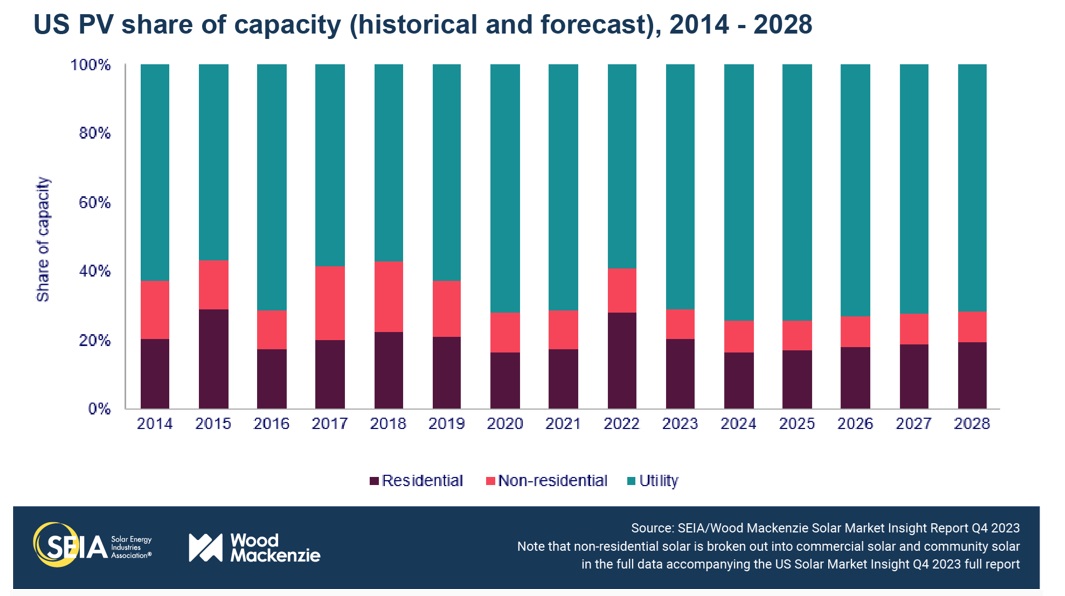

Solar Energy Industries Association and Wood Mackenzie report estimates that 33 GW of solar was added in 2023. Despite economic challenges in the near future, solar is expected to be the largest source of generating capacity by 2050.

The 6.5 GW of new electric generating capacity added in 2023 set a new record, according to the U.S. Solar Market Insight Q4 2023 report, and the expected 55% increase over last year is a slight upward revision over last quarter’s expectations. The growth is attributed, for the most part, to the Inflation Reduction Act and other federal clean energy policies.

While the growth in solar capacity has been on an upward trajectory, with an estimated 6.5 GW installed in Q3, the report forecasts economic challenges ahead, and expects to see just 10% growth in 2024.

“Solar remains the fastest-growing energy source in the United States, and despite a difficult economic environment, this growth is expected to continue for years to come,” said SEIA president and CEO Abigail Ross Hopper. “To maintain this forecasted growth, we must modernize regulations and reduce bureaucratic roadblocks to make it easier for clean energy companies to invest capital and create jobs.”

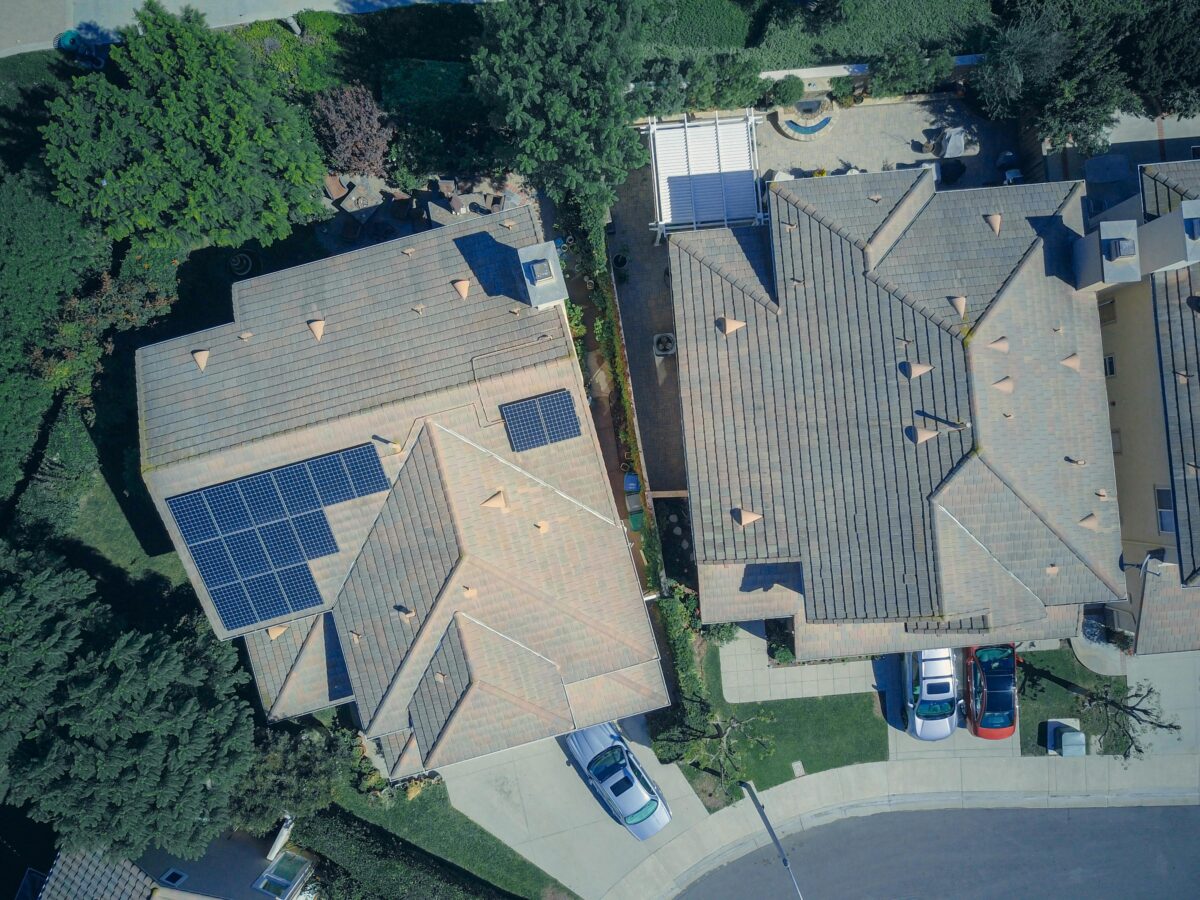

Solar made up nearly half (48%) of all new electric generating capacity additions in the first three quarters of 2023, according to the report. This brings total installed solar capacity in the United States to 161 GW with 4.7 million installations.

The California equation

California residential installations led the nation, growing at 31% year-over-year in Q2 and 29% in Q3. Nationwide, residential solar grew 12% in Q3. California’s installation pace, however, will not continue as it was driven by the scramble to get residential solar up and running before the changes to net energy metering took effect. The report notes that the California decline will be short-lived and growth in residential solar will resume in 2025.

Challenges

Aside from state policies that are slowing residential installations, other challenges now are the high cost of financing and a shortage of transformers. Still impacting the utility-scale market are the slow interconnection queues. The report notes that this segment had its lowest level of contract signed in a quarter since 2018.

The interconnection bottleneck will remain a challenge into the future, according to the report, and this along with worsening grid congestion and lack of a robust workforce.

“Growth is expected to be slower starting in 2026 as various challenges like interconnection constraints become more acute,” said Michelle Davis, head of solar research at Wood Mackenzie and lead author of the report. “It’s critical that the industry continue to innovate to maximize the value that solar brings to an increasingly complex grid. Interconnection reform, regulatory modernization, and increasing storage attachment rates will be key tools.”

Future

While economic challenges are expected to affect the industry in the near term, there’s a bright light as we head into the future. The report forecasts that growth in the U.S. solar industry will average 14% over the next five years.

By 2028, the report says U.S. solar capacity is expected to reach 377 GW, or enough to power more than 65 million homes. By 2050 solar is expected to be the largest source of generating capacity on the U.S. grid.