The Electric Reliability Council of Texas (ERCOT), the controlling body of the Lone Star state’s grid, is having an increasingly difficult time living up to the “reliability” part of its name. Long, powerful heat waves have stretched across the state for a good portion of the summer, leading to spikes in energy demand to cool homes.

ERCOT is facing energy supply shortages as a result of the increased demand. It narrowly avoided widespread rolling blackouts this summer, warning of low reserves “with no market solution available.” Reserve energy, largely natural gas plants, dipped as low as 3,600 MW this month, enough to power only 750,000 homes in a territory that serves 26 million people. Rolling blackouts were avoided partly because of a change in resources powering the grid, and partly due to Texans being willing to reduce their energy consumption at critical times.

One reason the grid was able to keep up with demand is thanks to the buildout of renewable energy, namely solar and wind, across the state. The two resources provide about 25% of ERCOT’s power, and solar does a particularly good job serving the grid during summer demand peaks.

“We’ve got twice the solar we had last summer, and something like three times what we had eighteen months ago,” energy consultant Doug Lewin told Texas Monthly. “We actually set another solar record today, and we set one yesterday. Renewables throughout most of May and June, as we’ve been experiencing extreme heat, really were the difference between [having] a whole lot of conservation calls and potential rolling outages and not having them.”

Texas has the largest projection for solar buildout with 28 GW of solar on the way, or 50% more than California in a three-year horizon. This buildout will need to continue if ERCOT is to meet growing demand, which is ballooning due to increasing population, increasing temperatures, a boost in electrification of appliances, heating and cooling, and the electric vehicle transition. Plus, renewables will be needed to make up for the retirement of fossil fuel generators. Between 2014 and 2020, 6.2 GW of coal generation was retired, said Real Clear Energy.

“I think none of the power companies want to run coal plants long-term,” said Daniel Cohan, environmental engineer at Rice University. “They’re dirtier and costlier to operate than building wind and solar projects from scratch, and most utilities companies now have plans to reach net-zero carbon emissions by 2050, if not before.”

This loss of generation, depletion of reserves, and steadily increasing demand all combine to create the market forces that explain why Texas is set to be the largest utility-scale solar market in the foreseeable years. At a residential level, there are numerous additional benefits solar can bring to Texans and the grid at large.

Residential energy

“We have approached all Texans and Texas businesses to conserve energy,” an ERCOT spokesperson said via email during the demand spikes and low reserve event this month.

The request came during dangerously hot weather. “We’re in the thick of some of the hottest temperatures we’ve seen in San Antonio ever. … By any measure, this is an extremely hot summer,” said Rudy Garza, CEO of CPS Energy, San Antonio’s power utility company.

“Each time there is a call for conservation, Texans step up and do their part,” said a spokesperson for Governor Abbott.

While Texans are “stepping up” by cutting energy use, the failures of the ERCOT grid are negatively impacting the lives of residents. Cutting air conditioning use can be dangerous for some on ultra-hot days, like the recent record-breaking 110-degree day in Austin and 106-degree day in San Antonio.

Rather than limiting comfort or relying on an ever-dwindling reserve supply, homeowners are increasingly turning to solar and energy storage as a solution to the Texas-sized problem. Solar and storage can step up in numerous ways that help both the homeowner and the grid at large.

Homeowners with solar and energy storage benefit from the peace of mind knowing that if ERCOT’s problems persist, and blackouts do occur on the hottest and coldest days of the year, their home will still have power running. This backup was about more than just comfort, but also about safety. In February 2021, Winter Storm Uri took an estimated 246 Texan lives.

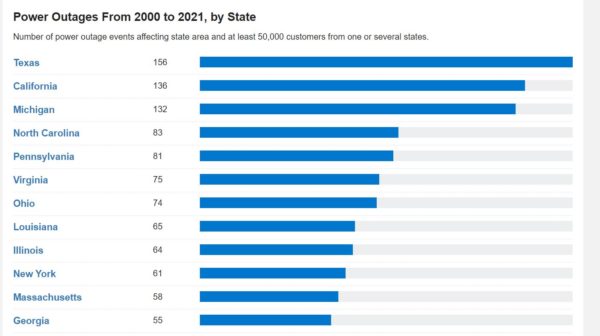

Power outages are increasingly a problem faced by Americans. Over the past 21 years, Texas has led the way with the most occurrences of outages on a per-customer basis by a good measure. Residential installer Sunrun shared that its home battery systems provided 234,000 hours of backup power following winter storm Uri. Interest in batteries skyrocketed, with hits on Sunrun’s battery-related website pages increasing 350% in the immediate aftermath.

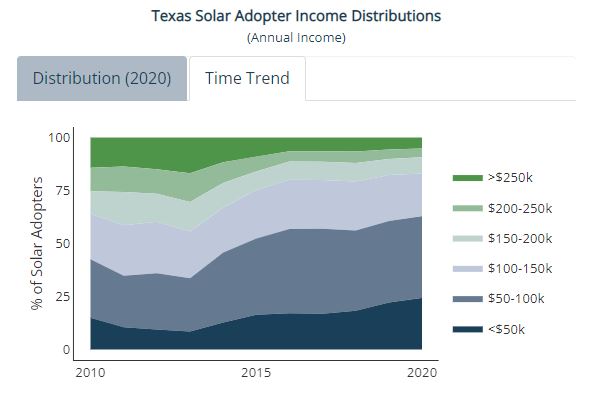

The benefits of solar and batteries are not just for wealthy homeowners. Data from the Lawrence Berkeley Laboratory shows that over time, homeowners in lower income thresholds are increasingly adopting the technology. In 2013, 33.6% of solar adopters had a household income of $100k or less. As of 2020, that number increased to 62.9%.

Multifamily homes are adopting solar and energy storage more widely, too. A 15 MW solar portfolio is set to power sixteen Dallas-based Class B and Class C low-to-moderate income multifamily housing developments that house over 3,600 units. Property manager Granite Redevelopment Properties worked closely with Dallas’ own The Solar Company to develop the plan, which they acted upon due to the clear financial benefit of the project.

“When we ran the numbers for overall project returns, we were sold and wanted to go all in. Not only is it a responsible decision from an environmental standpoint, it also makes tremendous financial sense and adds millions of dollars to the overall value of our portfolio,” said Tim Gillean, President at Granite Redevelopment Properties, LP.

The project is particularly beneficial to the “all bills paid” model that Class B and C multifamily housing units offer. The project cuts costs and provides price predictability for the landlord, while providing clean, local, and reliable power to the residents.

Grid benefits

Solar and batteries also offer flexibility. They act as a shield from the volatility of Texas’ wholesale electricity market, offering services like smart-time-of-use, demand response, and lower-cost EV charging scheduling.

Solar and batteries benefit the grid at large, even when installed at the residential level. By placing energy storage as “nodes” along the grid closer to the point of energy demand, less robust transmission lines are needed to support demand. This is a big deal for Texas, which has spent $685 million to $860 million on transmission upgrades alone for the first five months of this year, according to a report from the Austin American-Statesman.

The flexible use of batteries helps reduce the amount of power needed in peak demand events, and essentially can serve as the next generation of reserve power, replacing natural gas generators with solar-charged batteries.

Tesla is currently lobbying in the state to enable residential battery storage aggregation, which could unlock even more possibilities in the state. Energy storage aggregation involves customers signing up to participate in a capacity market, allowing their batteries to be partially discharged to the grid during peak demand hours.

A report published by the University of Otago in New Zealand explored this, analyzing a per-minute resolution time series of individual household demand over several neighborhoods that contained distributed solar and energy storage. The results found that the collective use of batteries had dramatic effects on both load smoothing and peak demand shaving. Aggregation of smart storage led to a reduction in per-house battery requirements by 50% for load-smoothing needs and by 90% for peak shaving.

This type of market already exists in New England, where Sunrun in 2019 secured a 20 MW bid to participate in New England’s ISO 2022-2023 forward capacity market, one of the first contracts of this type in the United States.

As part of the bid, Sunrun said it would deploy distributed solar and battery storage to about 5,000 customers in Massachusetts. It will be required to offer the grid 20 MW of power, 24 hours a day for the one-year period. In return, Sunrun will be paid $3.80/kW/month, representing a $912,000 total contract value. Homeowners who signed up for the program agree to allow their battery to be discharged overnight. In exchange, they receive an upfront cash incentive as either a payment or a reduction in the upfront cost of their system.

As challenges for ERCOT mount, residential solar and energy storage can offer relief for Texans and their neighbors.

Jason O’Leary, Principal Analyst at pv-intel.com, contributed to this article with data analysis and data visualization.