The U.S. energy storage market set new installation records in Q3 2024, according to the latest “U.S. Energy Storage Monitor” report released by the American Clean Power Association’s (ACP) and Wood Mackenzie.

50-MW energy storage system on the Golden Triangle II project in Mississippi. Credit: Origis Energy

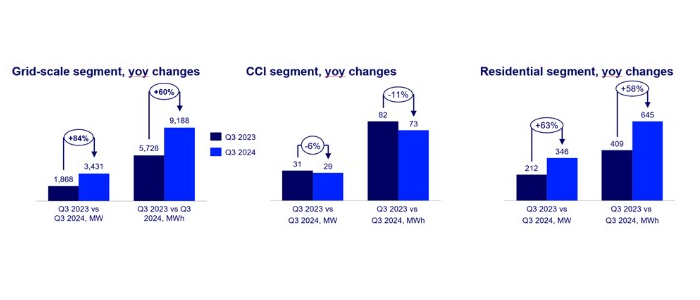

This is the highest record for third-quarter installations, with a total of 3.8 GW and 9.931 GWh deployed — 3,431 MW and 9,188 MWh coming from grid-scale deployments.

Grid-scale energy storage deployments in both Texas and California were robust in Q3, as the two markets continue to embrace storage as a grid solution. Texas tripled installations compared to the previous quarter with nearly 1.7 GW added, and California produced the highest gigawatt-hours of installations with nearly 6 GWh added, thanks to its focus on longer duration plants. Arizona, Colorado, Florida, and Vermont also saw installations in Q3, showing an appetite for grid-scale storage deployment across the country.

“We are seeing the energy storage industry fill a real need across the country to provide reliability in an affordable and efficient manner for communities,” said John Hensley, SVP, Markets and Policy Analysis for ACP. “With 64 GW of new energy storage expected in the next four years, the market signal continues to be clear that energy storage is a critical component of the grid moving forward.”

“The rapid energy storage deployment we’re seeing in the United States not only enhances reliability and affordability but also drives economic expansion. This additional storage capacity is helping meet increasing energy demand and is supporting growing industries like manufacturing and data centers,” said Noah Roberts, ACP’s VP of Energy Storage. “Energy storage is crucial for energy security and to help outpace rising demand.”

The residential market set an all-time high with a record-breaking 346 MW of residential storage installed in Q3 2024, a 63% increase over the previous quarter. California, Arizona and North Carolina led growth, installing 56%, 73% and 100% more residential storage in Q3 than in Q2 – despite residential battery supply shortages.

Community-scale, commercial and industrial (CCI) remained steady, with 29 MW installed, a slight 4% decrease from year-ago numbers.

The grid-scale and residential segments will continue to lead the market, with grid-scale installations projected to more than double by 2028 to reach a cumulative volume of 63.7 GW, and residential installing 10 GW of storage in the same time period.

“We have seen consistent growth in the market this year, especially in the grid-scale segment,” said Nina Rangel, senior research analyst at Wood Mackenzie. “Overall, storage installations will grow 30% in 2024, signaling the industry’s strongest year yet. However, it will be difficult to keep this pace. Between 2025 and 2028 we are projecting an annual average growth rate of 10%, as early-stage development constraints continue.”

Allison Weis, global head of storage of Wood Mackenzie noted that while consistent growth is expected, there are some uncertainties with the new presidential administration, as changes to certain tax credits and protectionist measures in the form of increased tariffs could come into play.

“While there might be potential opportunities in a new pricing environment for domestic manufacturers in terms of competition, any major shifts in tax incentives or increased tariffs could outweigh benefits and have an impact on new project development,” Weis said.

News item from WoodMac