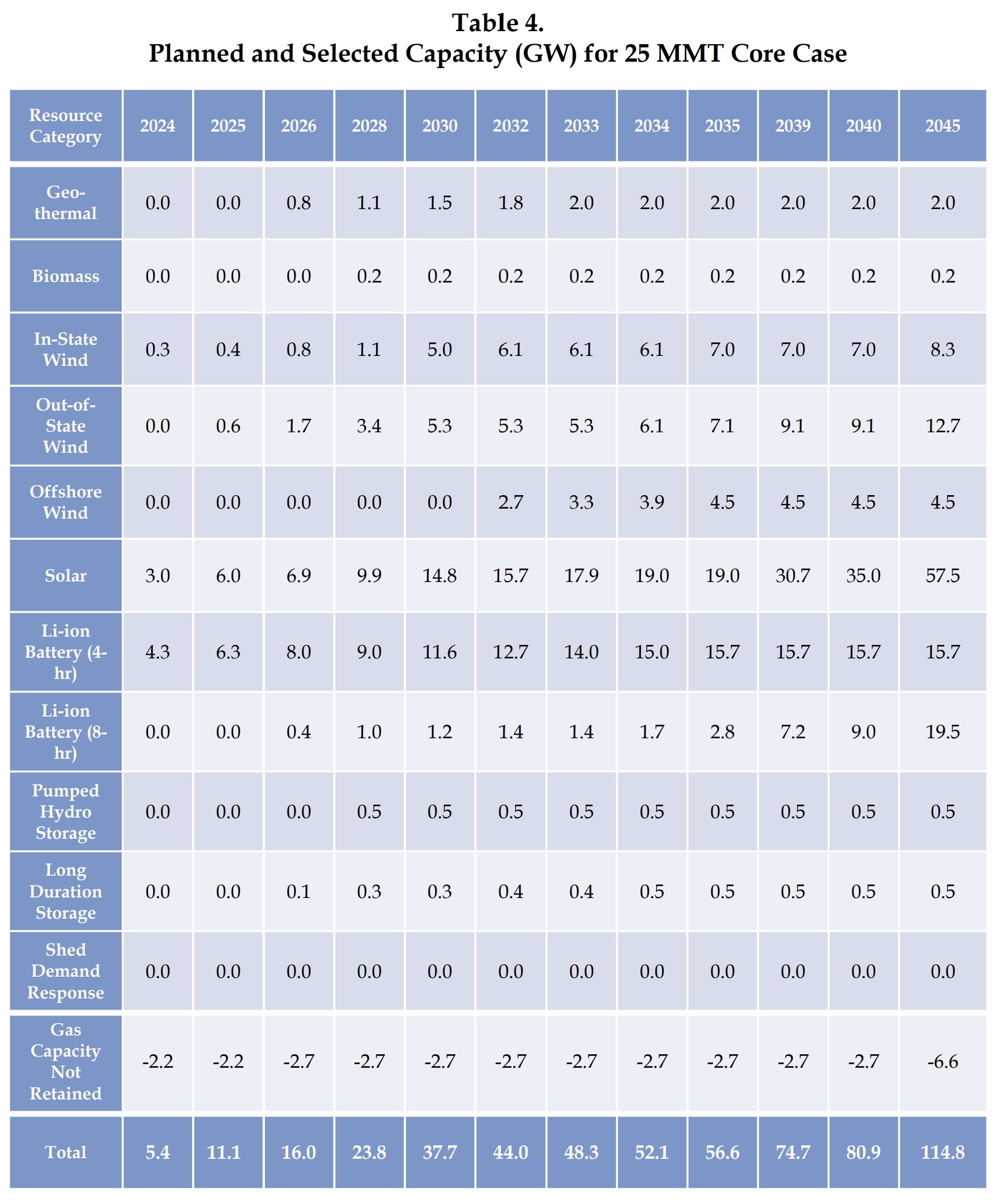

The default future projection, known as the 25 MMT Core Case, projects a need for 3 GWac of utility scale solar deployed in 2024, growing to almost 10 GW in 2028, before nearly doubling to 17.9 GW by 2033 and ultimately reaching 57.5 GW in 2045.

This decision marks the culmination of discussions which began in 2020, when it was suggested that previous procurement models were not aggressive enough to meet California’s negative emission goals.

The CPUC also considered additional modeling, including a “0 MMT Core Case” for 2045 and a “Low Gas” model as per requests by stakeholders. The “Low Gas” model proposes accelerating the closure of gas plants beyond the 25 MMT Core Case’s projections, which call for a 70% reduction in gas plant utilization by 2035 and a 90% reduction by 2039, compared to levels in the base year of 2024.

Furthermore, the CPUC urged the state to continue pushing for offshore wind. It contended that transmission upgrades are inevitable, stating that “it was not a matter of if, but rather when, transmission upgrades would be needed” and that these challenges should not impede the work of CPUC staff members mapping the 1.6 GW of potential capacity in waters near the North Coast/Humboldt area.

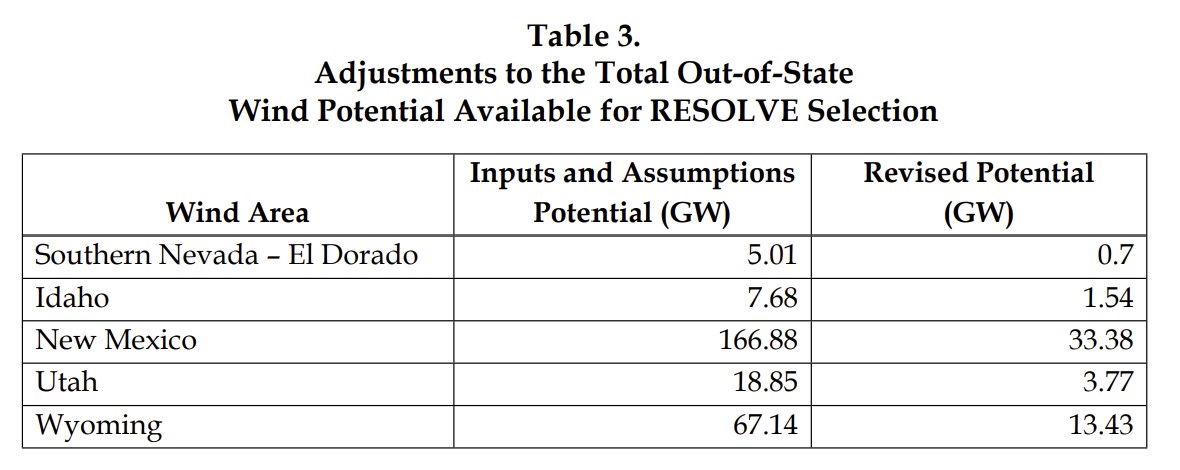

The state also greatly reduced the projected volume of out-of-state wind available to 52.82 GW of potential capacity.

Utilities were instructed to continue procuring new capacity as if the Diablo Canyon nuclear plant were closing, despite uncertainty about the exact closing dates within the 2024-2025 calendar year. The wide potential closure date range was identified as a potential grid destabilizing event as new capacity was still being deployed and commissioned. The CPUC reiterated the requirement of 2.5 GW of clean resources “designed specifically to mitigate the loss of the Diablo Canyon Power Plant”.

This capacity does not necessarily refer to utility scale power plants, but rather to any capacity for which local electricity utilities contract. For instance, PG&E has signed a contract with residential solar specialist Sunrun for the “Peak Power Rewards” program. This program compensates customers for dispatching power during times of peak demand on the grid. Over 90 consecutive days, 8,500 residential solar-plus-storage assets delivered an average of 27 MW of power during peak hours.

The model included 2 GW of geothermal capacity. One might see a change in this value in the future as Fervos Energy continues its evolution.