From July 2023 through summer 2024, battery cell pricing is expected to plummet by over 60% (and potentially more) due to a surge in EV adoption and grid expansion in China and the U.S.

We are in the midst of a year-long acceleration in the decline of battery cell prices, a trend that is reminiscent of recent solar cell price reductions.

Since last summer, lithium battery cell pricing has plummeted by approximately 50%, according to Contemporary Amperex Technology Co. Limited (CATL), the world’s largest battery manufacturer. In early summer 2023, publicly available prices ranged from 0.8 to 0.9 RMB/Wh ($0.11 to $0.13 USD/Wh), or about $110 to 130/kWh.

Pricing initially fell by about a third by the end of summer 2023. Now, as reported by CnEVPost, large EV battery buyers are acquiring cells at 0.4 RMB/Wh, representing a price decline of 50%to 56%. Leapmotor’s CEO, Cao Li, expects further reductions, with prices potentially dropping to 0.32 RMB/Wh this summer, marking a decrease of 60% to 64% in a single year.

EnergyTrend observed that energy storage battery cells are priced similarly to electric vehicle battery cells.

Additionally, CnEVPost reports that the battery cells being sold come equipped with advanced technologies, including faster charge rates, higher cycle life, improved temperature management characteristics, and higher energy density packaging.

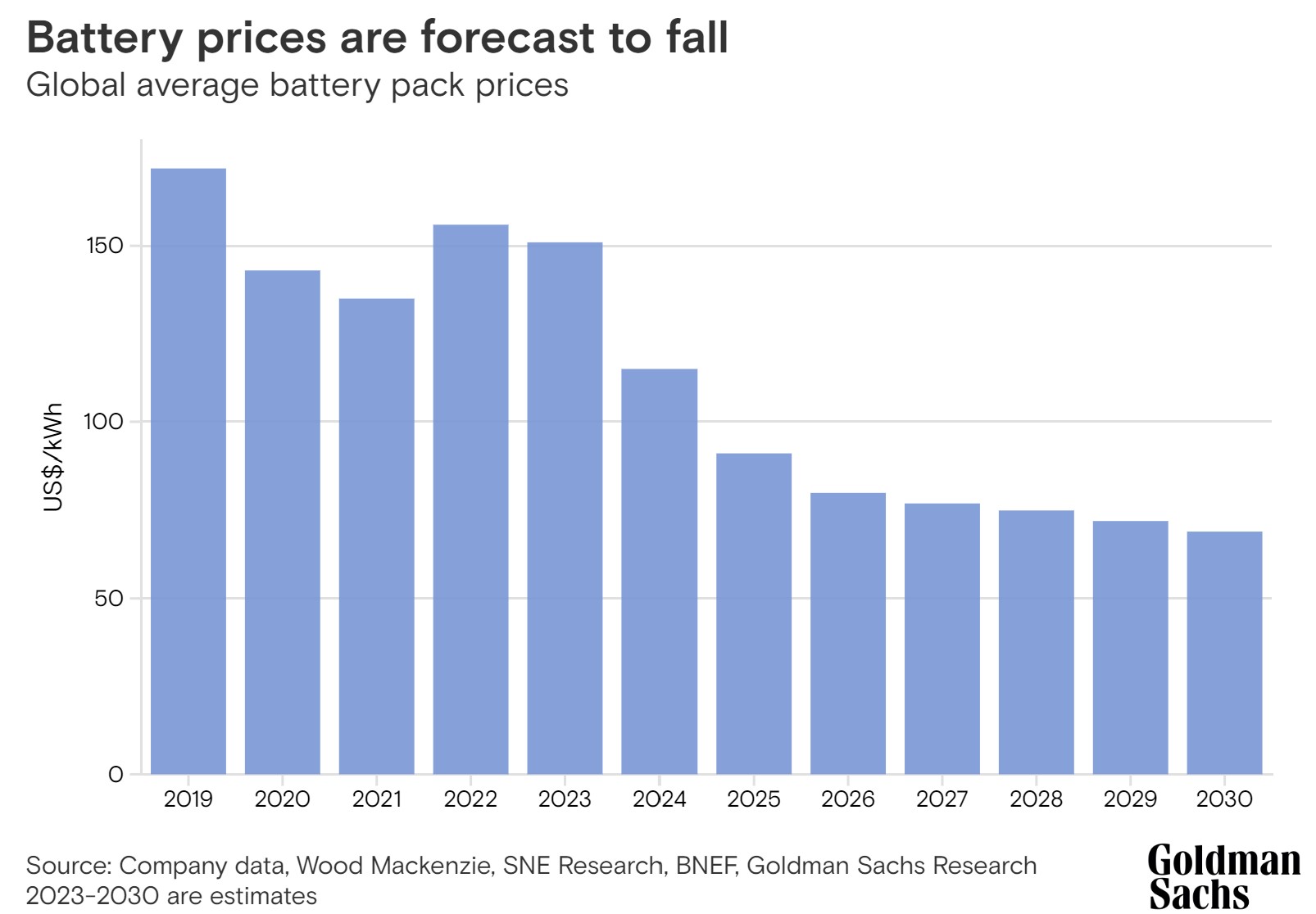

A February report from Goldman Sachs attributes the accelerated price declines partly to a slight slowdown in electric vehicle adoption, leading to lower commodity prices. The finance group revised its global battery demand growth projection to 29% for 2024, down from the previous estimate of 35%, with a 31% growth expected in 2023.

Goldman also forecasts a 40% reduction in battery pack prices over 2023 and 2024, followed by a continued decline to reach a total 50% reduction by 2025-2026. Goldman predicts that these price reductions will make electric vehicles as affordable as gasoline-powered vehicles, leading to increased demand.

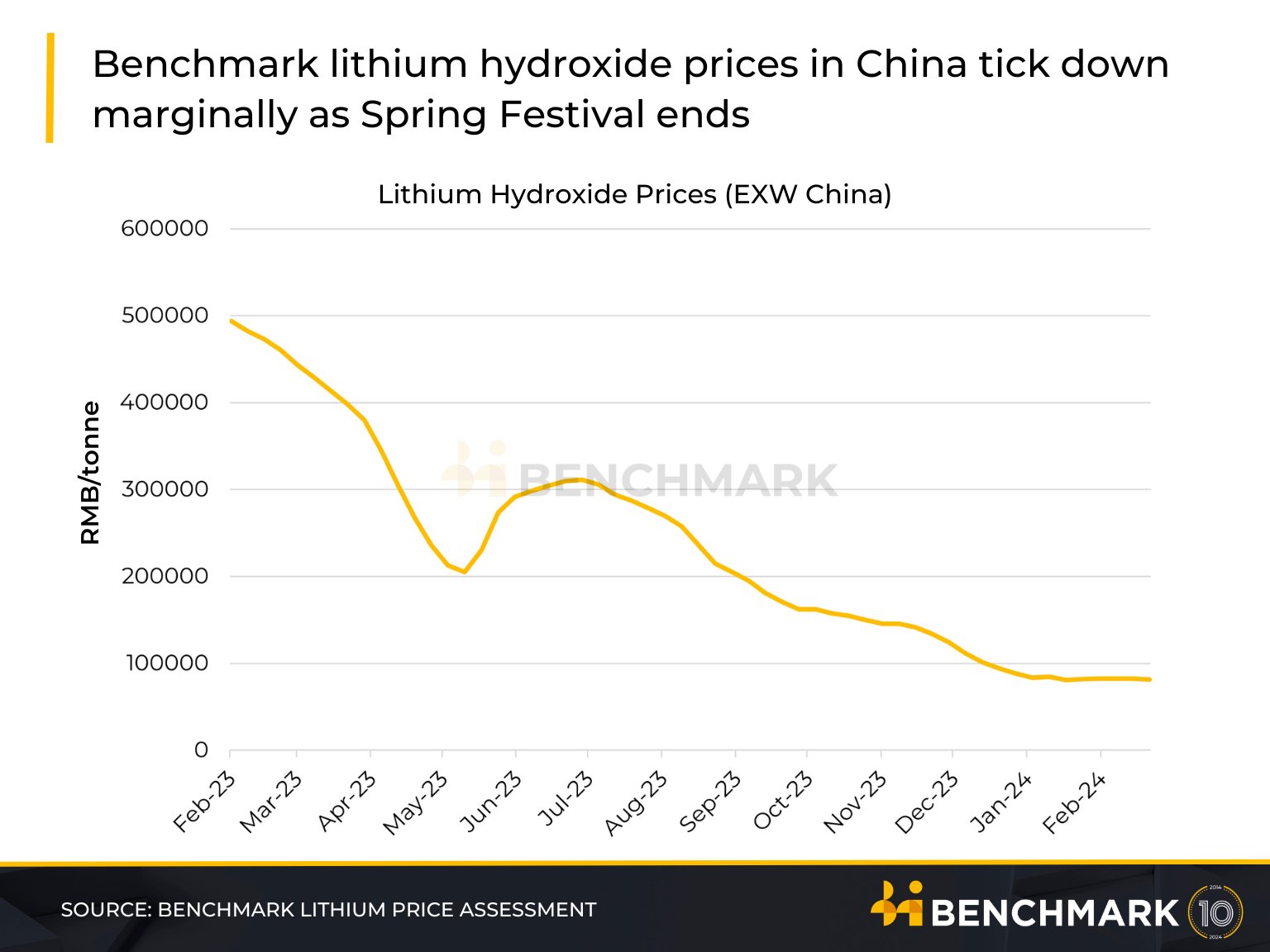

One of the most notable commodity price declines related to EVs is that of lithium hydroxide. Its price surged from late 2021 through 2022, then began to tumble in early 2023, and continues to decrease today.

The price decreases are attributed to several factors, including a perception of stabilizing demand as manufacturers struggle to make EVs profitable, which has led to a softening of speculative investment in vehicle metal futures markets. Other contributing factors include supply chain improvements, decreasing inflation, and new lithium supplies coming online.

Other metals, such as copper, have fallen from pandemic-era highs but have not returned to pre-2020 prices.

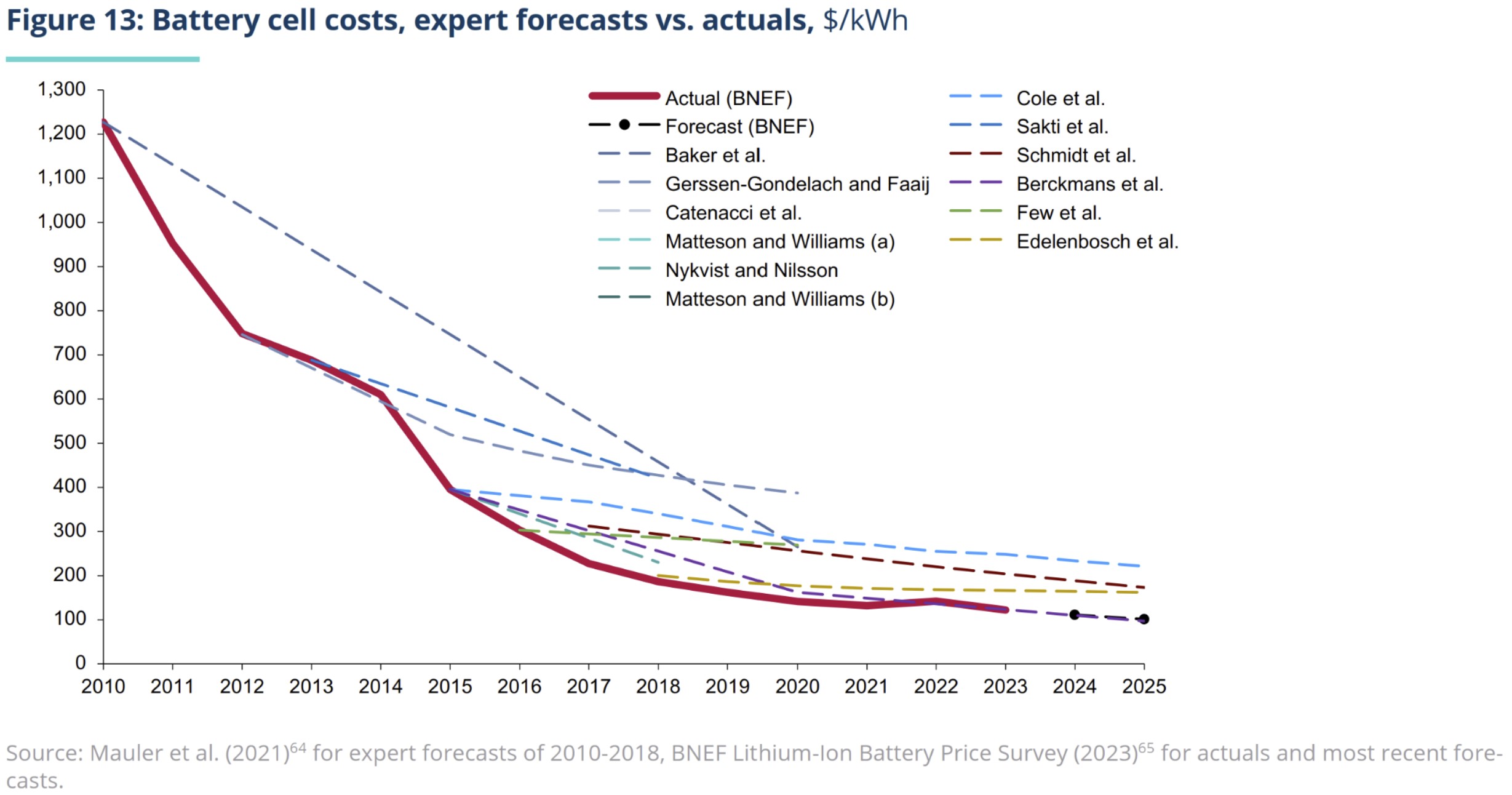

Interestingly, both batteries and solar panels have seen their prices drop by about 90% since 2010, with both products currently experiencing accelerated price declines. The Rocky Mountain Institute’s December report, “X-Change: Batteries – The Battery Domino Effect,” presents a chart mirroring the trends seen in solar panels over the last fourteen years.

Looking back thirty or forty years, the costs of both batteries and solar panels have decreased by 99% or more for their base units.

Driven by these price declines, grid-tied energy storage deployment has seen robust growth over the past decade, a trend that is expected to continue into 2024. The U.S. is projected to nearly double its deployed battery capacity by adding more than 14 GW of hardware this year alone. China is anticipated to become the grid storage leader, with deployments of just over 24 GW of capacity expected. EnergyTrend forecasts a global deployment of 71 GW of capacity, representing a 46% expansion over the 177% growth seen in 2022.

There is abundant anecdotal evidence from public and private sources corroborating these price declines in the marketplace. A significant example is the drop in electric vehicle prices over the past year, so substantial that Hertz had to publicly adjust the value of its Tesla fleet due to falling resale values. pv magazine USA has spoken with multiple energy storage vendors who have reported significant reductions in pricing, though one noted that while cell pricing has fallen significantly, the broader balance of system surrounding the battery cells has not fallen as quickly.

One vendor mentioned that advancements in battery cell technology, leading to increased energy densities, have contributed to lower deployed system costs per kWh.