NREL modeled solar-plus-storage as a mitigation tool to limit grid upgrade costs, and finds that for now, it’s still a better investment to build stand-alone solar. However, costs are close.

If you follow solar, you know that interconnection – costs. Time frames and viability are chief among project development challenges.

Government researchers studying the costs of adding batteries to save upgrades to the power grid when installing solar power have released data suggesting that in today’s wholesale market, small scale solar-plus-storage can’t compete financially with standalone solar. However, when just a few hundred thousand dollars of interconnection costs are introduced, the viability begins to tilt toward batteries.

The document — produced by the US Department of Energy’s National Renewable Energy Laboratory (NREL) – Use of Operating Agreements and Energy Storage to Reduce Photovoltaic Interconnection Costs, offers policy makers an opportunity to financially model how much incentives could cost when deploying distribution level solar-plus-storage.

To reach this conclusion, NREL started with a 3.3MWdc solar plant with interconnection costs ranging up to $650,000. The report also considered a 1.3MWdc solar project, as an example of an alternative facility that would not require interconnection upgrades. Energy storage and curtailment were also introduced, to determine the project with the best financial viability.

The financial model includes making use of the Federal Investment Tax Credit.

The analysis determines that even when interconnection costs are removed, and when operating in wholesale markets, the net present value of a project that adds batteries is less than systems smaller in size, with no batteries, no upgrade costs, and no output rules.

This result is unsurprising for anyone who deals in these markets, since distribution level wholesale market solar-plus-energy storage projects are pretty much unheard of.

The document’s research was released in two complementary publications. The first is a Technical and Economic Analysis, and the second is a Conceptual Framework.

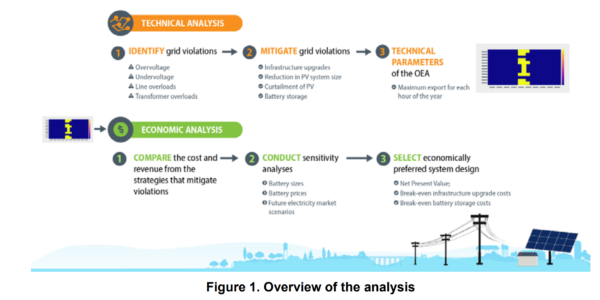

The techno-economic analysis’ purpose is to:

- Identify potential grid violations that would be induced by a PV system requesting interconnection to a distribution circuit

- Identify multiple technically viable options for mitigating the potential violations, including infrastructure upgrades, downsizing the PV system size, curtailment of PV, and addition of battery energy storage

- Define the required technical operating parameters of the system in order to mitigate all potential violations (the “Operating Envelope”)

- Compare the economics of each option, from the PV developer’s perspective.

Two requirements of the study are that there must be no annual electricity generation violations (i.e., more local solar than local demand), and that the analysis must use technology that is currently available.

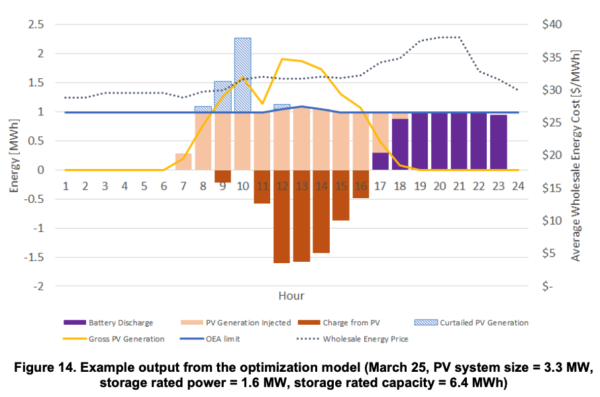

An example of a violation that might be outputting more electricity from the solar+battery facility local load at high noon. In the case of the solar-plus-storage system, the battery would absorb the daytime solar and pump it out later to avoid violations.

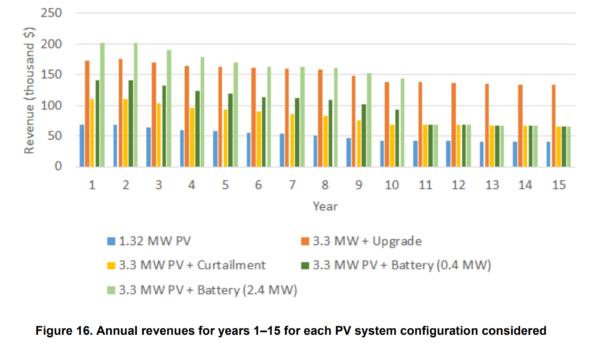

NREL modeled a 3.3MWdc project, and based on meeting the technical requirements, came up with four options to adjust the solar power project:

- The developer originally proposed a 3.3MW PV system, but to avoid grid violations, the PV system is downsized to 1.32MW.

- 3.3MW PV with infrastructure upgrade costs: The developer installs the originally proposed 3.3MW PV system and pays infrastructure upgrade costs to mitigate grid violations associated with the PV system.

- 3.3MW PV with curtailment to adhere to Operating Envelope: The developer installs the originally proposed 3.3MW PV system and agrees to adhere to the Operating Envelope, doing so by curtailing PV.

- 3.3MW PV, using battery and curtailment to adhere to Operating Envelope: Developer installs the originally proposed 3.3MW PV and agrees to adhere to the Operating Envelope, doing so by charging a battery and/or curtailing PV during the hours when the PV system generation is above the specified limits. Different battery sizes are explored.

- The 3.3MW battery system was modeled with two battery sizes – 0.4MW and 2.4MW, both with four hours of storage.

The revenue for these four designs was projected as:

The capex costs of these five systems was suggested to be between $980,000 and $2.82 million, after accounting for the U.S. Federal Investment Tax Credit.

The analysis concludes that with some combinations of decreasing battery pricing, or increasing interconnection costs, small scale solar-plus-storage might compete in the wholesale energy market. In most markets, however, distribution level assets don’t compete in wholesale markets — they’re usually connected directly to existing buildings, or selling into special programs (like community solar).

Without a doubt, integrating storage on distribution circuits and giving even a small amount of financial support would cut down grid upgrades and greatly increase highly distributed resistance, which could be just enough to make this market viable.