Module supply challenges led to 4.2 GW installed in the first six months, less than half of what was initially expected.

The Energy Information Administration (EIA) said developers across the United States plan to install 17.8 GW of capacity this year. However, through six months, only 4.2 GW has been installed and brought online as module supply challenges led to cancellations and delays.

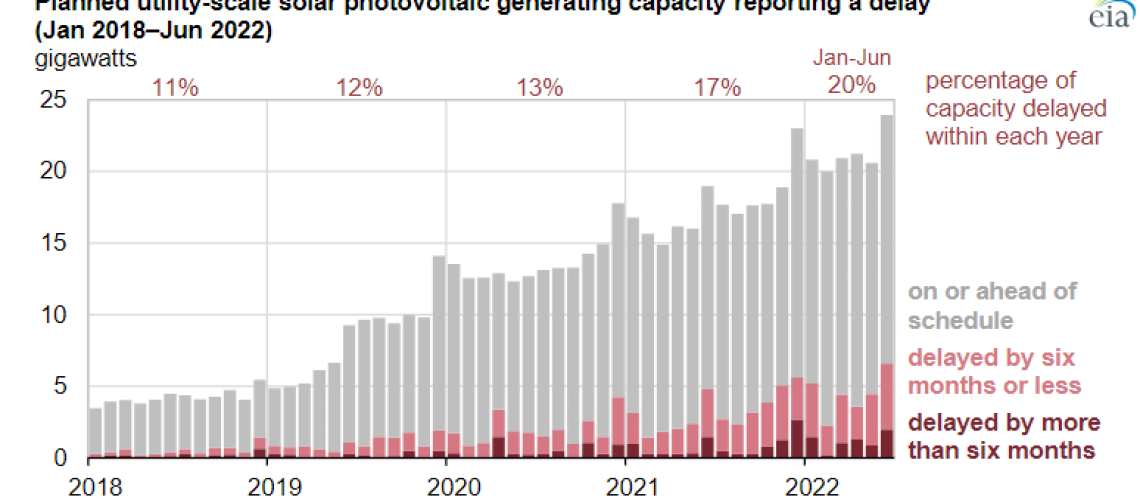

From January through June 2022, about 20% of planned PV capacity was delayed, said EIA. Reports show solar installations were delayed by an average of 4.4 GW each month, compared with average monthly delays of 2.6 GW during the same period last year. In most cases, reported delays are for six months or less.

In February, the US extended tariffs on imports of polysilicon solar goods from China and raised the tariff-rate quota from 2.5 GW to 5.0 GW. It also excluded bifacial panels from the extension of duties. In April, the Department of Commerce launched an anti-dumping circumvention investigation into solar goods imported from four Southeast Asian countries responsible for 80% of the nation’s polysilicon-based solar goods. This led to a great deal of uncertainty about the risk of tariffs, which then caused a tightened module supply and the delay of projects.

In June, President Biden took executive action to create a moratorium on solar tariffs related to the investigation, thereby clearing the uncertainty in the industry and advancing deployment in the nation. The administration also invoked the Defense Production Act to expand domestic production of solar goods. Any determination that Commerce makes on the anti-dumping investigation will apply after the 24-month moratorium, buying the industry time to deploy projects that were already planned.

EIA said it surveyed project developers and found most of the projects that will come online in the next 18 months are currently under construction. About 1.9 GW of solar capacity installations are projects currently under construction that have met delays but are still scheduled to come online in 2022; and another 1.7 GW under construction have been delayed to 2023.

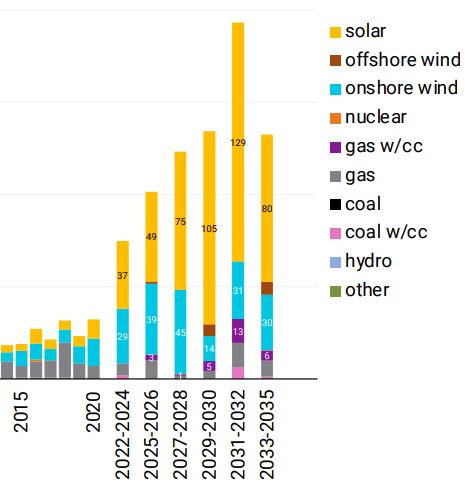

Deployment is set to ramp up over the coming years as state and federal governments set ambitious climate and energy goals, and the Inflation Reduction Act of 2022 is expected to be enacted. Following analysis of the potential impact of the Act, Princeton University researchers said solar deployment may accelerate from 2020 rates of 10 GW of capacity added per year to nearly five times as much by 2024, adding 49 GW of utility-scale solar each year. Solar deployment may be well over 100 GW per year by 2030, said Princeton.

Investment in solar could reach $321 billion in 2030, nearly double the figure of $177 billion expected under current policy. The Act would lead to nearly $3.5 trillion in cumulative capital investment in new American energy supply through the next decade, said Princeton. Annual US energy expenditures are expected to fall by at least 4% in 2030 under the act, a savings of nearly $50 billion dollars per year for households, businesses and industry.