A residential battery storage system in New York State could soon earn on the order of $190 per year, when aggregated with other systems participating in the state’s wholesale capacity market. Storage system owners in other parts of the country may wait much longer.

June 10, 2022

New York grid operator NYISO plans to enable aggregations of distributed storage systems to earn compensation for participation in wholesale capacity markets, by the end of this year.

New England grid operator ISO-NE already allows for such compensation. SunPower has aggregated 11 MW of New England rooftop solar plus storage systems into a virtual power plant, and each system will earn $190 per year by selling the capacity into the New England market and occasionally injecting energy to help meet peak load. System owners will in turn be compensated by SunPower.

Yet two other federally regulated grid operators, PJM and MISO, have proposed to delay offering compensation for wholesale capacity market participation until 2025 and 2030, respectively. The two grid operators together serve one-third of the US population. The remaining two federally regulated grid operators, CAISO and SPP, do not operate wholesale capacity markets.

In Texas, where the grid operator ERCOT is not federally regulated and there is no capacity market, Tesla has called for enabling distributed storage to participate in the wholesale energy market.

A “half-time report” from the Center for Renewables Integration reported the timelines for the federally regulated grid operators. The consultancy reviewed the plans filed by the six grid operators to comply with a federal order requiring grid operators to open their wholesale markets to participation by aggregations of distributed resources, known as Federal Energy Regulatory Commission Order 2222.

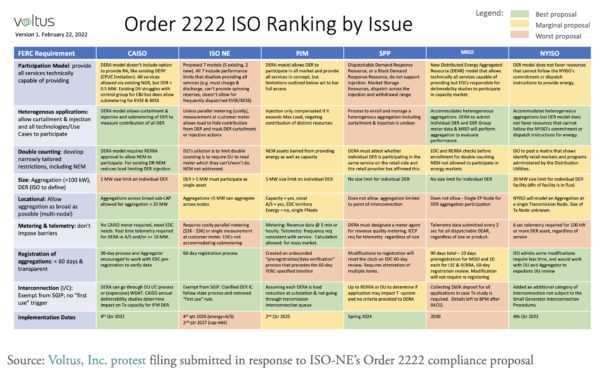

Beyond reporting the wide spread in timelines proposed by the six regional grid operators for meeting FERC Order 2222, the Center’s co-founder Kerinia Cusick evaluated the quality of the compliance plans, as shown in a filing by Voltus, a company that helps firms earn the maximize value of their distributed energy resources. The evaluation, shown below, appears to show that California’s grid operator CAISO, along with NYISO, have submitted plans most favorable to distributed resources.

FERC is now reviewing the grid operators’ proposals for complying with Order 2222. The commission has the option to either approve a plan, or send it back to the grid operator for further work.

Energy and ancillary services markets

FERC Order 2222 requires federally regulated grid operators to open their energy and ancillary services markets, as well as their capacity markets, to participation by aggregations of distributed energy resources.

The order will enable stand-alone distributed energy storage to inject energy to the grid more easily, said Cusick of the Center for Renewables Integration. Participation by resources such as fleets of electric vehicles “will hopefully be enabled,” if grid operators “get the rules right,” she said.

Ancillary services markets, along with capacity markets, “are much more financially attractive” than the energy market, with the exception of ERCOT, Cusick said. Existing markets for ancillary services include frequency regulation, spinning reserves, and non-spinning reserves, she said, adding “I anticipate that aggregations of distributed resources will want to participate in these markets.”

As a specific example of a grid operator’s ancillary services market in which distributed storage could participate, GridLab Executive Director Ric O’Connell mentioned PJM’s “Reg D” product, a fast frequency response product. “That product was mostly saturated with utility scale batteries, but it could have been a good option for distributed batteries,” he said.