The Treasury, Department of Energy and Internal Revenue Service provide details on the Qualifying Advanced Energy Project Credit program that makes available $10 billion in tax credits for energy communities.

The U.S. Department of Treasury, Department of Energy and the Internal Revenue Service released final guidance on energy security and investments into coal communities and underserved communities as part of the energy communities incentives in the Inflation Reduction Act (IRA).

The Treasury and IRS released guidance that provides information about the application process and technical guidance for the program on energy communities as well as the Qualifying Advanced Energy Project Credit program (48C) of the Internal Revenue Code from February 2023.

Using the existing 30% investment tax credit framework under the Inflation Reduction Act of 2022 for the development of solar, wind and other clean energy projects up to 5 MW, two additional 10% tax credits are available to qualifying projects located in low-income communities or in otherwise statistically categorized low-income population areas.

Qualifying Advanced Energy Project Credit

Under the IRA, $10 billion in total funding will be made available under the Qualifying Advanced Energy Project Credit program. Congress required that at least $4 billion be reserved for projects in communities with closed coal mines or retired coal power plants. The initial funding round will include $4 billion, with about $1.6 billion reserved for energy projects sited in these designated coal communities.

To apply, taxpayers should submit concept papers describing the proposed project. Concept paper submissions will be accepted starting June 30, 2023, and the deadline for concept papers will be July 31, 2023. Beginning today, taxpayers can access information and materials for submissions.

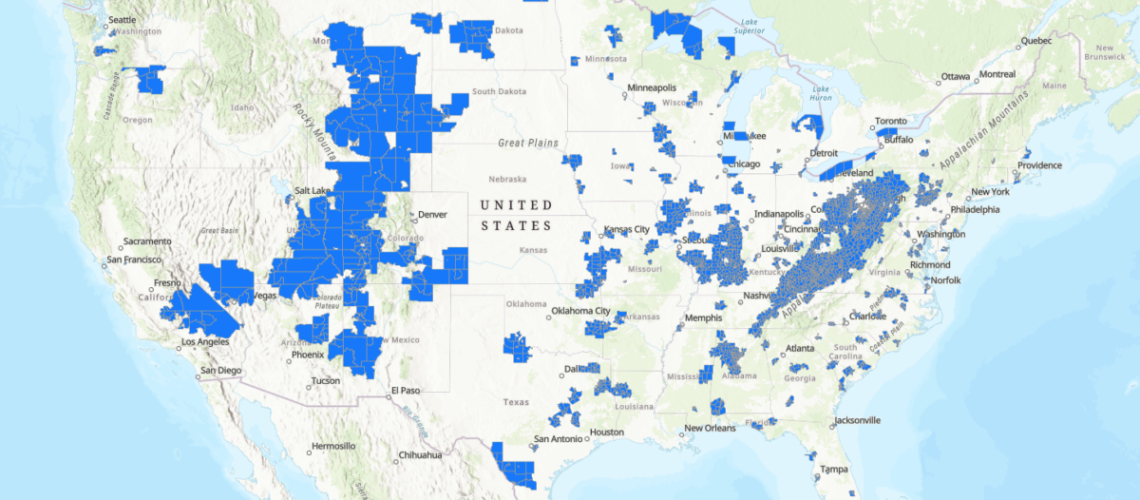

More information, including a 48C mapping tool and an upcoming informational webinar, is available on the Department of Energy’s 48C webpage.

Wally Adeyemo, Deputy Secretary of the Treasury: President Biden’s Investing in America agenda ensures all communities benefit from the growth of the clean energy economy by driving investment in areas of the country that have often been overlooked and left behind. These investments will improve the nation’s energy security and create good-paying jobs in vital fields like clean-energy manufacturing and critical materials processing. They will also allow for existing energy infrastructure to be retooled for the clean energy economy. All this work will contribute to lower energy costs for families who have struggled to pay their utility bills.

Low-Income Communities Bonus Credit

Treasury and IRS also released a Notice of Proposed Rulemaking (NPRM) for the Low-Income Communities Bonus Credit program under Section 48E of the Internal Revenue Code, which was established on February 13, 2023.

The rulemaking includes an application process and technical guidance for low-income communities program, which provides an additional 20% Investment Tax Credit adder for up to 1.8 GW of annual new solar and wind energy projects (with maximum size of 5 MW) that are located in designated low-income communities or otherwise serving low-income populations.

“Every community can benefit from President Biden’s agenda to Invest in America through the revitalization of domestic manufacturing, the strengthening of domestic clean energy supply chains and the modernization of our nation’s industrial sector,” said David Turk, Deputy Secretary of Energy. “The guidance announced today will help usher in investments that will further spur the creation of quality jobs in every pocket of our country, while strengthening our energy resilience.”

The Inflation Reduction Act of 2022 defines “energy communities” with respect to certain types of U.S. government statistical data areas, such as “census tracts,” “metropolitan statistical areas,” and “non-metropolitan statistical areas.” However, the Act did not specify which vintages of these areas should be used by taxpayers. Initial guidance provided by the Treasury in April clarifies which data sets will apply, and the DOE’s mapping tool reflects those data sets in a user-friendly way.