A Brattle Group study finds that arbitrary caps on solar power will increase electricity costs by billions through 2035, including $900 million in 2030, and $800 million in 2032 alone – while the utility is putting trust behind non-existent nuclear reactors.

The Brattle Group has published a study analyzing Duke Energy’s recent proposal to meet North Carolina state law requiring emissions be decreased 70% by 2030. They find Duke’s decision to limit the potential of solar power in the state by nearly 50% will cost state ratepayers billions of dollars through 2035.

The report, Duke Energy Resource Mix to Meet 70% CO2 Reduction by 2030 in NC, was commissioned by the Clean Power Suppliers Association (CPSA).

Proposed solar capacity deployments from Duke Energy, North Carolina

The report suggests that Duke’s decision to avoid deploying the cleaner, cheaper solar capacity will mean that ratepayers will be on the hook for much more expensive fossil fuels, and small modular nuclear reactors (SMRs). Betting on the deployment of SMRs carries extremely high risks, since they have not yet been developed. And despite the US Nuclear Regulatory Commission’s approval for a new SMR design, a leading developer recently had their application rejected.

In fact, the Brattle report suggests that by limiting their solar deployment, Duke will fail to hit their legally obligated 70% reduction to emissions by 2030 – and will be forced to extend it to 2034.

The company states that SMRs – which still don’t exist in the marketplace – have a higher execution risk than the 2 GW of solar power that is currently deployed each year in the region. During presentations, the company seems to have lost their homework, stating, “[t]he Companies do not have specific underlying calculations for the annual selection constraints,” and that the constraints “are based on engineering judgment and transmission planning experience.”

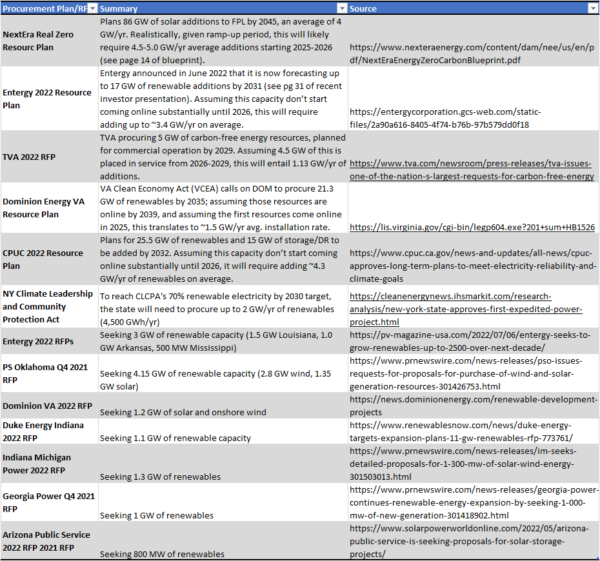

Comments filed by CPSA noted that neighboring utilities were modeling the integration of significantly greater volumes of solar power. For instance, NextEra is projecting 4 GW/year of capacity in Florida, Entergy 3.5 GW/year of renewable, and Dominion in Virginia at 1.5 GW/year.

Of course, Texas is projected to install more than three times what Duke believes it can deploy. And Duke Energy claims it will take thirteen years to install that fraction of Texas’ projected solar power, while Texas prepares to deploy at least 18 GW over the next five years.

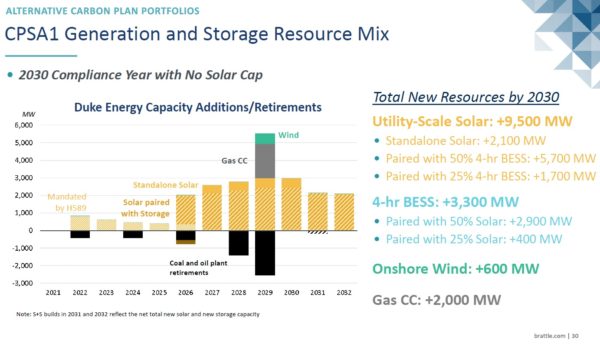

Brattle’s model finds that eliminating the solar cap would result in deployments of 9.5 GW of solar, allowing the state to comply with the 70% emissions mandate by 2030. The group suggests that 2.1 GW of that capacity would be standalone, 5.7 GW would be paired with 4 hours of storage, and 1.7 GW would be paired with two hours of storage. In total, more than 10 GW hours of energy storage would be deployed.

Strangely, the utility puts energy storage – proven hardware that has already been connected to the power grid for a decade – in the same development risk class as the yet unproven, and unavailable for purchase today, SMRs.

Duke projects that by 2035, between 570 MW and 1.3 GW of SMRs will be connected to their power grid. The company now projects that 2032 will be the earliest possible deployment date for their first SMR to be integrated into the grid, based on the assumption that the units gain approval for deployment in 2029.

Bloomberg and others have reported that Duke is working with TerraPower LLC, GE Hitachi Nuclear Energy, Holtec International Corp., NuScale Power LLC, and possibly others.